Long-term outlook.

Throughout the current week, the EUR/USD currency pair has maintained a moderate downward trend. As we have repeatedly stated in recent weeks, we anticipate the European currency to decline because it has increased excessively over the last six months, as is seen in the above illustration. Everything is normal from the perspective of a correction against the downward trend, given that the trend itself lasted two years and that a correction must be made against it. It is time and an honor to know, but the growth of the euro was not driven by fundamental or macroeconomic issues, thus the correction is a correction. This week, the macroeconomic and fundamental backdrops were mostly absent. You may remember several speeches by Fed officials, a report on the US economy, or a report on inflation in the European Union, but we have mentioned before that the significance of these publications lies solely in their signboard. The second estimate included GDP and inflation. Unsurprisingly, the market did not respond particularly well to this data.

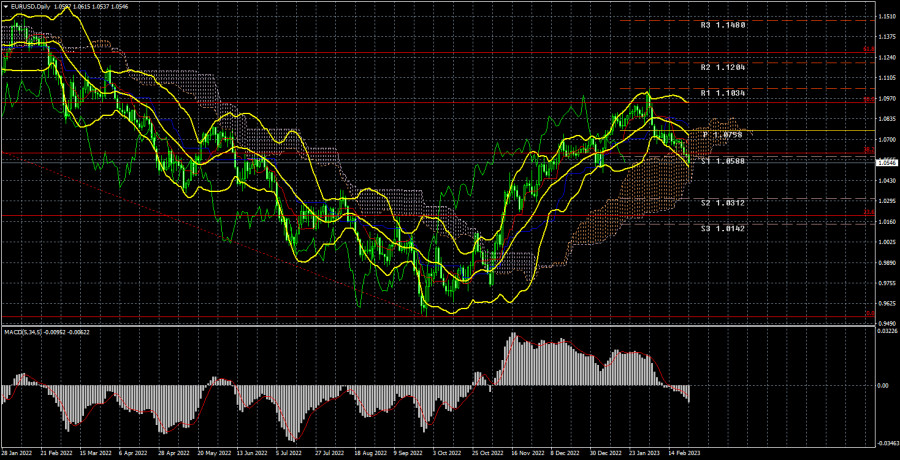

Also, it did not adhere to the so-called "moderately hawkish" Fed policy. We think that the market is now dominated by technical factors. Because the pair successfully passed the Kijun-sen line on the 24-hour TF and now has a strong probability of consolidating itself below the Ichimoku cloud, we think the fall may continue up to the levels of 1.0312 or 1.0200. In reality, the euro can achieve price parity and distance itself from its multi-year lows by doing just that. The betting component is still, in our opinion, crucial. The Fed is not going to ease down and occasionally gives hints of a more significant rate hike than anticipated. The euro is overbought at this time. The hikes that were previously known have been determined by the market, and the ECB has not yet indicated that it will tighten monetary policy further. It appears that the euro is falling and has a very good chance of continuing to move south.

Technical difficulties prevented the delivery of COT reports for over a month, but on Friday, one of the delayed reports for January 31 was made available. Since a month has gone by since then and we still don't have access to the data from the subsequent reports, which are more or less relevant, this report is not meaningful. As a result, we keep looking at the available data. The illustration accurately reflected market conditions for the euro currency during the past few months. The aforementioned illustration makes it very evident that, from the start of September, the net position of significant players (the second indicator) has been improving. At about the same time, the value of the euro started to increase. Although the net position of non-commercial traders is currently "bullish" and growing virtually weekly, it is the relatively high value of the "net position" that now permits the upward trend's impending end. The first indicator, which frequently occurs before the trend's end and shows that the red and green lines are very far apart from one another, signals this. Although the euro has already begun to decline, it is still unclear if this is just a brief pullback or the start of a new downward trend. The number of buy-contracts from the non-commercial group increased by 9.0 thousand during the most recent reporting week, while the number of short positions declined by 7.1 thousand. The net position thus increased by 16.1 thousand contracts. Currently, there are 148 thousand more buy contracts than sell contracts for non-commercial traders. Nonetheless, the correction has been developing for a while, so it is obvious even without news that the pair should keep falling.

Analysis of fundamental events

In addition to the aforementioned activities, business activity indices in various industries were released in the United States and the European Union, while in Germany, an inflation report revealed an acceleration in consumer price growth. Again, there was essentially no response to these figures; nevertheless, it should be emphasized that business activity in the service sectors improved while output declined. Regarding the German inflation news, Jerome Powell and a few other central bankers specifically discussed it. After this process was finished, the price of oil and gas, which has been declining for the previous six months, either started to rise or stopped falling. Consequently, it is safe to divide into two all pessimistic predictions for the return of inflation to 2% during the next year or two. To combat excessive rates of price growth, central banks will have to continue their efforts rather than simply lowering the rate and waiting. As a result, we anticipate seeing plenty of financial surprises this year that will have an impact on how the pair moves.

Trading strategy for the week of February 27 to March 3:

1) The pair started moving lower on the 24-hour period, surpassing the Kijun-sen line and the 38.2% Fibonacci level, or 1.0609. As a result, targets in the range of 1.0200-1.0300 can still be reached if the Senkou Span B line does not halt the descent. Sales, in our opinion, are currently appropriate.

2) The purchases of the euro/dollar pair are no longer significant. You should now wait for the price to return above the critical Ichimoku indicator lines before you start to think about long positions. There are currently no circumstances in which the euro currency can start moving higher again. But, in the present world, anything can happen at any time.

Explanations for the illustrations

Fibonacci levels, which serve as targets for the beginning of purchases or sales, and price levels of support and resistance (resistance/support). Take Profit levels may be positioned close by.

Bollinger Bands, MACD, and Ichimoku indicators (standard settings)

The net position size of each trading category is represented by indicator 1 on the COT charts.

The net position size for the "Non-commercial" category is shown by indicator 2 on the COT charts.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/qTx2Wj1

via IFTTT