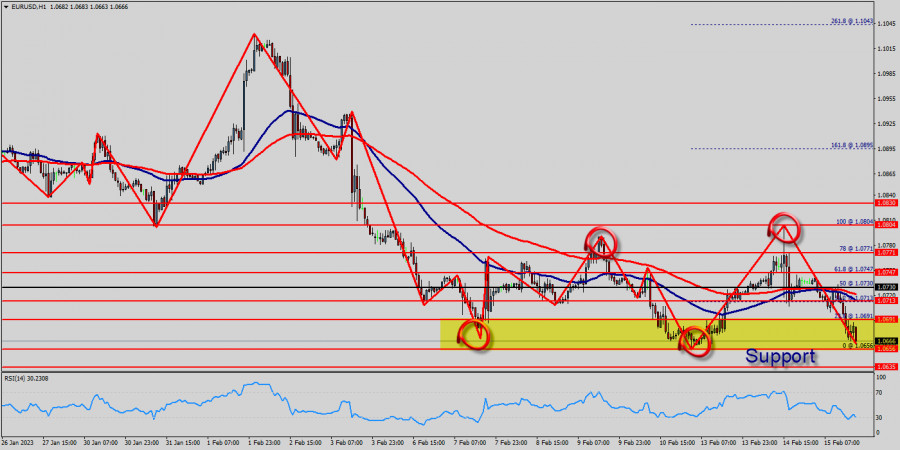

The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 1.0730 and 1.0656, so it is recommended to be careful while making deals in these levels because the prices of 1.0700 and 1.0600 are representing the resistance and support respectively.

The EUR/USD pair couldn't hit the weekly pivot point and resistance 1 (1.0730), because of the series of relatively equal highs and equal lows. But, the pair has dropped down in order to bottom at the point of 1.0656. Hence, the major support was already set at the level of 1.0600. Moreover, the double bottom is also coinciding with the major support this week. Additionally, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100.

The trend is still calling for a strong bearish market from the spot of 1.0730. Sellers are asking for a high price. But, please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated.

Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market. In other words, sell deals are recommended below the price of 1.0730 with the first target at the level of 1.0656. From this point, the pair is likely to begin an descending movement to the price of 1.0600 with a view to test the daily support at 1.0600.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/0L1Vpj6

via IFTTT