Earlier on Friday, it became known that the income of the US population in January rose by 0.6% compared to December, while consumer spending increased by 1.8% in monthly terms. At the same time, analysts had expected revenue growth of 1% and cost growth of 1.3%.

The University of Michigan Consumer Sentiment Index was also released, reflecting the degree of household confidence in the US economy. Thus, the University of Michigan (Michigan Consumer Sentiment Index), the index in February increased to 67 points from 64.9 points in January, with an initial estimate of 66.4 points.

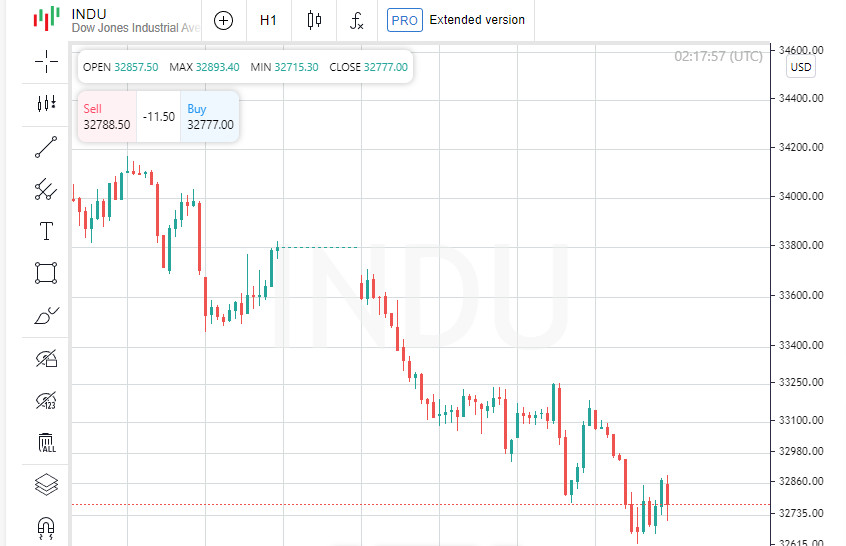

At the close on the New York Stock Exchange, the Dow Jones fell 1.02% to a one-month low, the S&P 500 index fell 1.05%, and the NASDAQ Composite index fell 1.69%.

Dow Inc was the top gainer among the components of the Dow Jones in today's trading, up 0.60 points (1.05%) to close at 57.79. JPMorgan Chase & Co rose 0.90% or 1.26 points to close at 140.93. Verizon Communications Inc rose 0.21 points or 0.55% to close at 38.74.

The least gainers were Boeing Co, which shed 9.98 points or 4.80% to end the session at 198.15. Microsoft Corporation was up 2.18% or 5.55 points to close at 249.22, while Intel Corporation was down 1.84% or 0.47 points to close at 25.14. .

Leading gainers among the S&P 500 index components in today's trading were Linde PLC, which rose 4.75% to 347.64, Edison International, which gained 4.21% to close at 68.63, and Coterra Energy Inc, which rose 3.61% to end the session at 25.56.

The biggest gainer was Autodesk Inc, which shed 12.95% to close at 192.53. Shares of Live Nation Entertainment Inc shed 10.08% to end the session at 68.78. Quotes of Adobe Systems Incorporated decreased in price by 7.63% to 320.54.

Leading gainers among the components of the NASDAQ Composite in today's trading were Bridger Aerospace Group Holdings Inc, which rose 78.73% to hit 7.90, Cyren Ltd, which gained 61.90% to close at 0.34. as well as Connexa Sports Technologies Inc, which rose 49.43% to end the session at 0.21.

The least gainers were Fulcrum Therapeutics Inc, which shed 56.09% to close at 5.66. Shares of Sellas Life Sciences Group Inc lost 53.66% to end the session at 1.71. Quotes of ObsEva SA decreased in price by 50.77% to 0.08.

On the New York Stock Exchange, the number of securities that fell in price (2,150) exceeded the number of those that closed in positive territory (867), while quotes of 88 shares remained virtually unchanged. On the NASDAQ stock exchange, 2,731 stocks fell, 914 rose, and 169 remained at the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, rose 2.51% to 21.67.

Gold futures for April delivery shed 0.47%, or 8.55, to hit $1.00 a troy ounce. In other commodities, WTI crude for April delivery rose 1.53%, or 1.15, to $76.54 a barrel. Brent futures for April delivery rose 1.34%, or 1.10, to $83.31 a barrel.

Meanwhile, in the forex market, the EUR/USD pair remained unchanged 0.43% to 1.05, while USD/JPY rose 1.28% to hit 136.43.

Futures on the USD index rose 0.61% to 105.17.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/wlq9rf5

via IFTTT