After a rather severe shock, caused by the bankruptcy of SVB, the fall of the banking sector as a whole and the flight of investors from Credit Suisse, which led to its takeover by UBS Bank (and in fact – a full-fledged bankruptcy), on Wednesday, there is an increase in stock indices and bond yields. Fears in the banking sector are still very strong, but the rapid actions of the Fed first, and then a number of other central banks led, if not to a restoration of confidence, then to a noticeable decrease in tension.

The markets seem to have confirmed that there will be no global collapse of the banking system. However, we must proceed from the fact that the Bank is forced to use the same mechanism as during the 2008 crisis – to supply liquidity to all those in need on demand. This means, among other things, an almost instant rejection of the reduction of the Bank's balance sheets and a slowdown in the growth of rates as the main means of combating inflation. And if the economies of most countries as a whole withstand the tightening of financial conditions and do not slip into recession, then the banking sector is on the verge of stable functioning.

In connection with the latest events, tomorrow's Fed meeting is of particular importance. The Fed cannot allow the risk of loss of confidence, so the previously planned rate increase is likely to occur, and the rhetoric should remain cheerful and soothing. This is the outcome that the markets are guided by, rolling back from the minimum levels. The crisis, if it is inevitable, will develop later, but not in the coming days, so for now we are focusing on the fact that the demand for risk will remain stable until the end of the week.

NZDUSD

New Zealand's current account deficit reached a record level in Q4 of 8.9% of GDP, GDP growth turned negative, falling from 2% to -0.6%, but there is no particular concern yet. ANZ Bank believes that the current account deficit will increase, and inflation will be more stable, as the growth of the influx of migrants, tourism and economic demand will contribute to this.

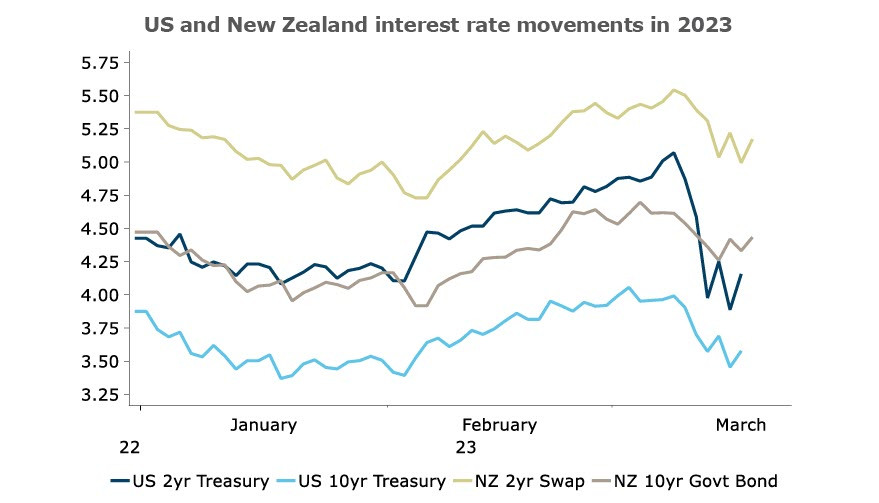

The banking crisis adds uncertainty to what actions the RBNZ will take next. Financial stability in New Zealand strongly depends on offshore financing, and no one knows yet how the speed and direction of financial flows will change. If we pay attention to the dynamics of interest rates in New Zealand and the United States, we can note an increased yield spread in favor of New Zealand, and if this trend continues, the growing spread can provide significant support to the kiwi in the long term.

The rate peak is currently projected at 5.25%, and this is higher than the Fed rate peak. Risks introduce a lot of uncertainty, for example, the depth of the unfolding banking crisis is not at all clear, the housing market is slowing down very actively (housing prices in February decreased by 1.1% and by 16% relative to the peak since November 2021, house sales in February decreased by 11.4% mom, the number of house sales is record low for the entire history of observations since 1992).

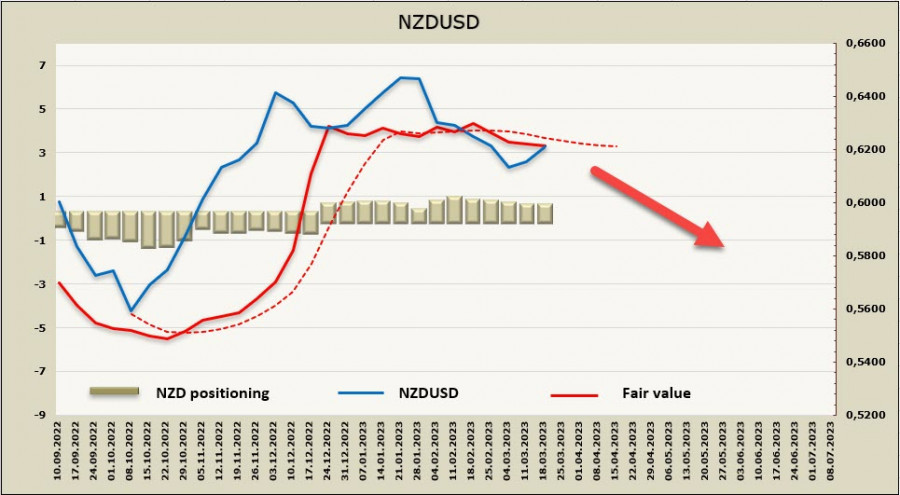

So far, the direction of financial flows has not been formed, the estimated price, taking into account the inflow of capital into bonds and stock indices, is directed downward, which indicates that the US dollar is perceived as a more reliable instrument in the current conditions.

NZDUSD, as we assumed a week earlier, reached the resistance of 0.6271, but failed to gain a foothold higher, and the chances of continued growth became lower due to growing risks and growing demand for protective assets. Growth above 0.6280 is considered unlikely, a more likely scenario is a resumption of decline to support 0.6079.

AUDUSD

Australia's economy is slowing, but remains resilient. In 2022, GDP growth was 2.8%, in 2023 0.7% is expected, that is, a slide into recession, according to NAB bank, still will not happen. A slowdown in growth should lead to a decrease in demand for labor, which is expected to raise the unemployment rate to 4.7%, an increase in unemployment should eventually lead to a decrease in wage growth and, as a result, a decrease in inflationary pressure.

Inflation is already slowing down, as in most countries, but reaching the upper limit of the target range of 3% is expected no earlier than the end of 2024. And if expectations for the Fed rate have sharply decreased, the forecasts for the RBA rate remain quite stable for now, two 0.25% increases are expected at each of the next two meetings, the peak rate of 4.1%, which will remain until the beginning of 2024.

Since the Fed is expected to cut the rate in the summer, the yield spread, which is currently in favor of the dollar, will begin to fade in the second half of the year. In the long run, this will give a chance for aussie growth against the dollar.

All these arguments look logical, but only on the condition that a large-scale banking crisis will be stopped and will not be further spread. If the crisis develops, then these calculations will become irrelevant, but in this case any forecast will be overgrown with conventions that make it meaningless.

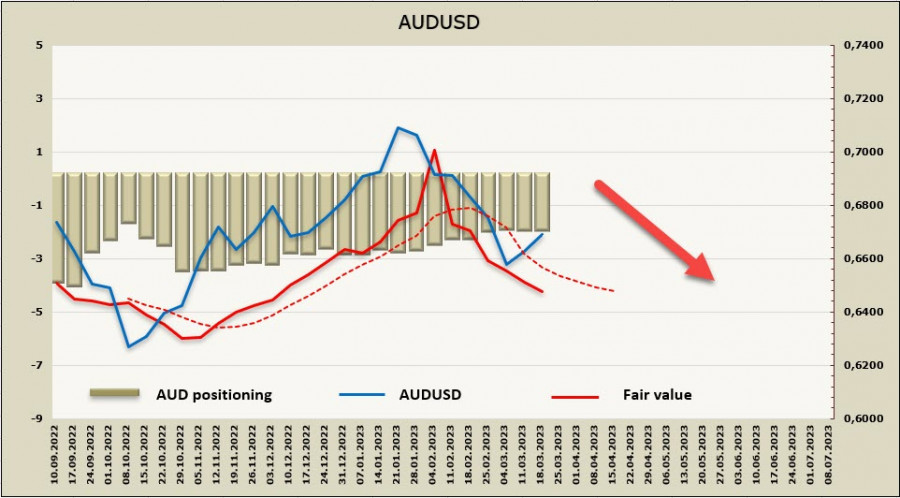

The estimated price is going down, so in the short term, we should expect a decrease in AUDUSD due to a sharp increase in demand for protective assets.

AUDUSD corrective rise ended before the pair reached the resistance zone 0.6780/90, and a return to this level has become even less likely. I assume that the pair will continue to fall, the support zone of 0.6570/85 will be tested in the near future, after which the target will shift to the technical level of 0.6466.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/CFpIqD3

via IFTTT