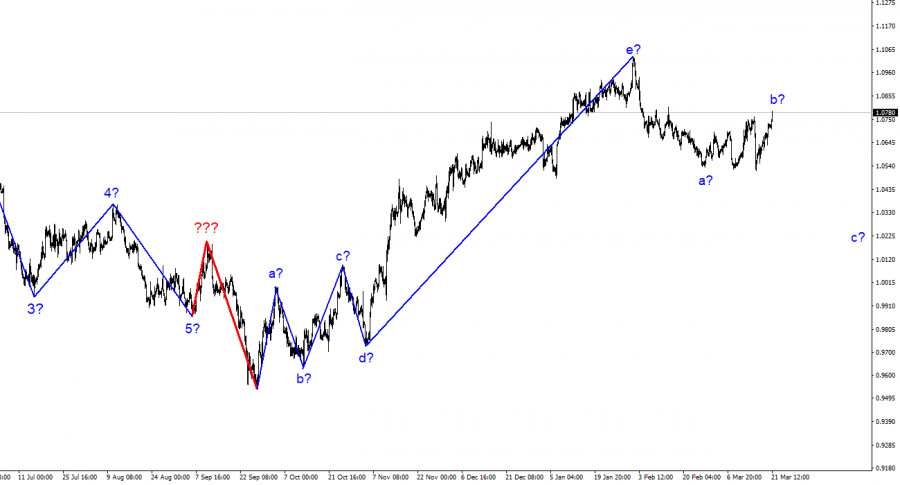

The recent increase in the euro's value has caused some confusion in the wave analysis on the 4-hour chart for the euro/dollar pair. Last week, we saw a sharp drop in quotes, which may be seen as the start of wave C. The drop in demand for the euro currency, however, was short-lived as it soon began increasing once more. There are now two possible scenarios as a result. Wave B will either take a five-wave corrective form or the wave pattern as a whole will shift, allowing the upward part of the trend to resume developing. The market mood has been significantly influenced by news over the past two weeks, which is why there are occasionally unanticipated movements in the pair. Trading may proceed more in line with the wave pattern if there were no economic data and bank collapse. Instead, we have a chance to miss the promising development of a downward wave. The only thing left to do in the current circumstance is to observe the progress.

Is the market anticipating an FOMC surprise?

On Tuesday, the euro/dollar pair increased by an additional 60 basis points. The demand for the euro has been steadily increasing for the fourth day in a row, even though the amplitude was not as high as it was on Monday. I can only associate such a move with the takeover of Credit Suisse by UBS, another distressed Swiss bank. The fact that Credit Suisse has been saved as a result of this news must please those who purchase euros.

The FOMC meeting, which has already started, is approaching at the same time. It will go on for two days, and tomorrow night the results will be made public. I find the pair's current movement somewhat strange. In reality, there were no outspoken statements made on Monday or Tuesday; only Christine Lagarde's speeches were delivered before the EU Parliament. Additionally, it promises to increase the pace further for however long it takes. But, there must be special justifications for such a rapid increase in demand for the euro. We can only fantasize about this topic.

This might be a result of the market anticipating a negative rate decision from the FOMC. Let me remind you that the likelihood of an interest rate increase in March fell precipitously after the failure of three banks in the United States and is currently at about 50%. Given that there had previously been reports of a 50 basis point hike, this is quite a bit. Nonetheless, this is an excellent reason to lower demand for the dollar if the market truly believes that the rate won't move. On the other hand, the FOMC decision may be factored into prices by Wednesday evening, and the pair's growth will be paused. Moreover, the pair may completely collapse if the rate increases by at least 25 points. I now believe that wave b will be composed of five waves, and wave c will shortly start to take form. To put it another way, I'm still waiting for a new, significant decline in the pair. On Wednesday night, everything will be decided.

Conclusions in general.

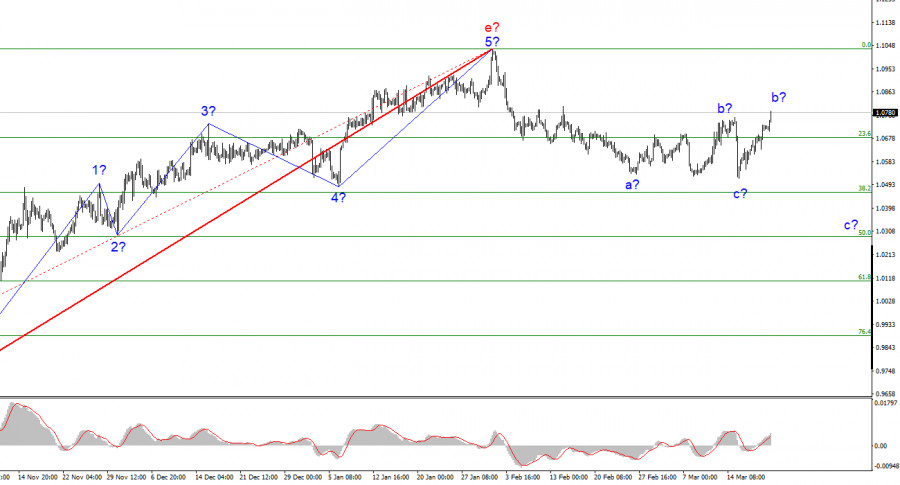

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is still possible to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. A corrective wave 2 or b can still be developed at this point; however, it will now take a longer form. Opening sales now on the MACD "down" signals is advised.

On the older wave scale, the upward trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward trend's development has already started, and it might have any size or structure.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/zbJ3a5j

via IFTTT