Long-term outlook.

Over this week, the EUR/USD currency pair was able to trade both ways. The start of the week was very dull, but by Tuesday, the market was aggressively working through Jerome Powell's speech to the US Congress. We think the head of the Fed did not report anything spectacular or unexpected because all of the ideas he expressed could have been predicted. The only unexpected thing was that nobody knew when they would be announced. The US dollar rose after this speech, as it turned out that Mr. Powell plans to express them in front of senators. But as it increased, it also decreased. If we assumed the euro's decline would continue on Wednesday, it became evident on Friday that we should not jump to conclusions. After all, Friday's statistics proved to be unclear while yet being extremely significant. Going ahead a little, it should be noted that Nonfarm once more came in over expectations, and the unemployment rate increased from 3.4% to 3.6%. Yet, given that the unemployment rate is still very close to its lowest level in 50 years, we think that even with these statistics, the dollar should have grown. The indicator's growth of 0.1-0.2% is not particularly significant. For instance, each consecutive increase would be significant if the unemployment rate had been growing for several months in a row.

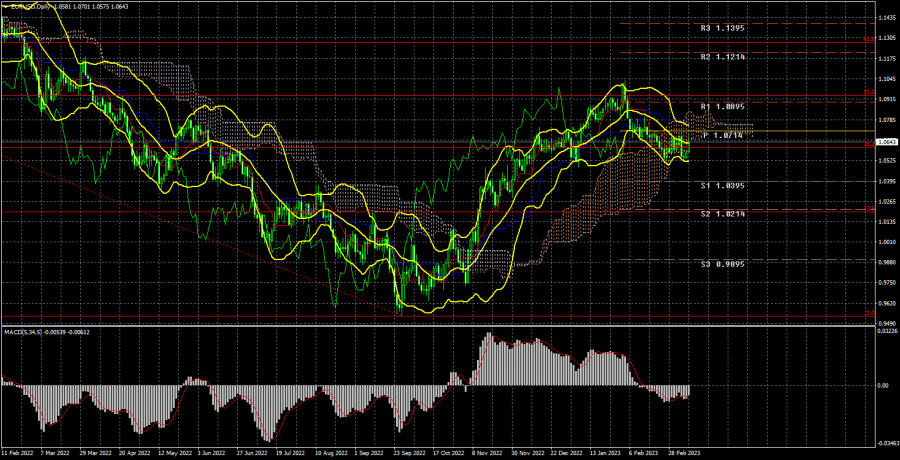

The outcome was that the pair spent the entire week in "swing" mode, as is evident on the 4-hour TF. The pair was fixed below the Ichimoku cloud on the 24-hour chart, not because it was aggressively decreasing but rather because the Ichimoku cloud rose. Moreover, the price was unable to establish a solid base below the 38.2% Fibonacci level. It is therefore impossible to conclude that the decreasing trend is still present now. To put it more precisely, it is conceivable to come to a resolution regarding saving but not to move further. We believe that the US dollar should already be continuing to strengthen based on the Fed's highly likely increase in aggressiveness, but the ECB has just started to convey clear signs of a higher rate hike.

COT evaluation.

A new COT report for February 21 was made public on Friday. It was about a month ago, around the time that the report for February 14 disappeared. It appears that the Commodities Futures Trading Commission will continue to provide reports from a month ago even if they are no longer very important. Note that the CFTC's efforts were unsuccessful, which is why we are currently receiving irrelevant information. Thus far, we can claim that the picture accurately reflects what has been happening in the market during the past few months. The aforementioned image unequivocally demonstrates that since the start of September 2022, the net position of significant players (the second indicator) has been increasing. At about the same time, the value of the euro started to increase. Although the net position of non-commercial traders is currently "bullish" and growing virtually weekly, it is the relatively high value of the "net position" that now permits the upward trend's impending end. This is indicated by the first indicator, which frequently occurs before the end of a trend and on which the red and green lines are quite far apart. The euro has already started to decline, although it's unclear if this is just a short pullback or the start of a new downward trend. The number of buy contracts from the "Non-commercial" group fell by 0.1 thousand during the most recent reporting week, while the number of shorts increased by 1.3 thousand. Therefore, the net position has grown again by 1.2 thousand contracts. For non-commercial traders, there are 165 thousand more buy contracts than sell contracts or three times more buy contracts than sell contracts. Nonetheless, the correction has been building for a while, so it is evident even without news that the pair should keep falling.

Analysis of important events.

This week's major event was scheduled to be the US Nonfarm Report, but it ended up being Jerome Powell's speech and the unemployment data. Powell's statement was what ultimately caused the pair to fall, as the news provoked an increase in quotes and prevented the market from correctly and logically calculating non-farm payrolls. We consider the NonFarm Payrolls report to be more significant than the unemployment rate, as it shows a considerable excess over the predicted values for the second consecutive month. Thus, it makes no difference that the value for January was reduced. An adjustment of 20–30 thousand jobs does not matter when 0.5 million new employees are created versus a prediction of 200 thousand. As a result, on Friday, the US dollar should have risen against the euro, but this is not what happened. In the future, this situation will need to be leveled. In other words, the dollar may increase the following week during times when there are no clear-cut grounds or reasons for doing so. We are still anticipating a decline in the euro/dollar pair.

Trading strategy for the week of March 13–17:

1) The pair is in a downward trend and is still situated below the Kijun-sen on the 24-hour period. As a result, the fall might continue with targets around 1.0200–1.0300. Although we still think that sales are appropriate, Friday's unemployment report confused the market.

2) The purchases of the euro/dollar pair are no longer significant. You should now wait for the price to return above the critical Ichimoku indicator lines before you start to think about long positions. There are currently no factors that would allow the euro currency to resume growing in the medium term. But, in the present world, anything can happen at any time.

Explanations for the illustrations:

Fibonacci levels, which serve as targets for the beginning of purchases or sales, and price levels of support and resistance (resistance/support). Take Profit levels may be positioned close by.

Bollinger Bands, MACD, and Ichimoku indicators (standard settings) (5, 34, 5).

The net position size of each trading category is represented by indicator 1 on the COT charts.

The net position size for the "Non-commercial" category is shown by indicator 2 on the COT charts.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/TugmpJk

via IFTTT