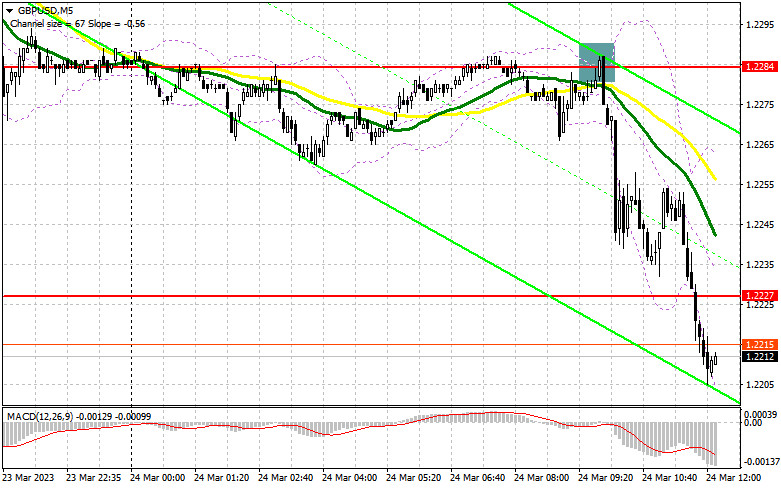

I focused on the level of 1.2284 when I made my morning forecast and suggested trading decisions based on it. Let's take a look at the 5-minute chart to see what happened. Growth and the emergence of a false breakout at this level provided a sell signal in the morning, causing the pound to decline by more than 60 points. The technical situation barely changed in the afternoon.

You require the following to open long positions on the GBP/USD:

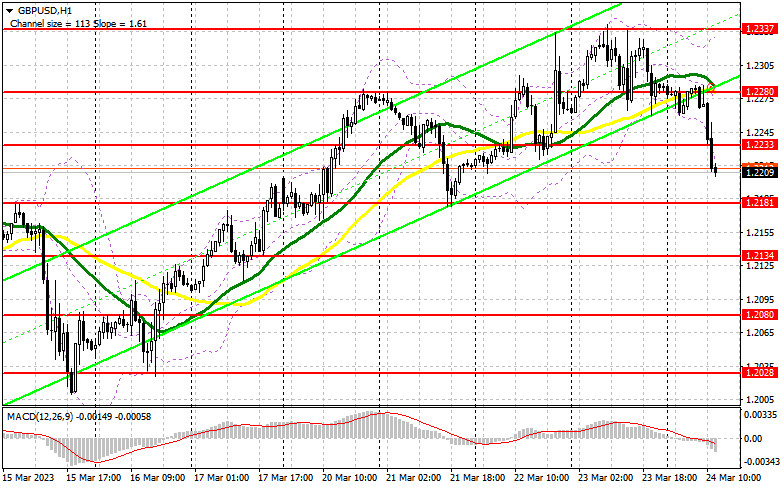

Following unfavorable reports on UK activity, the pound fell and started to correct. If similar statistics on the index of business activity in the manufacturing sector and the US services sector show growth in the afternoon, the pressure on the pair may rise. The best course of action would be to lower the price to develop a false breakout at the nearest support of 1.2189. With the potential to update the new resistance of 1.2233 developed at the end of the first half of the day, this will provide a point of entry into long positions. I wager on a more active rise of GBP/USD to a new maximum of 1.2280, where the bulls will once more encounter significant difficulties while fixing and testing this area from top to bottom. Moving averages are another factor that favors the bears. If this range is broken, there is a chance for growth at 1.2337, where I fix the profit. The pressure on the pound will rise, and it will be feasible to discuss the emergence of a new bear market if the bulls are unable to complete the tasks assigned to them and miss 1.2181 during the American session. In this situation, I suggest against making hasty purchases and only starting long positions close to the next support level of 1.2134 and only in the event of a false collapse. I'll buy GBP/USD right now only if it recovers from the low of 1.2080 with the intention of a correction of 30-35 points during the day.

For opening short positions on the GBP/USD, you will need:

Sellers took the opportunity and kept driving the pound down. Only the formation of a false breakout on it following the pound's upward movement against the backdrop of weak US data will be an excellent signal to open short positions in the anticipation of a continuation of the downward correction and the 1.2181 tests, where I expect active actions from buyers. The bears need to maintain their position below the resistance of 1.2233 throughout the second half of the day. The pressure on the pound will intensify with a breakout and reversal test from the bottom up of 1.2181, generating a sell signal with a drop to 1.2134, and the farthest aim remains a minimum of 1.2080, where I will fix profits. Buyers will attempt to return to the morning maximum of 1.2280, from where the pair has already fallen once today, with the possibility of GBP/USD growth and lack of activity at 1.2233, which cannot be ruled out. By analogy with what I previously indicated, only a false breakout at this level will provide a point of entry into short positions. If there isn't any downward movement there, I'll sell the GBP/USD pair in hopes of a quick recovery from the day's high of 1.2337, but only if the pair corrects itself by falling by 30-35 points.

Signals from indicators

Moving Averages

Trading is taking place below the 30 and 50-day moving averages, which suggests that the pair will continue to fall.

Note that the author's consideration of the period and costs of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located at 1.2337, will serve as resistance in the event of growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

from Forex analysis review https://ift.tt/gBsWEYy

via IFTTT