Federal Reserve Chairman Jerome Powell, delivered a semi-annual report to the US Congress. Expectations were confirmed - Powell's speech was as hawkish as it is possible in the current conditions.

In particular, Powell noted that "...inflationary pressures are higher than expected during our previous meeting of the Federal Open Market Committee (FOMC)...Despite the fact that over the past 12 months, core inflation has fallen to 4.7% , in the category of basic services, which account for more than half of consumer spending, there are still few signs of disinflation. To restore price stability, we will need a reduction in inflation in this sector and, most likely, some easing in the labor market."

For the markets, the above means nothing less than a revision of the Fed's peak rate targets. Markets reacted immediately - rate futures immediately rose, and now the peak rate is expected in the 5.50-5.75% range as early as June, which means two more 50p increases. in March and May and one more at 25p. - in June.

The dollar has appreciated sharply across the FX market, gold has fallen 1.5% and risk demand is expected to start to wane as a faster rate hike by the Fed means more expensive lending, which in turn raises the issue of recession.

In the current environment, it is unlikely that the dollar will lose its growth driver. We expect the dollar to continue strengthening across the spectrum of the market, and that trend will dominate at least until the Fed meeting on March 22.

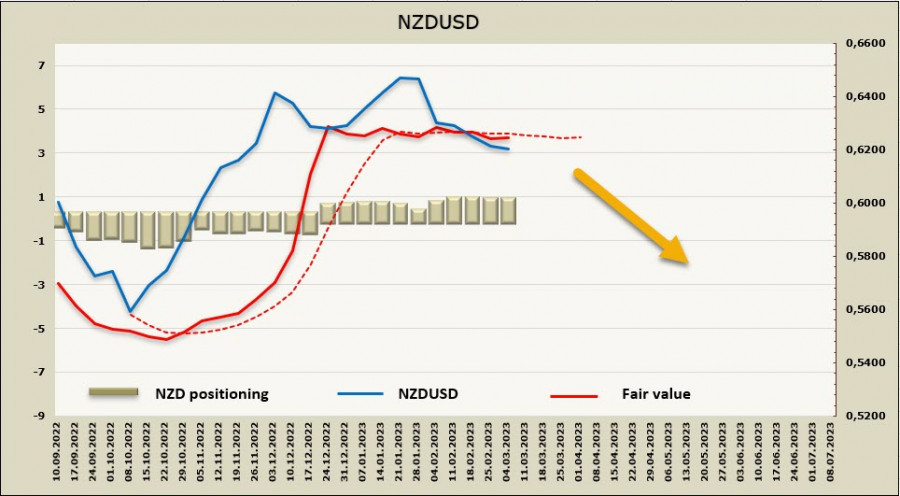

NZDUSD

ANZ's economic forecast looks bleak - a recession is approaching New Zealand, caused by monetary tightening. The recession will hit household incomes hard, but this appears to be the only viable path that will ultimately curb the runaway inflation. As of early March, ANZ saw a peak rate of 5.25%, after today's speech by Powell, this target is too low to ignore the growing yield spread in favor of the US dollar.

ANZ also notes that the work to reduce domestic (non-tradable) inflation may turn out to be more difficult than the markets suggest so far, and if at the same time inflationary pressure from the outside increases, then the rate forecast will have to be revised upward, and it is possible that in the coming days of waiting for the peak rate will shift to 6%.

But all this is from the category of assumptions, for now, we must proceed from the fact that the kiwi, like other commodity currencies, found itself under strong pressure after today's speech by Powell, and there are no reasons to wait for the fall to stop yet.

The settlement price is below the long-term average, but the dynamics are weak, and the bearish momentum has not formed.

The kiwi bounced off the support at 0.6125, the trading went sideways, there was no clear driver for a long time, but Powell's speech set the direction for the markets, and the kiwi is no exception. We expect a retest of support 0.6125, and then the road to 0.60. The move could slow down if the RBNZ comes up with a similar scenario and admits higher price pressure than before, pushing RBNZ rate expectations higher.

AUDUSD

The RBA, as expected, raised the rate at today's meeting by 0.25% to 3.6%. The more hawkish position of the RBA, which was indicated at the previous meeting, suggested at least two more increases by 0.25%, the first took place, one more is more than likely.

But we must not forget that the macroeconomic data that came out in recent weeks turned out to be weaker than expected, and it would be logical to assume that the RBA will soften the rhetoric a little and indicate the intention to "watch more than act". And that is exactly what happened – the accompanying statement noted that "The monthly CPI indicator suggests that inflation has peaked in Australia. Commodity price inflation is expected to ease in the coming months both due to global events and lower demand in Australia."

It turns out that the RBA statement was outdated in less than a day, since Powell presented a completely different position before Congress. It is unlikely that inflation in Australia can be considered in isolation from the global rise in prices, and global growth, as we now understand, is far from over.

The Fed meeting will take place on March 22, where it is assumed that the rate will be raised by 50p., The RBA will meet only on April 4, and the increase will be only 0.25%. Accordingly, for the entire next month, the markets will win back the growth of expectations for the Fed rate, the yield spread will increase, and not in favor of the Australian, so the probability of a reversal of AUDUSD to the north looks extremely low.

Estimated price is steadily declining, the Aussie is under pressure.

AUDUSD after a short consolidation went below the support at 0.6630/60, which we saw as a target a week earlier, technically the picture is bearish. China, which set relatively modest growth targets, does not support the aussie, growth in demand for raw materials is also questionable, so there are no reasons for a reversal to the north yet. The target is shifting to the support at 0.6465 (61.8% of the fall-winter growth).

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/pCNW7RK

via IFTTT