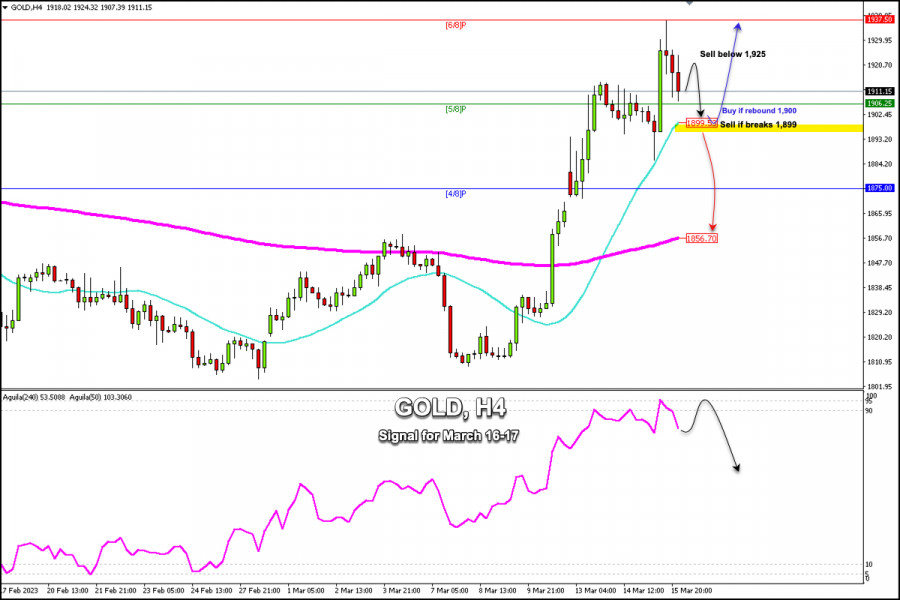

Early in the European session, Gold (XAU/USD) is trading around 1,911.15 above the 21 SMA and above the 5/8 Murray. We are observing a strong technical correction after the price was rejected at the area of 6/8 Murray located at 1,937.50.

Increased risk aversion has been the factor that gave gold a strong boost as a result of the Credit Suisse risk. Technically, the instrument has overbought signs, but each correction gives the bulls the opportunity to resume buying.

Gold rose from a low of 1,885 reached yesterday in the European session to a high of 1,937.22 hit in the American session. Recovery of more than $50 means strong volatility in the market and such turbulence is likely to continue in the next few days.

Currently, gold has retreated to the area of 1,911 and has erased more than 50% gains. In case of a further fall, the price could halt at about the psychological level of 1,900 where the 21 SMA is located.

A daily close below the psychological level of 1,900 and a daily close below the 21 SMA could accelerate the bearish move and the instrument could reach 4/8 Murray at 1,875 and could even cover the gap left earlier in the week.

The daily pivot point is located at 1,913. If it trades above this level, we could expect gold to make a technical rebound and the price can reach the resistance of 1,925 and even 1,937.

Our trading plan for the next few hours is to wait until gold makes a technical rebound and approaches the area of 1,925. If the price breaks above this level, it will be considered an opportunity to resume selling with targets at 1,899 (21 SMA) and 1,875 (4/8 Murray).

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/jCkwhuc

via IFTTT