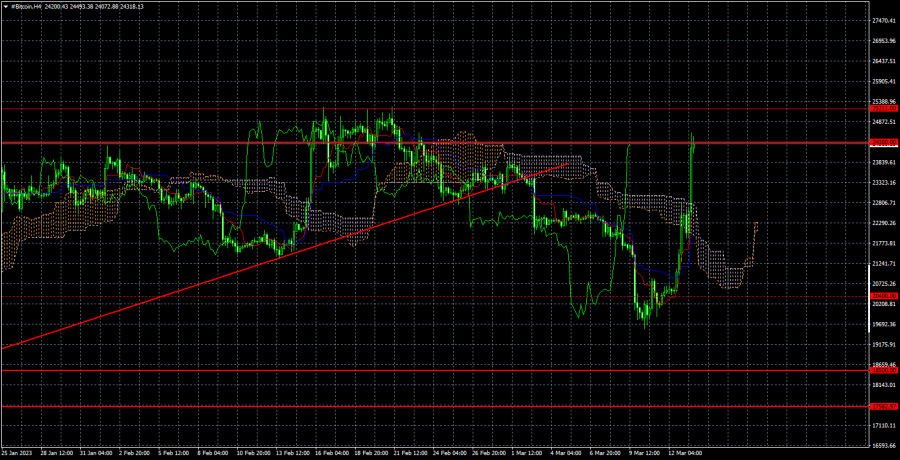

On the 4-hour chart, the picture is even more eloquent. Climbing to $24,350 is clear and obvious, and we have already discussed the reasons for this movement in our previous article. We will talk about what can stop Bitcoin from further (from our point of view) unreasonable growth. But let's reiterate it once again: a bounce from $24,350 or $25,211 can easily provoke a new fall. By the way, the first target we set last week was $20,400. But then we witnessed precedent events. Unfortunately, no one is immune from such situations.

The next U.S. inflation report will be released on Tuesday. Recall that the penultimate "rise" of Bitcoin began after the release of the January inflation report. At that time, Bitcoin went up by more than 50%, so every next report is treated with caution. In January, inflation went down sharply enough, but in February it didn't. So, a strong decline in inflation could easily provoke a new growth of Bitcoin and many other currency pairs and instruments. Not only does the market dislike the dollar now (not quite fairly), but that the inflation report can frankly spoil the picture. Recall that the lower the inflation rate is (or is not falling at all), the higher the possibility for the Federal Reserve to start tightening the monetary policy, which is bad for all the risky assets. The odds of a 0.5% rate hike in March fell to near zero, but it only fell according to various banks and experts. The Fed may have its own opinion on this, especially given the strong labor market, as confirmed by the latest NonFarm Payrolls report.

So, we shouldn't ignore the Consumer Price Index. The rest of this week's macroeconomic events are not that interesting for the cryptocurrency market. Maybe we will get more news about Silicon Valley and Signature Bank bankruptcies, and they will be much more important for Bitcoin than inflation or other macro data. We continue to expect Bitcoin to fall again, but once again there is reason for some growth. The situation is complicated by the fact that the market is clearly in an excited state right now and can make impulsive decisions.

On the 4-hour chart, Bitcoin returned to $24,350. A new bounce from it or $25,211 can be used to open short positions with $20,400 as the target. A consolidation above $25,211 can be used for long positions, but don't forget about the Stop Loss, as strong growth can be followed by a strong fall, since the Fed is not going to stop monetary tightening.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/vIt1JlN

via IFTTT