EURUSD took a step back amid the European stock market decline and hawkish comments of the Federal Reserve officials, but the general background for the euro remains favorable. The US has increasingly been talking about the recession and the end of the Fed's monetary tightening cycle, while the eurozone economy continues to please us and the European Central Bank remains resolute in its fight against inflation. However, ahead of the release of important data on the US labor market in March, it would be a good idea to play it safe and close some positions.

According to one of the major Fed hawks Loretta Mester, the federal funds rate should rise above the current level of 5%. The president of the Fed Bank of Cleveland believes that the cost of borrowing will remain at elevated levels for a very long time. At the same time, her rather neutral rhetoric contributes to the likelihood of a rate hike at the May FOMC meeting from 52% to 62%, which puts pressure on the US dollar.

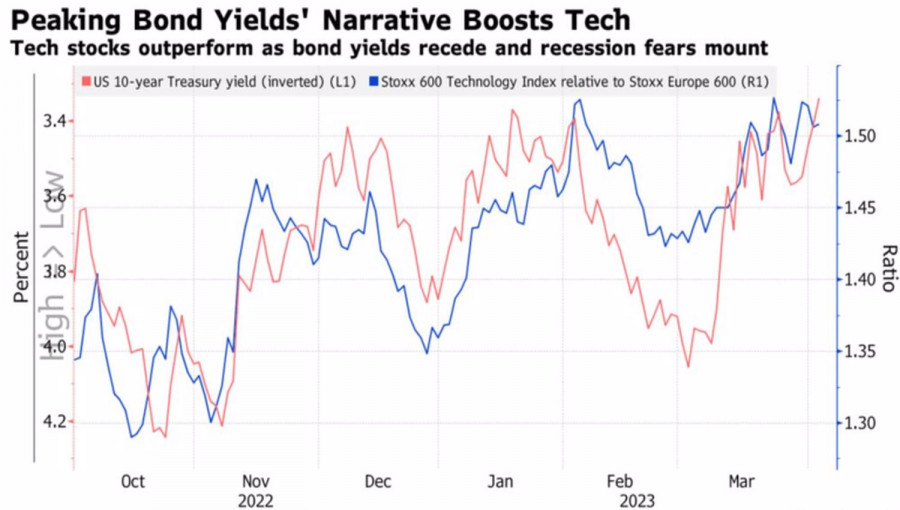

Bulls should not be particularly upset about the fall of the European stock market. Its values are closely tied to U.S. Treasury bond yields. The decline in the U.S. debt market's rates increases the global appetite for risk and opens the door for a EuroStoxx 600 rally.

Dynamics of US bond yields and European equity market

The lagging economic cycle in Europe and the ECB's monetary policy cycle make the EURUSD bulls feel confident. Gone are the times when the US dollar dictated its terms because the Fed acted faster than its competitors and treasury bond yields rose like a beast. Today all that has changed. Unlike the Fed, which seems to have finished raising rates, the ECB may raise them by another 50-75 bps. According to Governing Council member Gabriel Makhlouf, if employers constantly try to compensate for falling real incomes of their workers by raising wages, inflation will not be defeated. The wage-price-wage spiral will require additional monetary tightening.

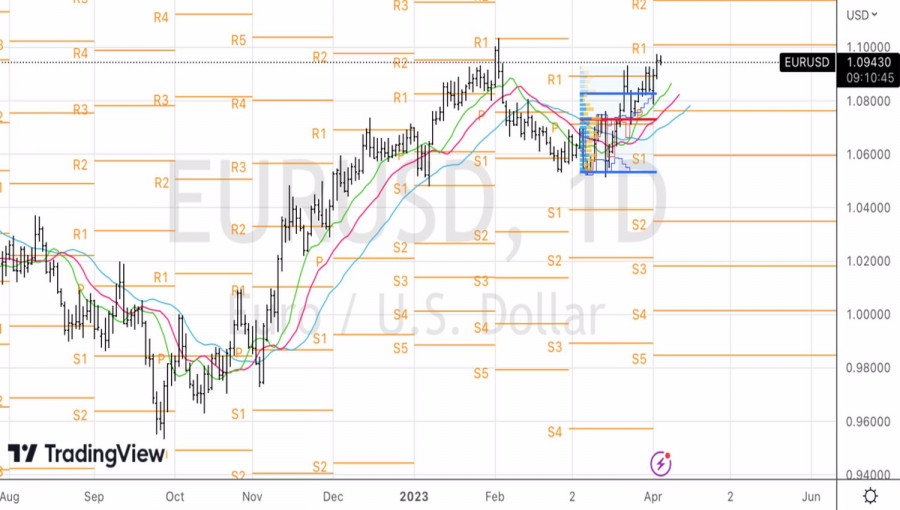

Thus, EURUSD medium- and long-term prospects remain bullish, but investors are cautious ahead of the US employment report. Overall, the projected slowdown in non-farm payrolls to 240,000 and a decline in the growth rate of payrolls are bad news for the US dollar. They may finally convince the futures market that the rate hike cycle is over. Meanwhile, rising global risk appetite will allow the major currency pair to move up.

Technically, on the EURUSD daily chart, the process of reviving the uptrend continues. To start breaking it in the form of a full-fledged correction, it is necessary to activate the Anti-Turtles pattern by breaking through the support at 1.073-1.076 . While the euro trades above it, you should focus on buying towards $1.12 and $1.14.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/RTZ5iml

via IFTTT