When American exceptionalism turns into American doom, the US dollar has nothing left to do but flee the battlefield. In Forex, the view is strengthening that only the US will face a recession in 2023, while the Eurozone will manage to avoid an economic downturn, and China will be vigorously recovering. This is in stark contrast to last year's events when, due to the armed conflict in Ukraine and the energy crisis, the currency bloc was on the verge of collapse, and EURUSD fell below parity for the first time in 20 years. Today, the market has different realities.

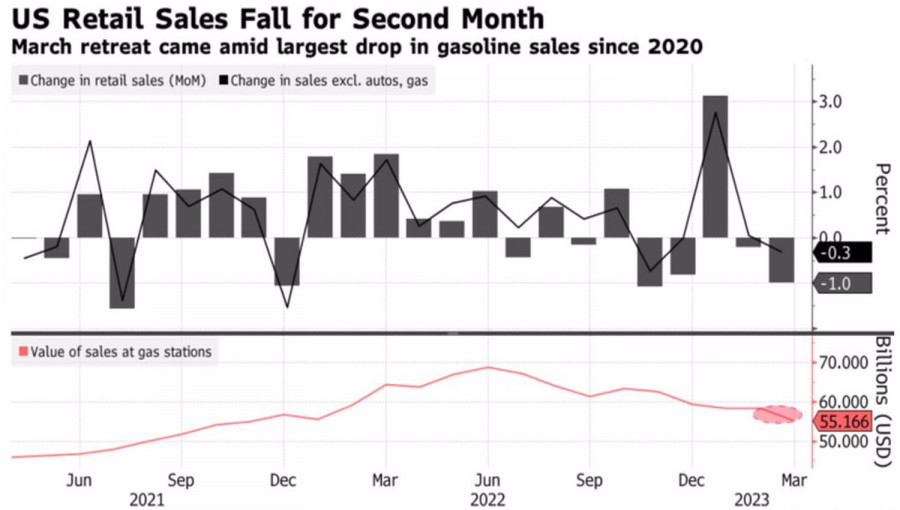

The release of US retail sales data only heightened investors' concerns about a significant slowdown in GDP. The indicator shrank for the second consecutive time, significantly stronger, at 1% MoM, than Bloomberg experts predicted. If consumer spending collapses following the crisis in the real estate and banking sectors, a recession will become inevitable. The Fed will have to make a "dovish" U-turn in 2023, no matter what the Central Bank says otherwise. This will weaken the US dollar.

Dynamics of retail sales in the US

While markets are currently set for a 25 basis point increase in the federal funds rate in May, followed by a 75 basis point decrease in the second half of the year. Such a balance of power became possible after consumer prices slowed from 6% to 5% and the first slump in producer prices in two years on a monthly basis. US inflation is clearly slowing down, allowing investors to argue that the Federal Reserve has done its job and the monetary policy tightening cycle is nearing its end.

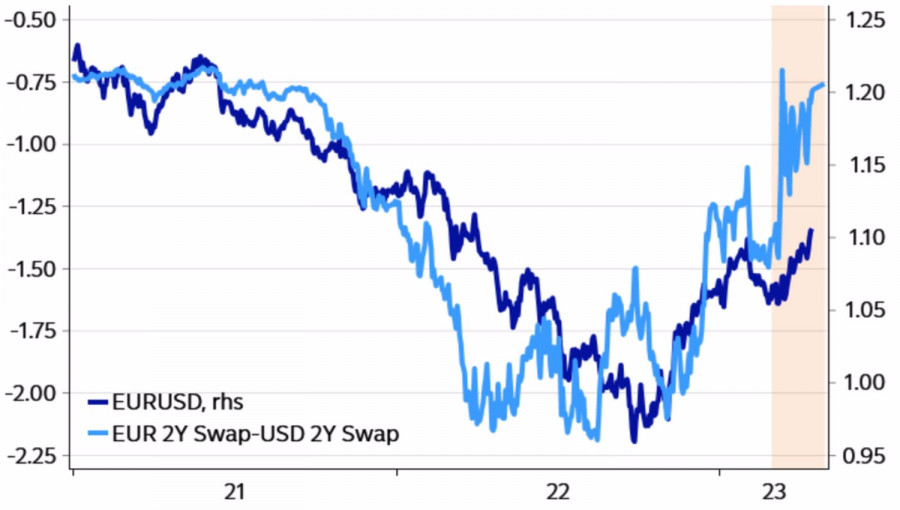

In Europe, the picture is different. There, ECB officials are very aggressive against the backdrop of record core inflation levels. It needs to be broken, and the short-term market predicts a further 75 basis point increase in the deposit rate, to 3.75%. At the same time, derivatives believe that at the next Governing Council meeting in May, the cost of borrowing will increase by 31 basis points. That is, the chances of +50 basis points still remain, which contributes to the rise in EURUSD quotes. From the point of view of the interest rate swap market, the euro is still undervalued compared to the US dollar.

Dynamics of EURUSD and interest rate swap differentials

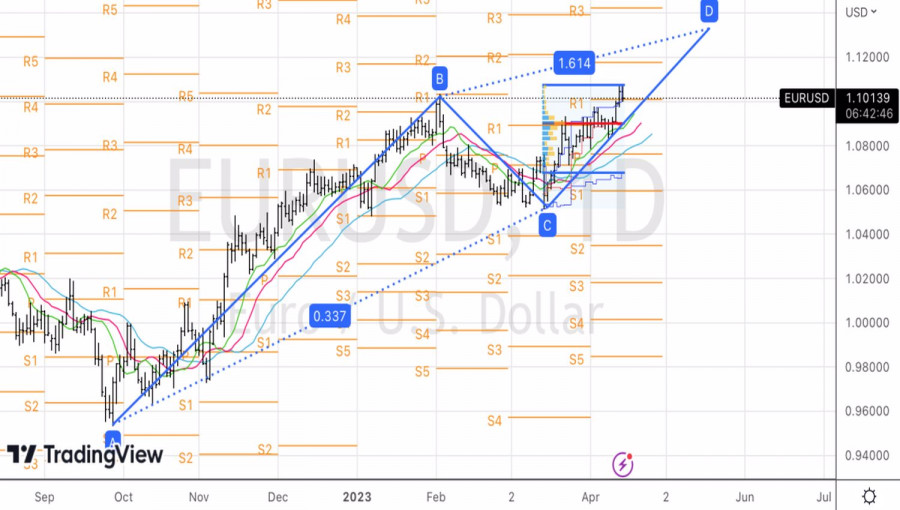

In my opinion, the decline in the main currency pair in response to disappointing retail sales data in the US is the result of speculators taking profits on long positions after a sharp EURUSD rally throughout the week leading up to April 14. When everyone is buying, there is an excellent opportunity to sell well, so there is no need to be surprised by the seemingly unexpected strengthening of the US dollar. It's just the peculiarities of trading.

Technically, on the daily chart, EURUSD bounced off the upper limit of the fair value range at 1.0675-1.0975. No asset can grow indefinitely, and the correction seems like a necessary breather. At the same time, the uptrend persists, and a bounce off support levels at 1.097 and 1.09 should be used to establish long positions.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ogQ7r1d

via IFTTT