EUR/USD is following an uptrend today as traders attempt to settle the price at levels above 1.09. Throughout March, buyers repeatedly challenged this area but retreated each time back to 1.07/08.

To assert their strength above 1.09, the euro bulls must first overcome resistance at 1.0930, which corresponds to the upper Bollinger Bands' line on the 4-hour chart. The next price barrier is the target of 1.0980 (the upper Bollinger Bands' line on the daily chart), breaking through which will open the way to above 1.10. However, it is too early to talk about such highs as traders are only mulling over what positions to open, feeling out the borders of the 1.09 zone. Nevertheless, the overall fundamental background sets the stage for a bullish trend. The "oil factor" only provided temporary support to the greenback, while hawkish ECB messages, weak US reports, and a global appetite for risk tilted the scales towards the euro.

Rise and fall of the greenback yesterday

The US dollar temporarily strengthened its position across the board in response to OPEC+ decision to reduce oil output rates. This decision threatens the US with inflation and rising gasoline prices. In particular, according to economists polled by the Associated Press agency, gasoline prices in the US will appreciate by approximately 26 cents per gallon, and by summer (i.e., the vacation season), fuel prices may rise more drastically. The risk that rising oil prices will accelerate inflation provided support to the US currency. Hawkish expectations regarding further actions by the Fed increased, as indicated by the CME FedWatch Tool. The likelihood that the Federal Reserve will raise the rate by 25 points after the May meeting increased to 67%. Accordingly, the likelihood of a pause declined to 33%. Just a week ago, the market was more confident that the regulator would maintain the status quo in May.

However, this fundamental factor only provided temporary support to the US currency. Dismal macroeconomic reports published yesterday in the US once again reminded of the long-standing dilemma, which boils down to one question: what is the greater evil - inflation or recession, with the additional "option" of more bank crashes?

Apparently, in the late New York session, the market once again doubted that the Federal Reserve would go headlong and raise rates despite the existing risks. At the moment, the probability of a 25-point scenario at the May meeting has decreased to 55% (again, according to the CME FedWatch Tool), reflecting the overall decrease in the hawkish scenario for the Fed's further policy moves.

Dismal reports

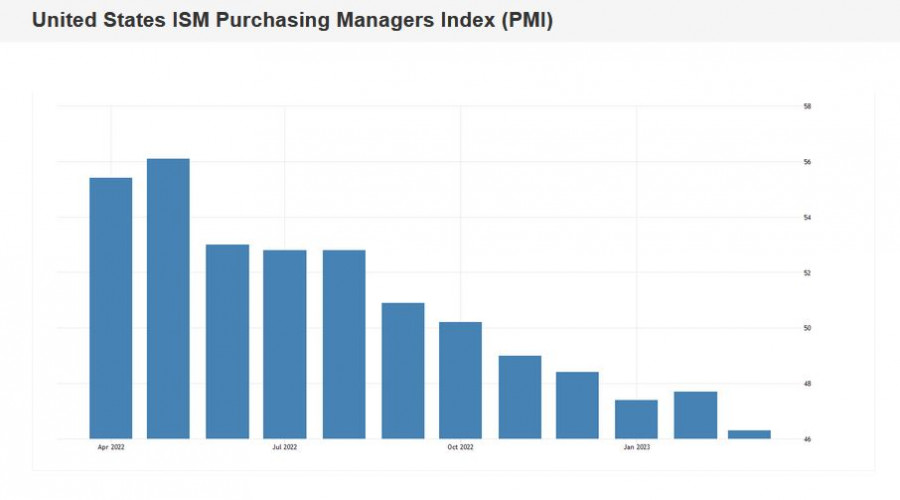

Traders were discouraged by the ISM Manufacturing Index, which came out in the red zone. The indicator was at 46.3 whereas the consensus suggested a milder decline to 47.5. The March result is the weakest since May 2020, when the US manufacturing sector was bruised by the fallout of the coronavirus crisis. The new orders index fell to 44.3 from the previous value of 47, and the employment index dropped to 46.9 from the previous value of 49.1. The inflation component of the report (the index of paid prices) crossed the threshold 50-point mark, dropping to 49.2 points from the previous value of 51.3.

Another macroeconomic indicator disappointed the dollar bulls. It became known that the volume of spending in the US construction sector fell by 0.1% in February after a 0.4% increase in January. This is, of course, a secondary indicator, but it still added to the negative fundamental picture for the dollar.

Euro on Top

Interestingly, the euro was unaffected by the publication of the ECB Consumer Expectations Survey (a survey of inflation expectations conducted monthly by the European regulator). According to the survey results, median inflation expectations for the next 12 months continued to decline: in January, the indicator was at 4.9%, and in February, it was 4.6%. But the market "keeps in mind" other practical signals. We are talking about the dynamics of core inflation in the eurozone which continues to climb, setting new historical records. At the same time, ECB President Christine Lagarde, like many members of the Governing Council, has repeatedly expressed concern that the core consumer price index still accelerates its pace of growth.

Additional support for the euro came from ECB representative Robert Holzman, Governor of the Central Bank of Austria, who yesterday stated that a 50-basis-point rate hike in May is still "possible." According to him, if the central bank moderates the rate hike to 25 points, then it will be "difficult for the regulator to go back." Importantly, Christine Lagarde's rhetoric maintains intrigue regarding the agenda for further monetary tightening. Although after the publication of inflation data on the Eurozone for March, the question is no longer whether to raise rates or not - but by how much exactly. Holzmann's message indicates that the 50-point scenario is still on the agenda.

Conclusion

The EUR/USD pair is trying to consolidate in the area of 1.09, demonstrating bullish sentiment for the second day in a row. The fundamental background favors further price growth: the dollar fell against the backdrop of the disappointing ISM Manufacturing index in the US, while the euro received support from the ECB, whose representatives continue to voice hawkish messages.

However, it is advisable to consider long positions in the pair only after the price is consolidated above the resistance level of 1.0930 (the upper line of the Bollinger Bands indicator on the H4 timeframe). In this case, the next target of the bullish move will be the level of 1.0980, the upper line of the Bollinger Bands indicator on the D1 timeframe.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ZC5PudD

via IFTTT