Buy when everyone else is selling. Going against the crowd is certainly dangerous, but if you are sure you are right, you can make good money. The pound's decline, provoked by a rise in oil prices, could not last long. OPEC+ surprised the market with its decision to cut production by 1 million bpd. Brent and WTI soared. And the risks of a new acceleration in inflation have risen, suggesting a continuation of the Federal Reserve's monetary tightening cycle. But weren't investors too quick to believe it?

The market sells first and thinks later. The surprise from OPEC+ has speculators running to the U.S. dollar. Higher energy prices could accelerate U.S. inflation and push the Fed into decisive action. And the Fed is not to be trifled with. The odds of a quarter point rate hike in May has soared above 50% for the first time in days. Just a week ago, the probability of a continuation of the monetary tightening cycle was estimated at 20%. Not surprisingly, GBPUSD collapsed, however, it was mostly because of emotion.

Indeed, if the Fed is guided by core inflation, the surge in energy prices should not have excited investors so much. The Fed's monetary tightening is coming to an end. The other thing is that the federal funds rate will remain at 5% or 5.25% for an extended period of time. And the better the US macro data is, the less likely a dovish pivot.

The dynamics of economic surprises in the U.S. and the extent of the Fed rate cuts

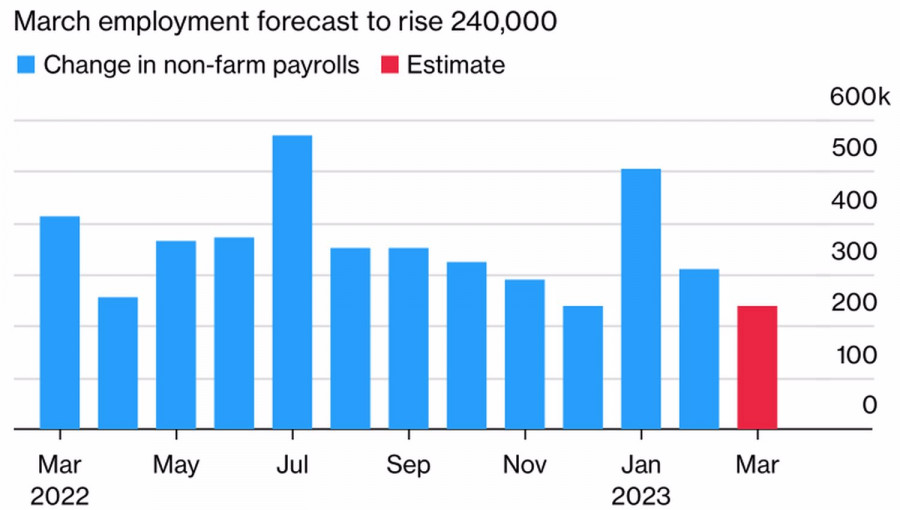

In this regard, the U.S. jobs report could have a major impact on GBPUSD. Reuters experts are expecting the figure to slow down to 240,000, which is the lowest level in many months. Combined with a slowdown in wage growth, it raises the likelihood of the end of the Fed's monetary tightening cycle and puts pressure on the US dollar. I would not be surprised if ahead of significant reports, the pair will be bought on rumors.

U.S. jobs dynamics

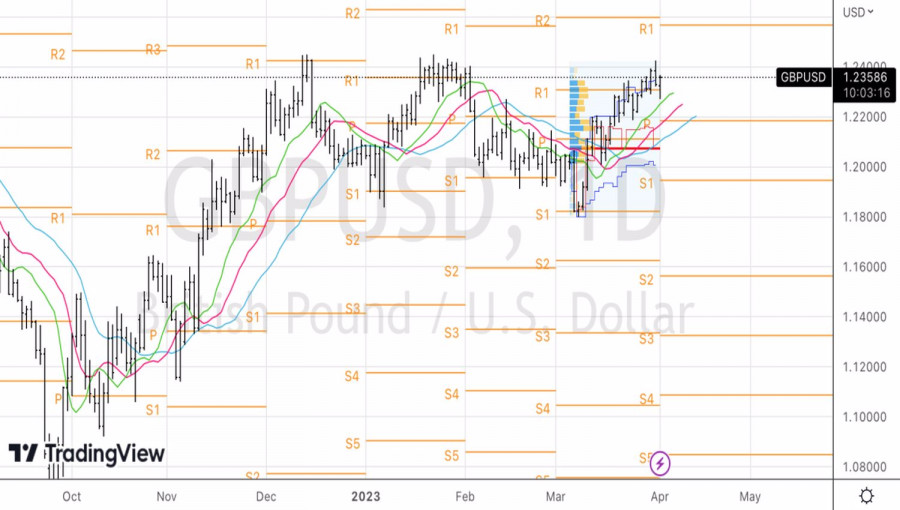

As for the pound, according to ING, along with the improvement in the economic outlook, sterling is definitely drawing benefits from the market's conviction that the Bank of England will need to continue raising rates. Markets are pricing in a 60% chance of a further 25 bps hike from the central bank in May, and a 40% chance of no change. ING believes that GBPUSD will soar above 1.25 within the next week.

Well, we should admit that there is some logic in it. The pair's bullish prospects look justified against the background of the weakened US dollar, which is close to the end of the Fed's monetary tightening cycle.

Technically, after reaching the first target at 1.235, a pullback followed. We could build up long positions in a pronounced uptrend with the target at 1.26.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/d49kQwe

via IFTTT