Over the past two weeks, the cryptocurrency market has started to resemble a deserted desert. The price of Bitcoin continues its persistent consolidation near the $27k level without any attempts to break out of the range of $26.6k–$27.5k. The situation has not changed even after the speeches of Federal Reserve System members on Friday.

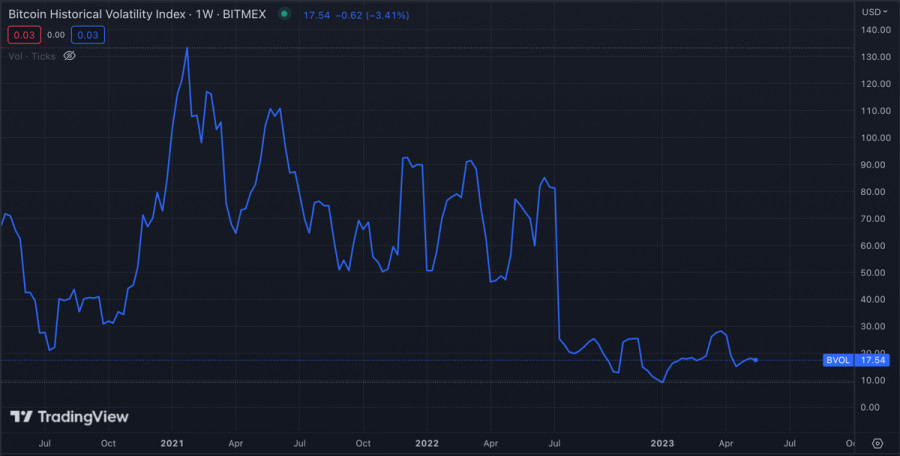

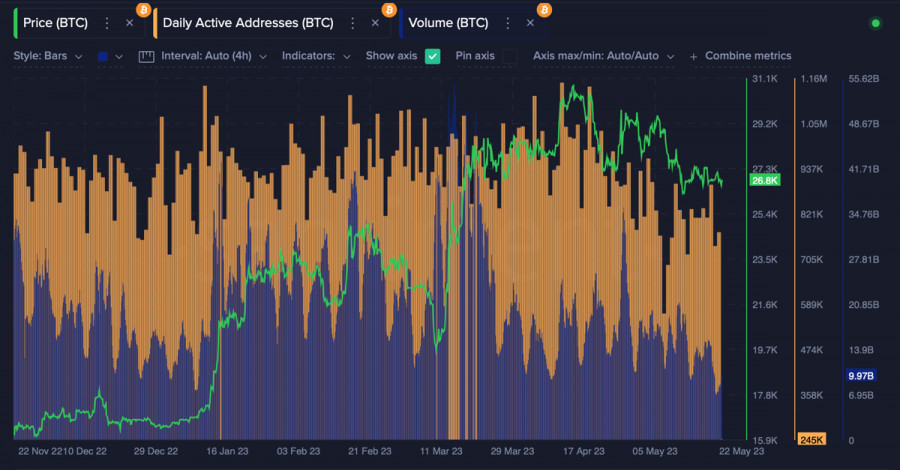

The asset continues its flat movement with bulls and bears in full parity. As a result, we have not seen strong price movements or spikes in volatility. On-chain activity and trading volumes in the Bitcoin market also continue to decline to local lows.

The Fed statements

The speeches of the major volatility providers in the financial markets—the Fed officials—could not affect the situation. Although Fed Chair Jerome Powell's speech saw an increase in activity, it did not significantly impact the price movement.

Moreover, a large number of traders closed their limit orders due to the high level of uncertainty regarding the movement of BTC price. As a result, the cryptocurrency price remained fluctuating in the range of $26.6k–$27.5k. Meanwhile, Powell made important statements that can be considered positive.

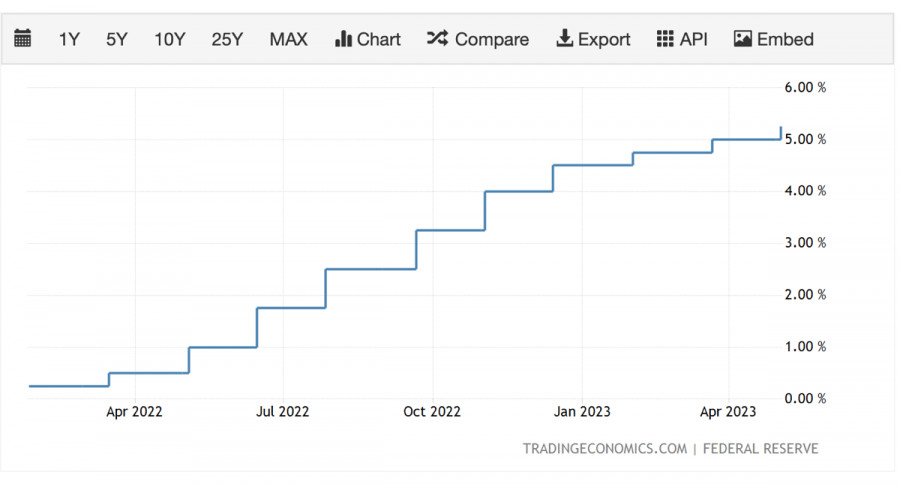

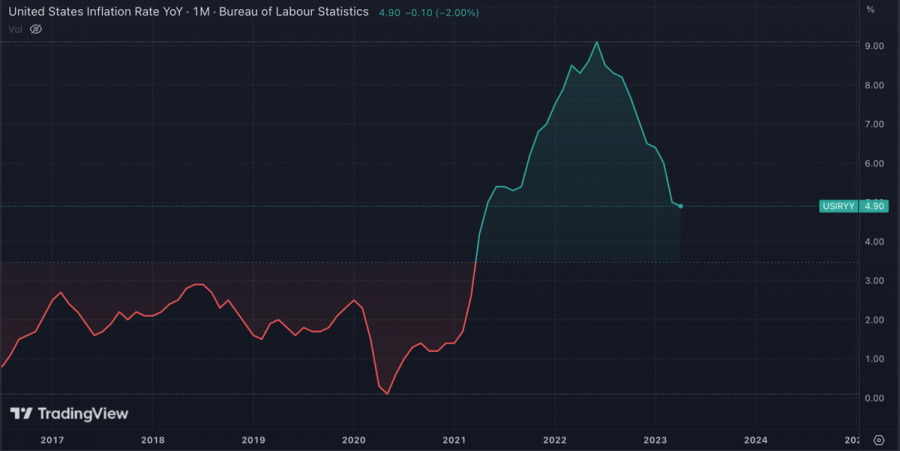

The official noted that the key goal of the Fed is to reduce inflation to 2%, which stood at 4.9% as of the end of May. Powell also acknowledged that the interest rate will not be raised due to high credit stress, which has caused a local crisis in regional banks in the United States.

Bullish sentiment in the BTC market

Despite minimal price movement of the leading cryptocurrency, market sentiment can be assessed as positive. Several important on-chain metrics indicate this. According to Santiment, the number of BTC held by "shrimp" wallets has reached an all-time high of 1.32 million coins.

Glassnode also reports that the volume of BTC coins held by long-term investors has reached a peak of 14.46 million units. These are positive signals indicating fundamental trust in the asset. At the same time, significant outflows of BTC coins from crypto exchanges are observed.

Santiment reports that approximately 5.7% of the total BTC supply is held on trading platforms. Analysts suggest that investors withdraw assets for offline storage immediately after purchasing, which also indicates long-term plans.

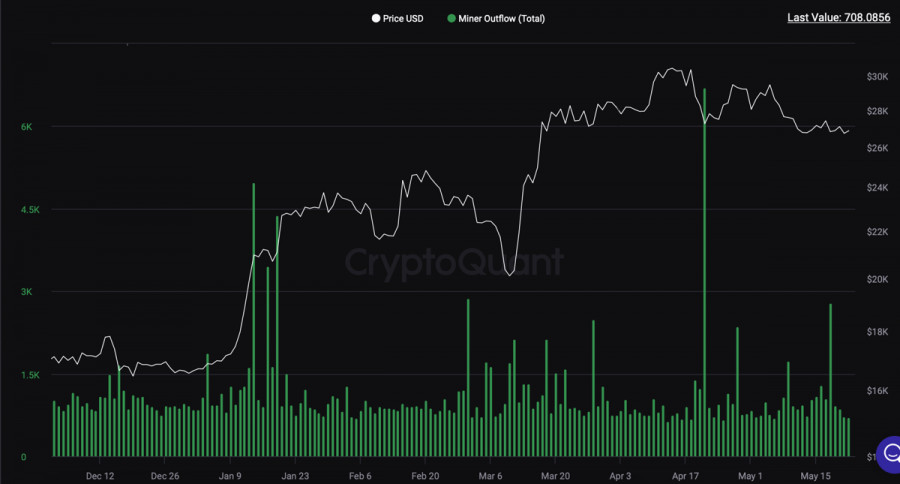

However, this has a negative impact on the short-term prospects of BTC, as volatility levels and trading volumes have reached lows seen in recent years. It is also reported that BTC miner inventories have decreased by 2,000 BTC over the past few days.

BTC/USD Analysis

All these factors indicate the long-term value of Bitcoin but show weakness in buyers' short-term perspective. The asset continues to consolidate around $26.6k–$27.5k, and there is no reason to believe that the situation will change significantly in the near future.

Technical metrics are also moving within narrow ranges, indicating a weak impulse and its likely realization only within the range of fluctuations. However, when the consolidation movement is completed, we can expect BTC to break out of the range of $26.6k–$27.5k.

Conclusion

As of May 22, Bitcoin looks bearish, and therefore, the chances of a further decline in the asset are higher. The key levels for bears are $26.6k, where an important support level is located, and two strong accumulation blocks around $26.1k and $26.2k.

If these thresholds are breached, the asset will continue its downward movement towards the $25k area. However, if the asset resumes its upward movement and consolidates above $28.5k, we can expect a resumption of the upward trend. But the chances of a bullish scenario are currently extremely low.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/dhmt7rj

via IFTTT