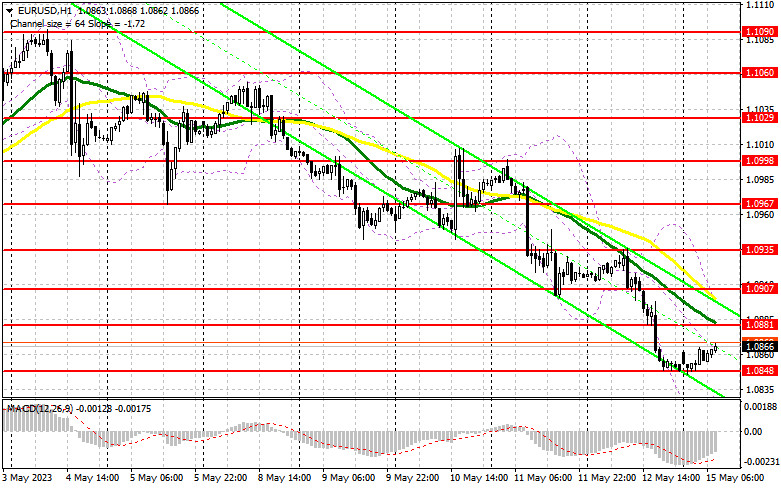

On Friday, no entry signals were made. Let's look at the 5-minute chart to get a picture of what happened. Previously, I considered entering the market from 1.0911. Quotes declined to around 1.0911, but no entry point from this level was created. Buyers failed to settle at 1.0911 and no false breakout followed. So, the technical picture for the second half of the day somewhat changed. No suitable signals came during the American session, and the euro extended losses, giving no reason for buying.

When to open long positions on EUR/USD:

Even despite fairly weak US statistics, buyers still were unable to partially offset losses at the end of last week. With the US debt ceiling issue, investors are reluctant to buy risky assets. The eurozone's industrial production will be the only macro report delivered today. So, the focus will shift to the economic forecast from the European Commission, as well as a Eurogroup meeting. Although the ECB's Joachim Nagel will speak today again, his remarks will unlikely support the euro, which, although oversold, is not in demand.

For this reason, I will open long positions on a correction from the weekly low of 1.0848, formed in the Asian session. This will indicate the presence of buyers in the market willing to push the euro up at the beginning of the week. A false breakout there will create a buy entry point with the target at 1.0881 resistance, which is in line with the bearish moving averages. Only a breakout and a downside test of this range after the ECB representative's speech will boost demand for the euro and produce an additional buy entry point with the target at a high of 1.0907. The most distant target remains the area of 1.0935, where I will take profit.

If EUR/USD declines and there are no buyers at 1.0848, which is quite likely due to a bear market, we may see a trend develop. Therefore, only a false breakout near 1.0800 support will make a signal to buy the euro. I will open long positions immediately on a bounce from a low of 1.0748, allowing a bullish correction of 30-35 pips intraday.

When to open short positions on EUR/USD:

Bears are still in control of the market and are not planning to retreat yet. However, the fall cannot last forever. So, be very careful at weekly lows. Sellers should protect the nearest resistance at 1.0881, which is in line with the moving averages. This will allow us to open more short positions. A false breakout at this level will generate a sell signal with the target at 1.0848. After consolidation below this range and an upside retest, the price will head toward 1.0800. The most distant target is seen at a low of 1.0748, where I will take profit.

If EUR/USD goes up during the European session and there is no bearish activity at 1.0881, which could happen due to profit-taking by large players, buyers will try to return to the market. In this case, I will open short positions at 1.0907 after failed consolidation only. I will open short positions immediately on a bounce from a high of 1.0935, allowing a bearish correction of 30-35 pips.

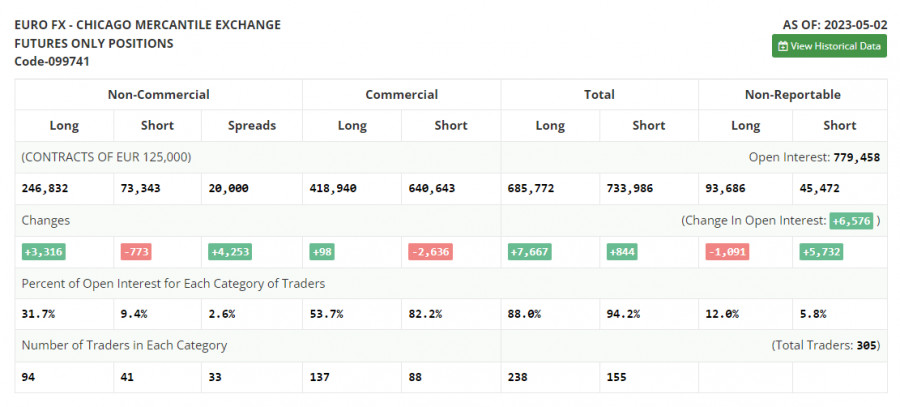

The COT report for May 2 logged an increase in long positions and a decrease in short positions. This report does not yet account for significant changes that took place in the market after the Federal Reserve and European Central Bank meetings last week. So, traders should not focus on it too much. Both central banks raised rates by 0.25%, maintaining market balance while allowing risk asset bulls to expect further growth. There is no important data this week. So, traders can relax a bit. According to the COT report, non-commercial long positions grew by 3,316 to 246,832, and non-commercial short positions dropped by 773 to 73,343. As a result, the overall non-commercial net position increased to 173,489 from 144,956, recorded a week before. The weekly closing price dropped to 1.1031 from 1.1039.

Indicators' signals:

Moving averages:

Trading is carried out below the 30-day and 50-day moving averages, which indicates a bearish continuation.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Support stands at 1.0830, in line with the lower band.

Description of indicators

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

from Forex analysis review https://ift.tt/Ew23rTf

via IFTTT