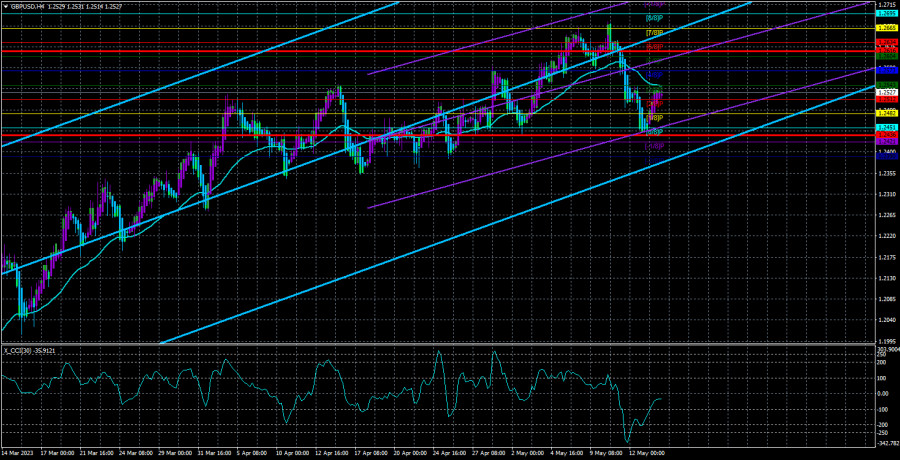

On Monday, GBP/USD almost approached the moving average. All in all, the situation remains unclear for the pound sterling. Like the euro, it has moved in the same direction for 2 months. Then, the CCI twice entered the overbought zone, generating a strong sell signal. However, once the fall began, the CCI entered the oversold zone and unexpectedly produced a signal to buy. If it is a random signal, the price may not break the moving average. If it does break the MA, the uptrend may quickly resume.

Overall, the pound shows little interest in a downtrend. Despite three consecutive quarters of zero growth and other weak macro indicators, the pound is bullish. The Bank of England may end the rate hike cycle in the coming months, and UK inflation has not decreased whatsoever. These fundamental factors alone should have pushed the sterling down. At the same time, the Federal Reserve's interest rate is still above the BoE's, and US inflation has already fallen to 4.9%.

Therefore, almost any further growth in GBP/USD makes no sense. Currently, it remains to be seen whether the price consolidates above the MA or not. So far, the pair has fallen by just 240 pips after a rise of approximately 900 pips.

Macroeconomic calendar

On Monday, the macroeconomic calendar was empty in the UK. Today, data on unemployment, claimant count, and average earnings will be released. The unemployment rate is projected to remain at 3.8% and the number of people claiming unemployment benefits to drop by 15,000. If actual results miss market expectations, selling pressure may increase. Meanwhile, the average earnings report will be of secondary importance.

On Wednesday, Governor Andrew Bailey will deliver a speech. He rarely speaks and is rarely eloquent. Therefore, we should not expect a lot from him this time. Nevertheless, he may hint at the regulator's future stance on rate hikes, which may have a strong influence on the pound sterling. No more macro releases are scheduled for this week in the UK anymore.

On Tuesday, the US will see the release of statistics on industrial production and retail sales. They may also trigger a market reaction. Several Fed officials will deliver speeches. However, their remarks will hardly affect the market because there is a 90% probability that the US regulator has ended the tightening cycle.

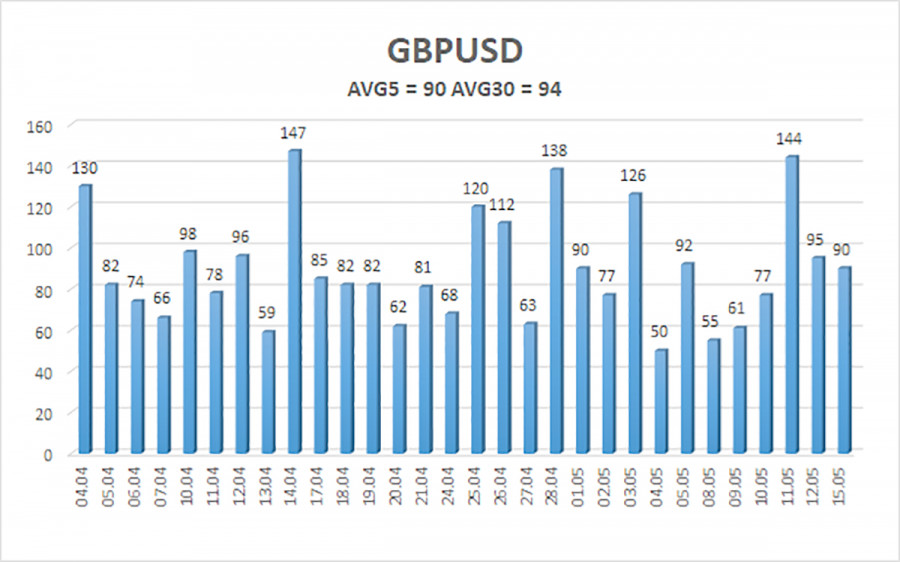

No more important releases will be published in the US before the end of the week. Data on building permits, jobless claims, and new home sales will be of secondary importance. They may influence the market if they differ significantly from market expectations. All in all, no other events will be able to change market sentiment this week. Both the euro and the sterling will likely extend the fall. Notably, volatility has decreased noticeably over recent months, and it has become more difficult to trade. When the pair barely moves during the day, it gets harder to yield a profit.

The 5-day average volatility of GBP/USD for the past 5 days totaled 90 pips and is evaluated as mild. On Tuesday, the pair is expected to move in a channel limited by the 1.2436 and 1.2616 levels. Heiken Ashi's downward reversal will signal the likelihood of a downtrend.

Support:

S1 – 1.2512

S2 – 1.2482

S3 – 1.2451

Resistance:

R1 – 1.2543

R2 – 1.2573

R3 – 1.2604

Outlook:

In the 4-hour time frame, GBP/USD has settled below the MA and may well continue falling. Therefore, we may sell with targets at 1.2451 and 1.2436 until Heiken Ashi reverses to the downside or bounces off the MA. Long positions could be considered after consolidation above the moving average with targets at 1.2604 and 1.2616.Indicators on charts:

Linear Regression Channels help identify the current trend. If both channels move in the same direction, a trend is strong.

Moving Average (20-day, smoothed) defines the short-term and current trends.

Murray levels are target levels for trends and corrections.

Volatility levels (red lines) reflect a possible price channel the pair is likely to trade in within the day based on the current volatility indicators.

CCI indicator. When the indicator is in the oversold zone (below 250) or in the overbought area (above 250), it means that a trend reversal is likely to occur soon.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/MafuKQ9

via IFTTT