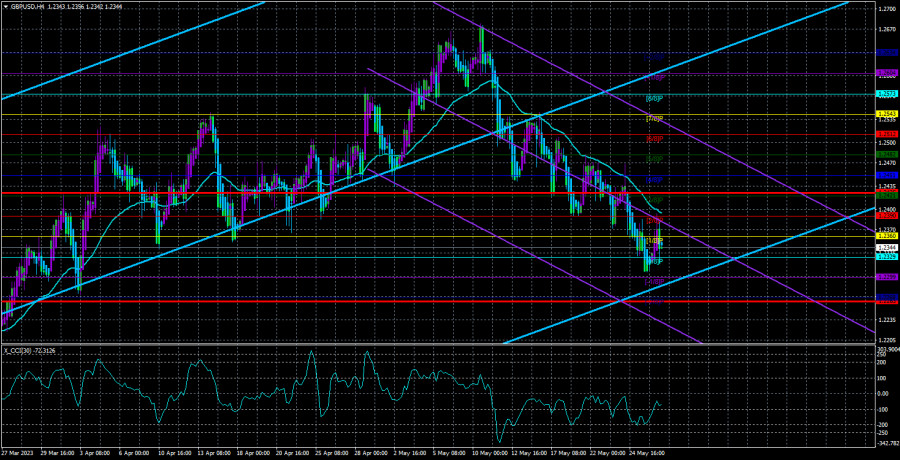

The GBP/USD currency pair made another attempt to correct slightly upwards on Friday, but it failed to succeed. The price again failed to reach even the moving average line, so the overall confident southward movement continues. Unfortunately, as mentioned before, trading on the 4-hour timeframe is extremely problematic because the movement is not the strongest (although stable), and the Heiken Ashi indicator frequently reverses upwards. The situation is similar to that of the euro. Therefore, the best solution is to trade in the medium term.

The pound has not yet exhausted its potential for decline. So far, it has only fallen by 350 points, while the preceding growth amounted to 900. And this is just the latest surge in the British currency's growth. Therefore, even against this surge, the current correction is too weak. If we add to this the unwarranted rise of the pound in the last 2.5 months, its overall overbought condition, and two entries into the extreme zone of the CCI indicator, it becomes clear that the pound's path is only downward. There are simply no new growth factors for the British currency.

After all that has been said, it is important to emphasize one more point. The market can trade illogically at any moment, completely detached from its macroeconomic and fundamental background. It's simple: you can't control the market. The pound will appreciate if major players make trades (not for profit) according to their own demands. And those demands can vary. A large bank may need a significant amount of pounds for major deals or reserves, and then it turns out that the "fundamental" suggests a decline, but the British pound will still rise. Therefore, it is always important to understand that there are no 100% forecasts and cannot be.

There are no threats to the dollar at the moment.

Next week, there will be a significant number of important macroeconomic statistics. However, it is impossible to predict how it will affect the pair's movement for understandable reasons. The data will start on Wednesday, when the JOLTS Job Openings report will be published in the United States. The previous value of the report could have been more pleasing to traders, but the dollar is currently on the move. Additionally, the Beige Book by the Federal Reserve System will be published on Tuesday, a summary of regional economic reports. This document usually does not contain important information.

On Thursday, we will have the ADP report, which is an analog of the nonfarm payrolls and usually does not impact the market. However, the ISM report on business activity in the manufacturing sector can be significant for the dollar's prospects. The manufacturing sector continues to struggle in many developed countries, and the United States is no exception. The indicator consistently remains below the key level of 50.0. The report on unemployment claims appears secondary compared to these data. However, it is what it is. On Friday, the most important statistics will be released. Nonfarm Payrolls, unemployment, and wages. Last month, the markets anticipated an increase in unemployment and a decline in nonfarm payrolls, but that did not happen. A similar situation may occur this time.

In the UK, next Thursday, only one report on business activity in the manufacturing sector will be published. In addition to all the above, there will be a series of speeches by representatives of the Federal Reserve System. Specifically, Michelle Bowman, Patrick Harker, and Thomas Jefferson will take the stage. It is also possible that other representatives of the Bank of England and the Federal Reserve System will speak during the week. Still, there needs to be more information about it. It should be noted that Mr. Bailey was not scheduled to speak this week either; news of his speeches became known only a day in advance.

Thus, there will be a significant number of important events. Since the dollar currently enjoys a strong advantage, its strengthening will continue. However, it should be clarified: we believe the dollar's rise will continue in the medium term. For a few days, we may see a correction. Everything will depend on the incoming information.

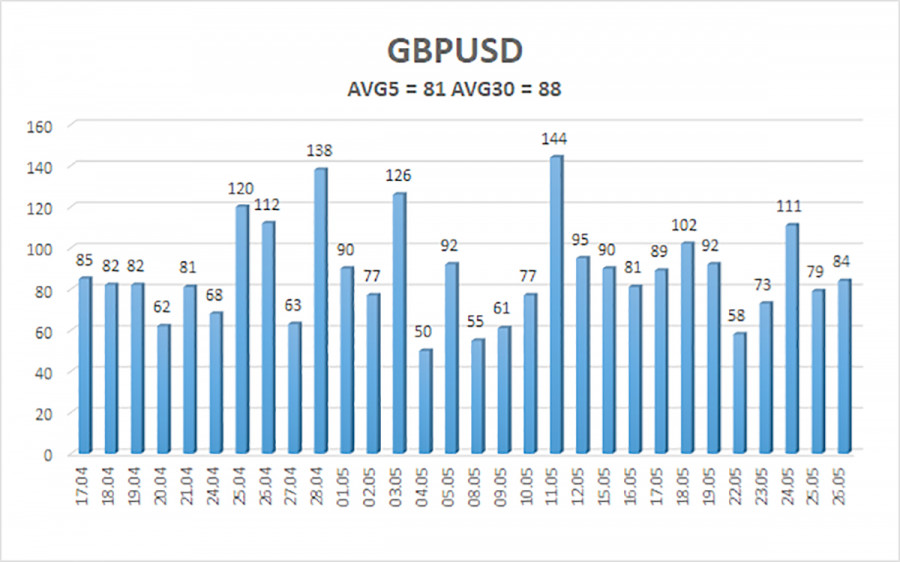

The average GBP/USD pair volatility for the last five trading days is 81 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, May 29, we expect movements within the channel limited by the levels of 1.2263 and 1.2425. A reversal of the Heiken Ashi indicator upwards will signal a new wave of corrective movement.

Nearest support levels:

S1 - 1.2329

S2 - 1.2299

S3 - 1.2268

Nearest resistance levels:

R1 - 1.2360

R2 - 1.2390

R3 - 1.2421

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to move south overall, so short positions with targets at 1.2299 and 1.2263 remain relevant and should be held until the price consolidates above the moving average. Long positions can be considered if the price consolidates above the moving average, with targets at 1.2425 and 1.2451.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both channels move in the same direction, it indicates a strong trend.

Moving average line (settings 20, 0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an approaching trend reversal in the opposite direction.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/28Hoanv

via IFTTT