Analyzing Friday's trades:

EUR/USD on 30M chart

The EUR/USD pair extended its downward movement on Friday. The euro had been falling throughout the week, which hasn't happened for more than two months. I believe that the market has finally regained its senses and is no longer just buying the euro, and that too baselessly. Now it has started to take profits on long positions. I also believe that the euro has completely exhausted its growth potential, so it will only fall further. The bearish potential is several hundred points, at least. For the first time in a long time, the descending channel exists not just for show.

There was practically no macro data on Friday. The US only published the University of Michigan consumer sentiment index, which turned out to be much worse than forecasts. However, the dollar did not pay any attention to the weak report and continued to rise. It seems that we are facing the opposite situation to what we have been observing for the past two months. Now the dollar is rising, no matter what. And this is fair, since the dollar has been depreciating for two months both with and without reason.

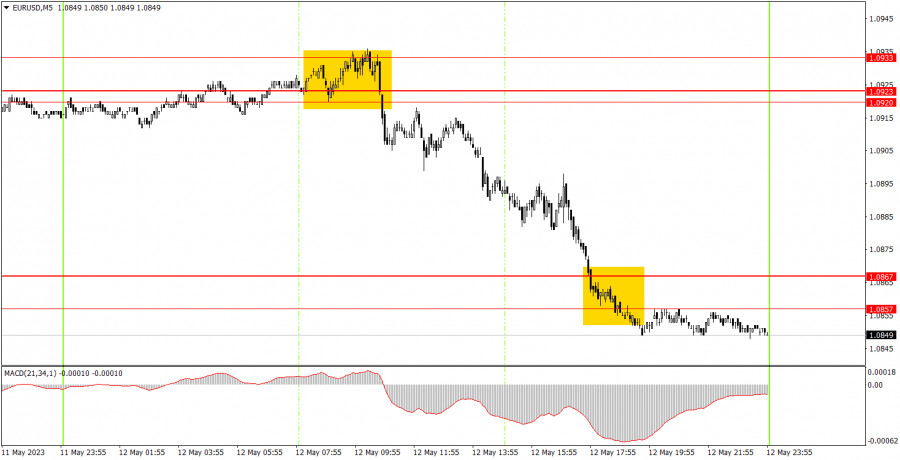

EUR/USD on 5M chart

On the 5-minute chart, the pair moved in an excellent manner. It started to fall at the beginning of the European trading session and ended at the end of the US one. There was only one sell signal, which was consolidating under the 1.0920-1.0933 area, afterwards the pair fell to the 1.0857-1.0867 area. Thus, beginners could open one short position, which brought them profit of no less than 50 pips. Please remember that a trend-driven movement even within a day is the best scenario for traders. It is easy to work and earn on such movements.

Trading tips on Monday:

On the 30-minute chart, the EUR/USD pair continues to trade lower. For the first time in a long time, the pair may show a significant downward move, which would be completely logical, from a technical perspective. We have been waiting for the dollar to strengthen for a long time and it looks like we finally got it. On the 5-minute chart, it is recommended to trade at the levels 1.0692, 1.0737, 1.0792, 1.0857-1.0867, 1.0920-1.0933, 1.0965-1.0980, 1.1038, 1.1070. As soon as the price passes 20 pips in the right direction, you should set a Stop Loss to breakeven. On Monday, there are no macroeconomic events scheduled in America and the European Union will only release an industrial production report. Also, there will be several speeches of Federal Reserve representatives in the afternoon, but keep in mind that only one speech out of 10 might provoke a market reaction. As a rule, the rhetoric of the Fed representatives does not change from speech to speech, so there is usually nothing to react to.

Basic rules of the trading system:

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart:

Support and Resistance levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/oq659S7

via IFTTT