US stock markets are declining for the second consecutive day without any signs of a debt ceiling agreement, and the clock is ticking louder in anticipation of the "X-date," which, according to current calculations, is set for June 1st, as confirmed by Treasury Secretary Yellen.

FOMC minutes reflect a somewhat contradictory nature of most comments. "Some" officials deemed additional tightening likely justified, while "some" concluded that it might be time to end the hikes. Interpret it as you wish.

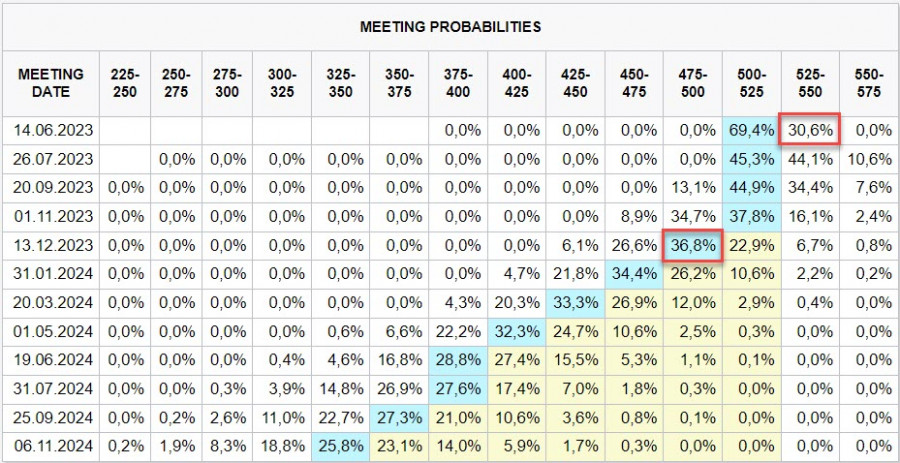

Nevertheless, the futures market shows a weak momentum in favor of a more prolonged tightening. The probability of another rate hike on June 14th has reached 30%, and in July, it is already 44%, while expectations of the first cut have shifted to December.

Expectations for interest rates, albeit weak, are in favor of the US dollar, which continues to strengthen across the entire spectrum of the currency market.

This morning, Germany's GDP data for Q1 was published, which turned out to be noticeably worse than expected, causing EUR/USD to decline. This is another factor in favor of the dollar.

The main focus remains on discussions about the debt ceiling, and any specific details can sharply increase volatility.

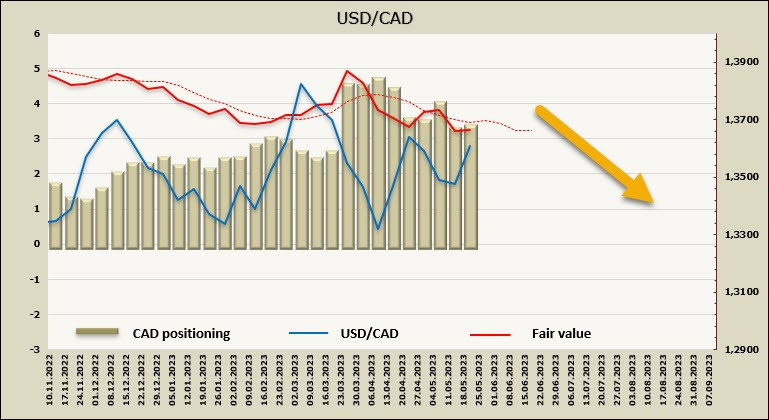

USD/CAD

Bank of Canada Governor Macklem expressed concerns about inflation risks at the end of last week. Core inflation remains stable and shows no signs of decline, and the housing market is growing confidently, largely due to the highest migration rates to Canada among all developed economies.

The probability of the Bank of Canada reconsidering its decision to pause rate hikes, which was made in January, currently appears high. Scotiabank analysts expect that the rate could be raised as early as the next meeting in June. If these expectations are confirmed in the market, the Canadian dollar will receive a strong driver for growth.

Speculative positioning on CAD remains consistently bearish, with a net short position of -3.2 billion at the end of the reporting week. The calculated price is below the long-term average, but the direction is absent.

Trading continues near the mid-range values of the sideways range, without a clear direction, and there are currently no obvious reasons capable of causing a strong movement in either direction. Slightly more likely is a movement towards the upper boundary of the technical pattern at 1.3770/90.

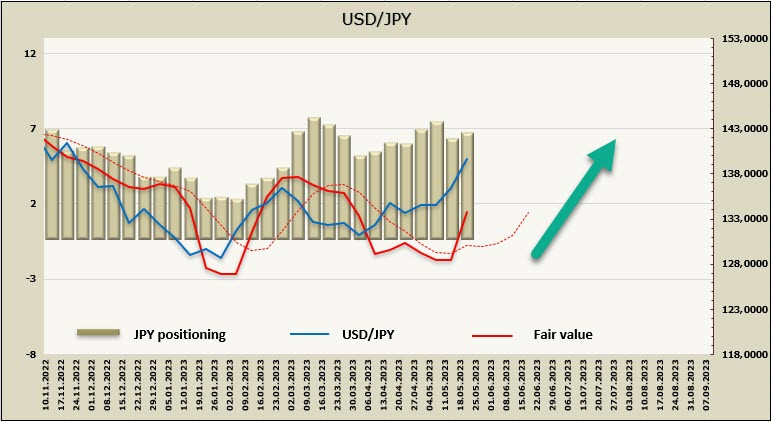

USD/JPY

Bank of Japan Governor Kazuo Wada delivered his first speech as the head of the bank. He expressed a strongly dovish approach, giving no hints of any need for immediate action.

Regarding monetary policy, Wada stated, "At this stage, the Bank needs to firmly continue with accommodative monetary policy." It appears that no adjustments to yield curve control are expected at the upcoming meeting on June 15-16, and expectations of possible changes are shifted to the next meeting on July 27-28.

It is also worth noting that the Bank of Japan was the only major central bank that refrained from changing its monetary policy while others hastily raised rates to combat inflation. These efforts paid off as global inflation began to decline, and Japan experienced a decrease in external inflationary pressure without taking any action of its own. This reduces the need for the Bank of Japan to take measures to change its policy.

The net short position on JPY increased by 0.3 billion during the reporting week to -5.9 billion, and the calculated price sharply increased, indicating the strength of the bullish momentum.

USD/JPY managed to update the previous local high at 137.92, and the yen reached resistance at 139.60 (50% retracement of the sharp decline from November to January), with the next resistance at the channel boundary of 140.80/141.00. The main reason for the yen's weakness is that expectations regarding the Bank of Japan's monetary policy change after the new leadership took office did not materialize, and now a downward reversal is possible only in the event of a sharp increase in demand for safe-haven assets or after a clear signal from the BoJ, which the markets do not expect before July.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/NzYcDrZ

via IFTTT