The US inflation report disappointed both bulls and bears on Wednesday. No significant changes were recorded in April, with both indices only falling by 0.1%. Such figures should not affect the Federal Reserve's decisions at future meetings, as it is currently impossible to conclude that inflation has stopped declining. If this were the case, there could have been expectations for additional interest rate hikes in 2023. On Thursday, however, it was the Bank of England that disappointed. It disappointed and simultaneously saved the pound from falling.

Before the results of the meeting, analysts believed that the BoE needed to show that it was willing to maintain a tightening course, as inflation remains very high and any "dovish note" could have resulted in the pound being sold. As a matter of fact, the central bank did manage to meet certain expectations. The BoE confirmed that it will continue to fight high inflation through interest rate hikes, also indicating its readiness to raise rates more sharply if inflationary pressure proves to be more resilient.

The distribution of votes among the Bank's governors also saved the pound from falling. Seven voted for a rate increase of 25 basis points, while two abstained. This is exactly the layout that was expected, and the same distribution of votes was present at previous meetings this year. Some analysts feared that the number supporting a refusal to increase rates could be higher, but these fears did not materialize.

It was also noted that the British economy withstood the impact of high rates and showed good resilience, so the BoE has the opportunity to continue monetary tightening. The British central bank did not give the market any dovish hints, which saved the pound from falling. However, the current wave marking implies a decline in the instrument and a decrease in demand for the pound. One of two things: either the downward movement will still begin, as the market has already factored in all rate hikes, or the instrument will continue to rise, breaking synchronicity with the EUR/USD pair.

I believe the first scenario is more likely, as recently, the demand for the pound has been increasing at a very slow pace, and often not growing at all. The BoE did not give the market any dovish hints, but we did not see any new hawkish ones either. Therefore, we can also say that the rhetoric of the central bank has not changed. Based on this, I think that the market will not raise the demand for the pound. However, a corrective wave would certainly not hurt now. The dollar does not look so hopeless based on its news background. If the issue of raising the debt ceiling is resolved by the end of the month, the market may start looking more positively towards the US currency.

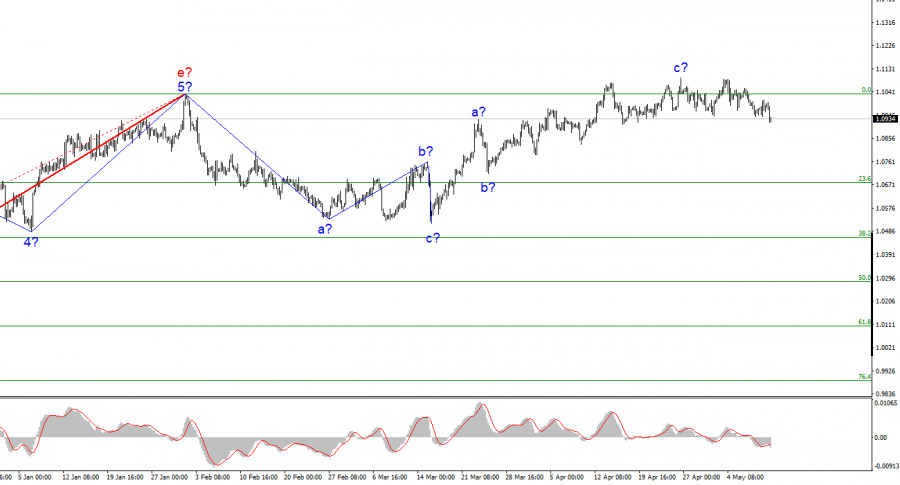

Based on the analysis conducted, I conclude that the construction of the uptrend segment is nearing completion or has already been completed. Therefore, it is now advisable to sell, and the instrument has quite a large space for decline. I think that targets around 1.0500-1.0600 can be considered quite realistic. With these targets, I advise selling the instrument on the reversals of the MACD indicator to the downside as long as the instrument is below the 1.1030 mark, which corresponds to 0.0% Fibonacci.

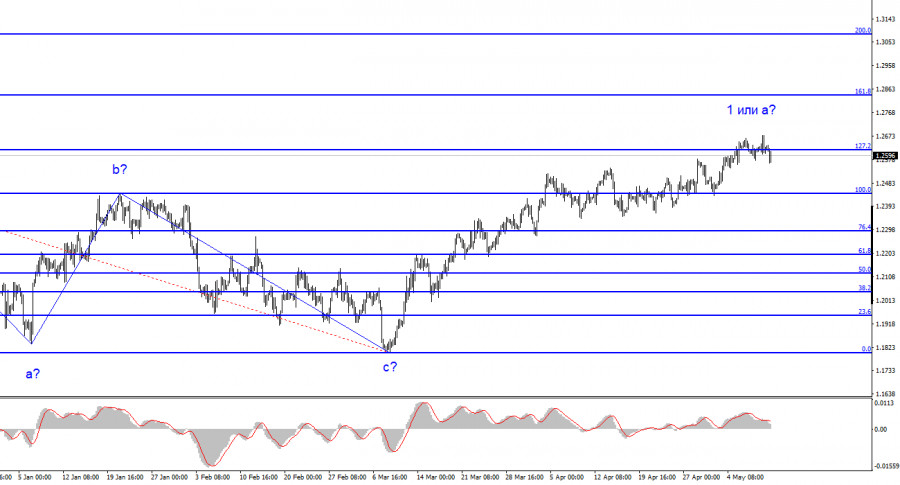

The wave outlook of the GBP/USD pair has long assumed the construction of a new downward wave. The wave marking is not entirely clear, just like the news background. I do not see factors that would support the pound in the long term, and wave b can turn out to be very deep, but it has not even started yet. I believe that it is now more likely for the instrument to decline, but the first wave of the ascending segment continues to become more complex. An unsuccessful attempt to break through the 1.2615 mark, which corresponds to 127.2% Fibonacci, indicates the market's readiness for short positions.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/l0q6JvD

via IFTTT