It does not matter how far the ECB is willing to go in raising rates. What matters is that the Fed is not going to cut them. Danske Bank predicts that the European Central Bank will raise borrowing costs three more times - in June, July and September - to 4%. However, this will not prevent EUR/USD from falling to 1.06. The company estimates the fair value of the euro at $0.9, which suggests huge potential for the major currency pair to fall within 1-3 years. This view contrasts with the Bloomberg experts' consensus estimate of 1.12 by the end of the year. However while Danske Bank is bathed in the rays of glory.

The credit institution is betting on the differential of nominal and real bond yields between the U.S. and Germany. Even if the Fed stops and keeps the federal funds rate at a peak of 5.25% for a long time, the difference in debt yields will continue to stack up in favor of the United States. This will contribute to capital overflows from Europe to North America and a further fall in EUR/USD. According to Danske Bank, the dynamics of the terms of trade and relative labor costs at the moment also speak in favor of the continuation of the peak of the main currency pair.

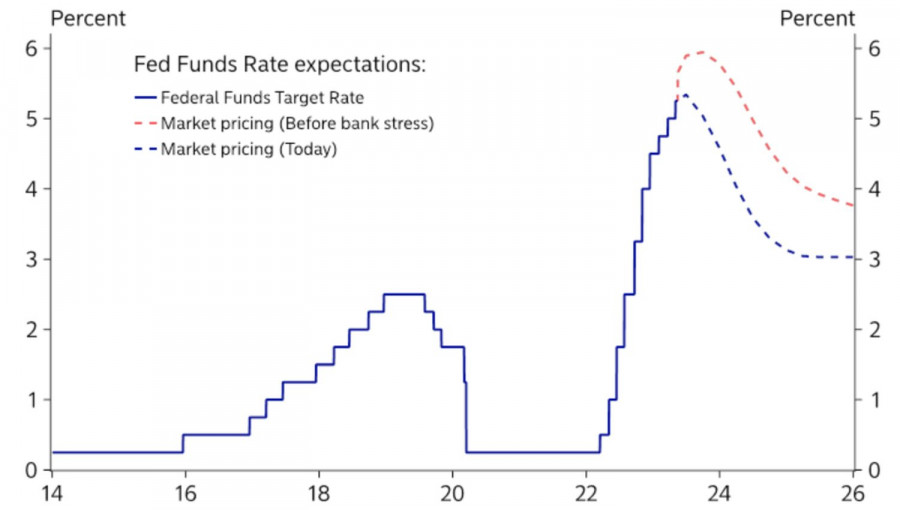

Be that as it may, expectations of a "dovish" pivot by the Fed were clearly overstated. Their current decline underlies the euro correction against the U.S. dollar. While before the April U.S. jobs report the odds of a monetary expansion in September were estimated at 90%, the figure has now fallen to 39%. However, in November the probability of a dovish reversal is 3 to 4. Its decline would allow EUR/USD to continue its correction.

Market Expectations for the Fed Funds Rate

Thus, the lagging cycle of monetary tightening by the ECB compared to the Fed is unlikely to help the euro. Will the economy be able to leverage the regional currency? The EUR/USD rally in November-April was due, among other things, to a change of view on the health of the leading countries of the world. The strong US economy in 2022 should have been weakened by the Fed's most aggressive monetary tightening in decades. It hasn't.

On the contrary, the belief in the rapid recovery of China after the pandemic and the ability of the Eurozone to avoid recession in the background of the energy crisis faithfully served the bulls on EUR/USD up to the beginning of May. Then everything changed. A series of disappointing reports on the currency bloc made investors doubt its stability. The Celestial Empire is not growing as wildly as the euro fans would like it to.

Alas, neither divergence in the monetary policy of ECB and Fed, nor divergences in the economic growth of eurozone and US are not able to support EUR/USD as it used to. In such conditions the correction looks logical. The question is, how deep may the pair fall?

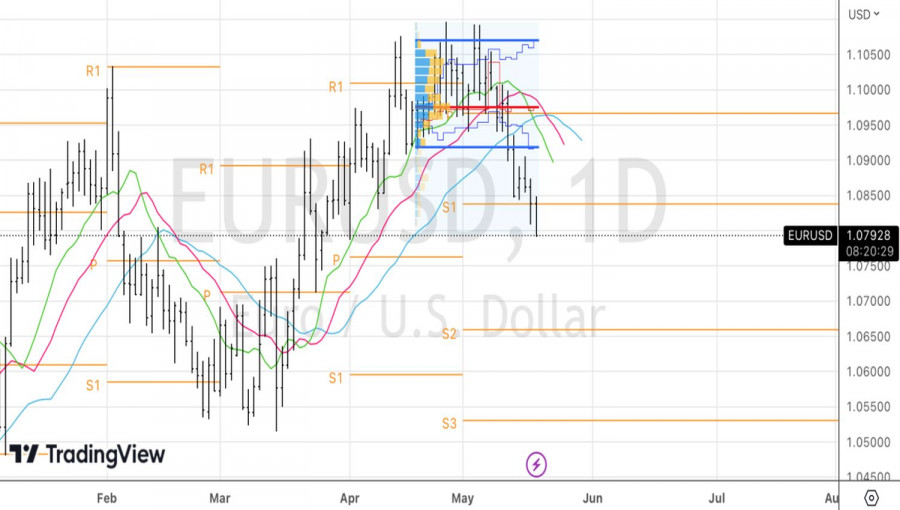

Technically on the daily chart EUR/USD can find support near the pivot levels of 1.0755-1.0765. If they do not hold, the pullback will continue towards 1.071 and 1.066. Formed earlier shorts are held and continue to build up.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/0DilnFG

via IFTTT