Analysis of trades on May 17

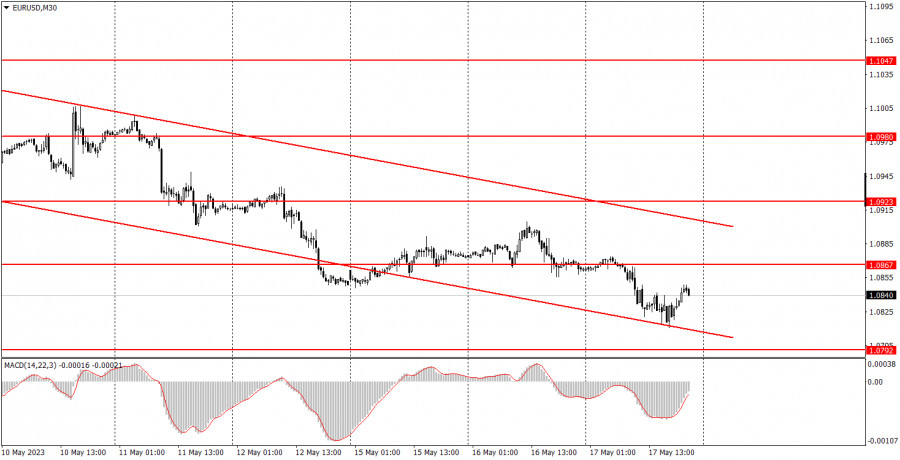

EUR/USD 30M chart

The EUR/USD currency pair continued its downtrend throughout Wednesday, with volatility remaining low. Throughout the day, traders could only pay attention to the EU inflation report. We mentioned yesterday that there was a slight possibility of deviation in the actual value of the second estimate from the first one. This is where the market could have reacted to changes, but no changes occurred, hence no market reaction. During the American trading session, a report on the number of building permits was released in the US, which managed to trigger a 20-point drop in the dollar. Naturally, such a movement is not of interest to market participants, so it can be assumed that there was no reaction.

Overall, the downtrend for the pair continues, evidenced by the descending channel. We still anticipate a drop in the European currency and see no reasons for its rise.

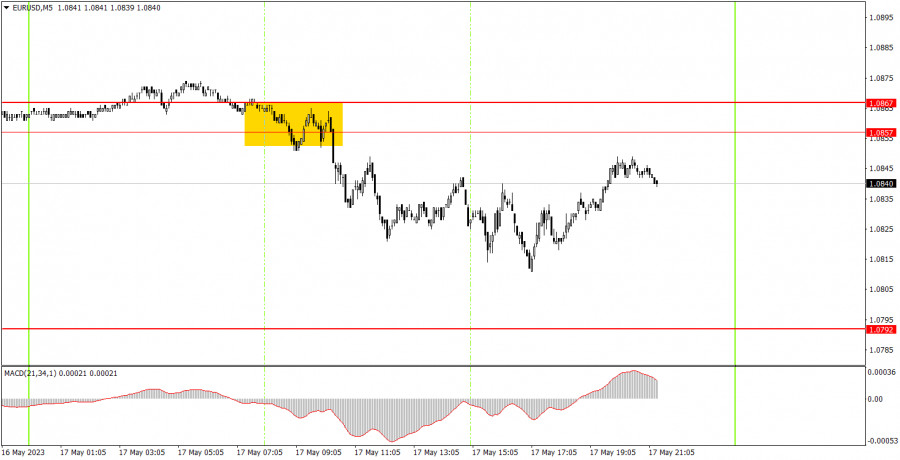

EUR/USD 5M chart

The 5-minute timeframe clearly shows how the pair moved throughout the day. Volatility was again low, and the price constantly changed direction and retraced. By the end of the day, it managed to almost return to its initial positions. We remind novice traders that the weaker the movements, the lower the chances of making a profit. It is hard to profit from price fluctuations if the pair barely moves. The volatility of 50 pips allows for a profit of 25 pips per trade at best. Therefore, traders should decide for themselves whether they want to trade now.

Only one trading signal was formed on Wednesday. The pair rebounded from the 1.0857-1.0867 area and managed to slid a maximum of 35 points. By the end of the day, neither the nearest target level was reached, nor was the sell signal canceled. Therefore, the trade closed profitably in any case, but with a very small gain.

Trading strategy on May 18

On the 30-minute timeframe, the pair continues to generally move downwards. For the first time in a long time, the pair may show prolonged downward movement, which would be absolutely logical from all perspectives. On the 5-minute timeframe, the levels to pay attention to tomorrow are 1.0692, 1.0737, 1.0792, 1.0857-1.0867, 1.0920-1.0933, 1.0965-1.0980, and 1.1038. When passing 15 points in the correct direction, you can set the Stop Loss to breakeven. Only Christine Lagarde's speech is scheduled for Thursday. However, over the past week and this week, there have been quite a few speeches by ECB, Bank of England, and Fed representatives, and none of them have elicited a clear market response. Officials' rhetoric rarely changes, so we don't expect significant price movements tomorrow.

The basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5–15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/yQen1SO

via IFTTT