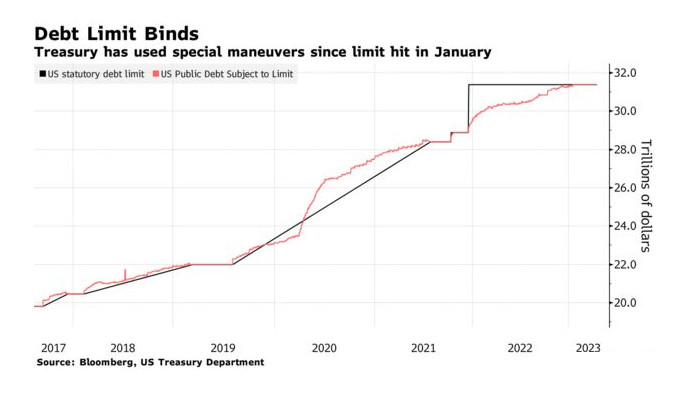

After the recurring comedy with the prospects of a historic US default, a drama with consequences and new challenges will follow.

Many analysts and financiers say that legislators will eventually come to an agreement that will likely prevent a devastating default on debts. But that doesn't mean the economy will emerge unscathed.

The Treasury will have to try to replenish its depleting cash buffer to maintain its ability to meet its obligations through a stream of treasury bill sales. The surge in supply, which is estimated at over $1 trillion by the end of the third quarter, will quickly drain liquidity from the banking sector, raise short-term financing rates, and tighten the screws in the US economy, which is on the verge of a recession.

Bank of America Corp. says this will have the same economic effect as a quarter-point rate hike. The high cost of borrowing has already affected some firms and is slowly restraining economic growth due to the most aggressive tightening cycle by the Federal Reserve in decades.

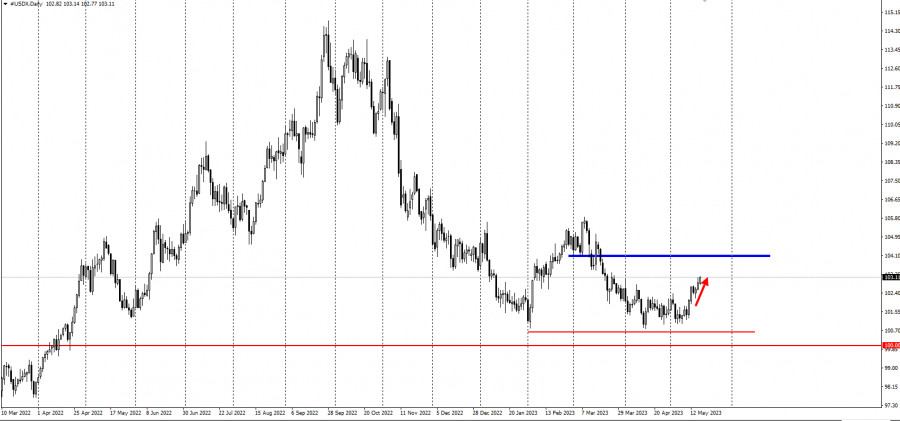

Against this backdrop, the dollar index continues to strengthen:

After resolving the debt ceiling issue, the US cash reserve (the total Treasury account) is supposed to reach $550 billion, up from the current level of about $95 billion, and reach $600 billion within three months, according to the ministry data.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/N9IgOEy

via IFTTT