The euro is tired of falling, but is it capable of rising? Danske Bank notes that the seasonal decrease in wind power in Europe potentially disrupts the stability of the energy market in the Old Continent and has a negative impact on EUR/USD. The company recently forecasted a decline in the main currency pair to 1.03, and an upward rebound was clearly not part of its plans. In reality, the fate of the euro and the US dollar does not depend on the wind.

At the end of the week, by June 9, the "bulls" for EUR/USD decided to launch a counterattack. They took advantage of the principle of "sell the euro on rumors of a recession in the eurozone and buy the fact," as well as the surge in US unemployment benefit claims. However, these drivers pale in comparison to the release of May's US inflation statistics and the FOMC meeting. It is after these events that the fate of the main currency pair will become clearer.

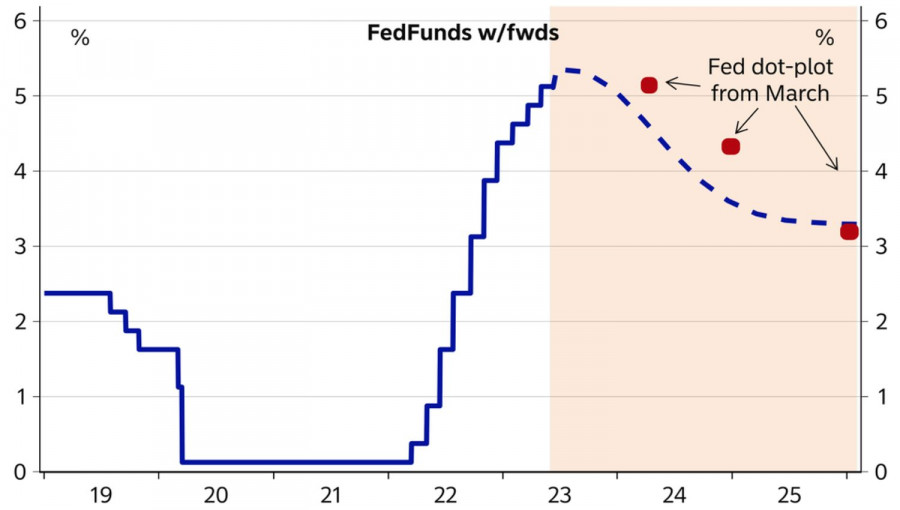

Despite the unexpected interest rate hikes in Australia and Canada, investors still expect a pause in the Federal Reserve's monetary tightening cycle in June. It is more likely that the federal funds rate will remain at 5.25%, with FOMC forecasts indicating higher values. Jerome Powell will emphasize the dependence of monetary policy on data during the press conference.

The dynamics of market expectations for the Fed's interest rate

Before the announcement of the Federal Reserve's meeting results, the market will see the data on US inflation for May. They can either unite the divided Committee or further divide it. The hawks of the FOMC see no reason for a pause in the rate hike process, while the centrists insist on it. They argue that the Central Bank needs more information to make decisions.

It is important to note that the verdict of the Bank of Canada only momentarily made the market doubt the pause by the Fed. The BoC is often compared to a canary in a coal mine, with its behavior becoming an example for others. This was the case with the beginning of the monetary tightening cycle and its pause in January. If Ottawa resumes monetary restriction, it is likely that other regulators will do the same.

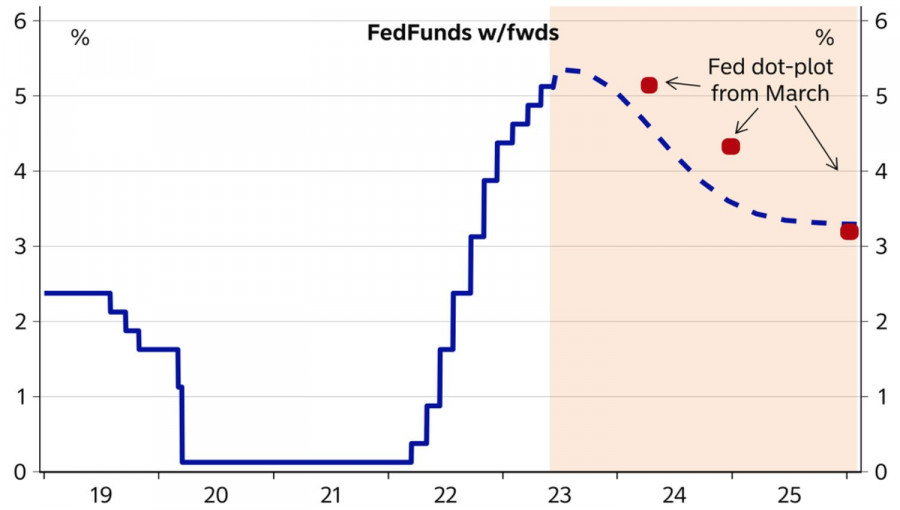

Support for EUR/USD came from the decline in Treasury bond yields and the S&P 500 entering bullish territory. Such an environment is usually seen as an improvement in global risk appetite and puts pressure on the US dollar. However, the outperformance of US stock indexes compared to European ones was one of the drivers of the decline in the main currency pair in May. If the market conditions for equities in the Old and New Worlds remain the same, the euro correction could continue.

The dynamics of EUR/USD and the relationship between US and European stock indexes.

Therefore, the week leading up to June 16 promises to be crucial in clarifying the prospects for the main currency pair, and its current growth appears to be a false start.

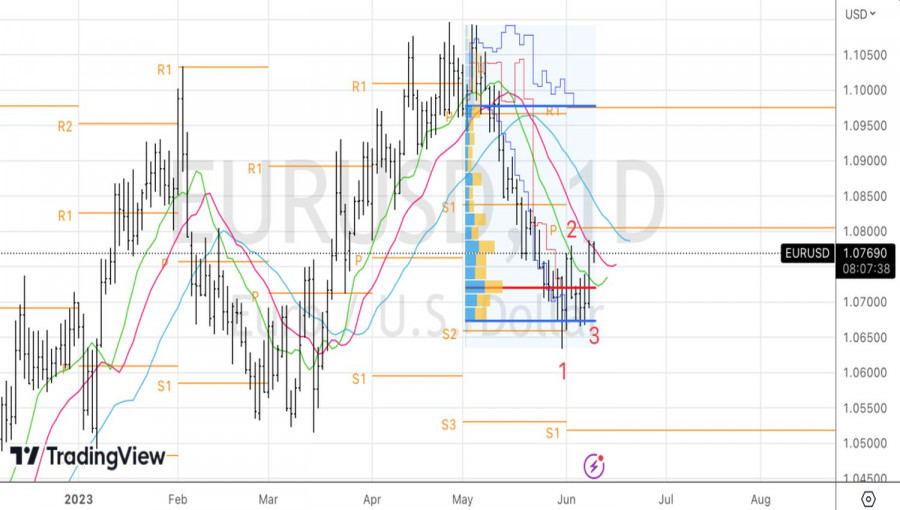

Technically, on the daily chart, EUR/USD is experiencing a retracement of the 1-2-3 reversal pattern. In this case, a failed breach of the red moving average followed by a drop below the test bar's low at 1.0755 could provide a basis for selling.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/s07JzIQ

via IFTTT