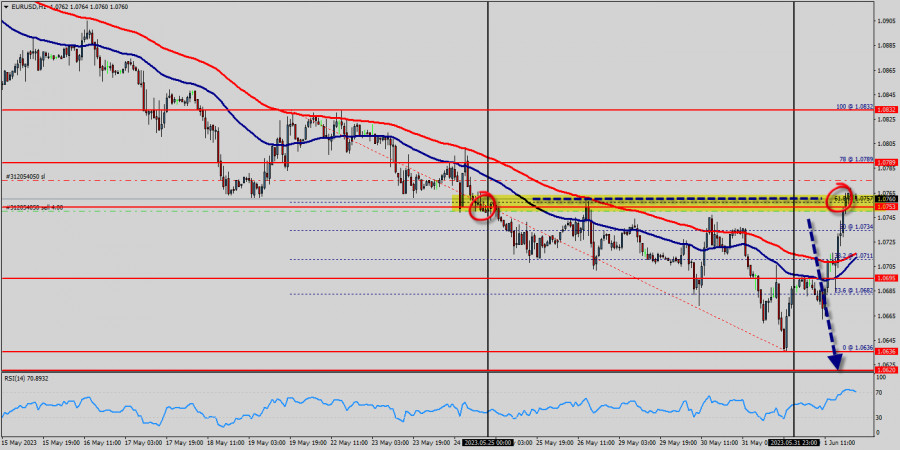

The EUR/USD pair opened below the weekly pivot point (1.0789). It continued to move downwards from the level of 1.0789 to the bottom around 1.0636. But the pair has rebounded from the bottom of 1.0636 to close at 1.0762.

Today, the first support level is seen at 1.0695, and the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.0789, which coincides with the 78% Fibonacci retracement level.

This resistance has been rejected several times confirming the downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the EUR/USD pair is able to break out the first support at 1.0753, the market will decline further to 1.0695 in order to test the weekly support 2.

Right now, the first resistance level is seen at 1.0789 followed by 1.0832, while daily support 1 is seen at 1.0753. Furthermore, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 1.0753. So it will be good to sell at 1.0753 with the first target of 1.0695. It will also call for a downtrend in order to continue towards 1.0636.

The strong daily support is seen at the 1.0636 level, which represents a new double bottom on the H1 chart. According to the previous events, we expect the EUR/USD pair to trade between 1.0789 and 1.0636 in coming hours.

The price area of 1.0789 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.0789 is not broken.

On the contrary, in case a reversal takes place and the EUR/USD pair breaks through the resistance level of 1.0789, then a stop loss should be placed at 1.0850.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/DoNM4VB

via IFTTT