The main event that influenced the markets on Monday was the weak US ISM report for the services sector. The ISM index unexpectedly fell from 51.9p to 50.1p against an expected growth of 52.2p. All key sub-indices declined, with new orders dropping from 56.1p to 52.9p, and employment falling below the expansion zone from 50.8p to 49.2p.

The employment index contradicts the strong growth in non-farm payrolls last Friday. These are statistical anomalies that may be resolved in the next report for June. It should be noted that the National Federation of Independent Business (NFIB) survey also indicated a sharp reduction in employment.

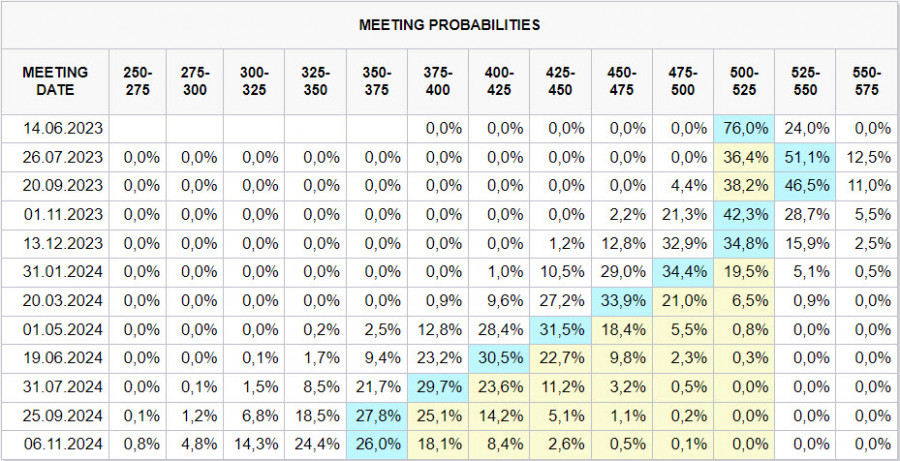

Expectations for the Fed rate have stabilized around a 25% probability of a rate hike next week, and the possibility that rate cuts may not occur by the end of the year. The Fed has entered a quiet period, so we will not hear any comments regarding the unexpectedly weak ISM report, which raises doubts about the sustainability of the US economy.

Another event that will have a significant impact on the dollar index will unfold in the coming weeks. After the decision on the US debt ceiling was reached, the Treasury will begin replenishing the Treasury General Account, which involves issuing securities. According to some estimates, this issuance could amount to $600-700 billion over a period of 6-8 weeks.

The need to raise funds will result in liquidity absorption, and risk assets are likely to be affected first. Therefore, expectations that risk assets, including commodity currencies, will come under pressure in the coming weeks, will increase.

NZD/USD

The key question affecting the Kiwi exchange rate is whether a recession will be confirmed in the economy amid still-high inflation. The GDP report for the first quarter will be published next week, and the forecast is negative as the available data already indicate deteriorating performance across most sectors of the economy.

The Reserve Bank of New Zealand (RBNZ), after raising the interest rate to 5.50%, announced a pause until November and will enter a monitoring phase. Currently, the main factor influencing the Kiwi exchange rate is the uncertainty regarding which will slow down faster, inflation or the overall economy.

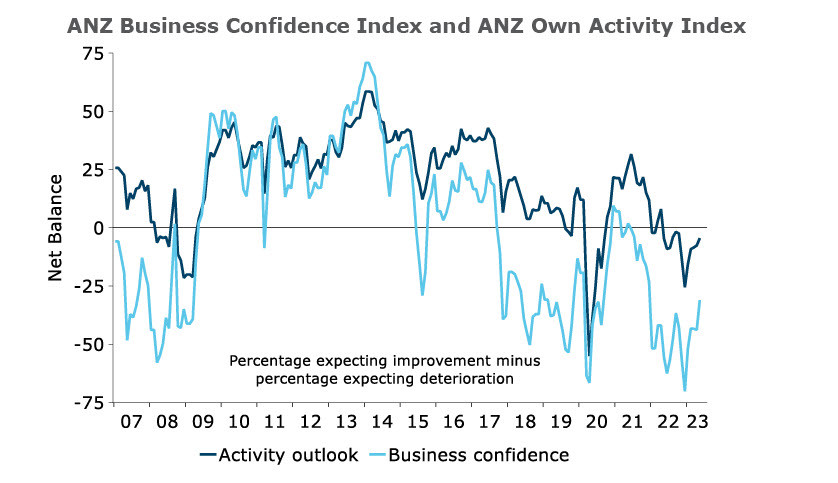

The business survey released last week by the RBNZ showed that business confidence increased by 13 points, from -43.8 to -31.1, and expected own activity improved from -7.6 to -4.5. This is positive news, but at the same time, the proportion of firms expecting cost increases in the next three months remained consistently high, and expected profitability remains under pressure, with all sectors in negative territory.

Wage growth is currently a key issue for the RBNZ. The proportion of firms reporting wage increases in the past 12 months remains high at 83%, which is in line with the proportion of companies expecting wage increases in the next 12 months (84%), indicating no trend of declining wage expectations. Additionally, the housing market remains stable with no observed price declines.

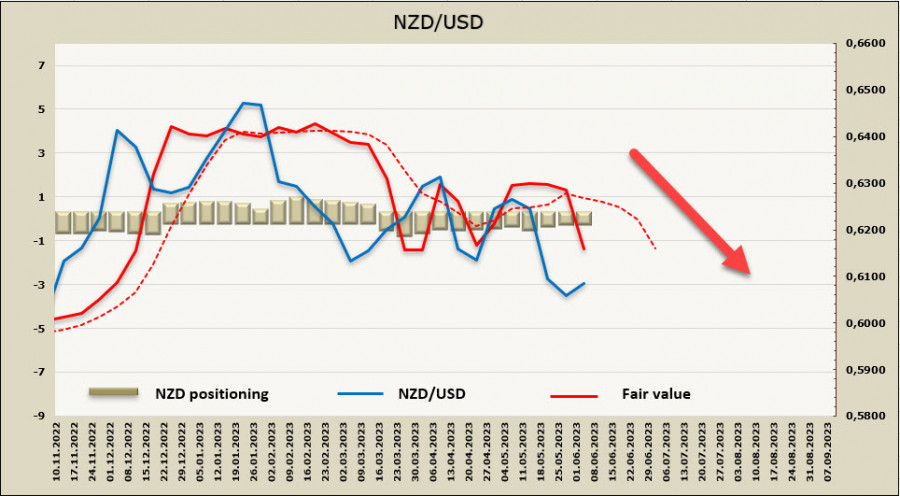

Positioning on the NZD, as indicated in the latest CFTC report, remains neutral with minimal shifts in either direction. The calculated price is trending downward.

One week ago, we expected the Kiwi to continue its decline towards 0.5940/50. Indeed, the Kiwi dipped lower but fell slightly short of the target. The unexpected decision by the RBA indirectly provided support for the NZD, and short-term growth may allow it to reach the middle of the channel at 0.6120/40. However, the long-term trend remains bearish, and we expect a resumption of the downward movement after the completion of the correction. The nearest target is the recent low at 0.5979, followed by 0.5900/20.

AUD/USD

In this morning's RBA meeting, the central bank raised the interest rate by a quarter point to 4.1%, which came as a surprise to the market. Out of the 25 analysts surveyed by Bloomberg, 17 did not expect an increase, and the market reacted with an increase in the AUD exchange rate.

Nevertheless, there were preconditions for such a decision as the risks of inflation being more persistent increased. These risks were based on the decision made last week to raise the minimum wage for a wide range of workers, and the RBA reflected this in its accompanying statement, mentioning three times the increase in labor costs.

The RBA also noted that wage growth aligns with the inflation target if productivity growth accelerates, but this is where the main problem lies. On Wednesday, the GDP report for the first quarter will be published, with a growth forecast of +0.3%. The NBA believes growth will be 0.2%, and at the same time, a decrease in the trade balance surplus from 15.3 billion to 12.5 billion is expected. If Australia's economic slowdown accelerates, it will exert additional pressure on the Aussie exchange rate.

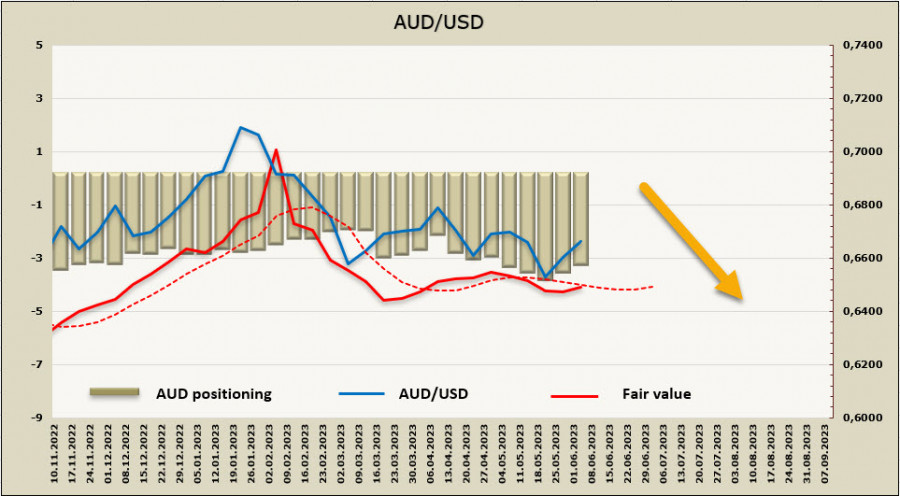

The net short position on the AUD decreased by 369 million over the reporting week to -2.876 billion, and speculative positioning remains confidently bearish. The calculated price has lost momentum and currently has no direction.

AUD/USD reached the target of 0.6466 outlined a week ago, followed by a technical correction supported by the unexpected RBA decision to raise the interest rate. The corrective upward impulse may continue, with the nearest target being the channel boundary at 0.6700/20. If there is a strong close above this zone, the target will shift towards the local high at 0.6817, indicating an attempt to break out of the bearish channel. However, this scenario is less likely than the second one, which is the completion of the corrective rise near the channel boundary at 0.6700/20 and a resumption of the downward movement.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/Jzt3MfY

via IFTTT