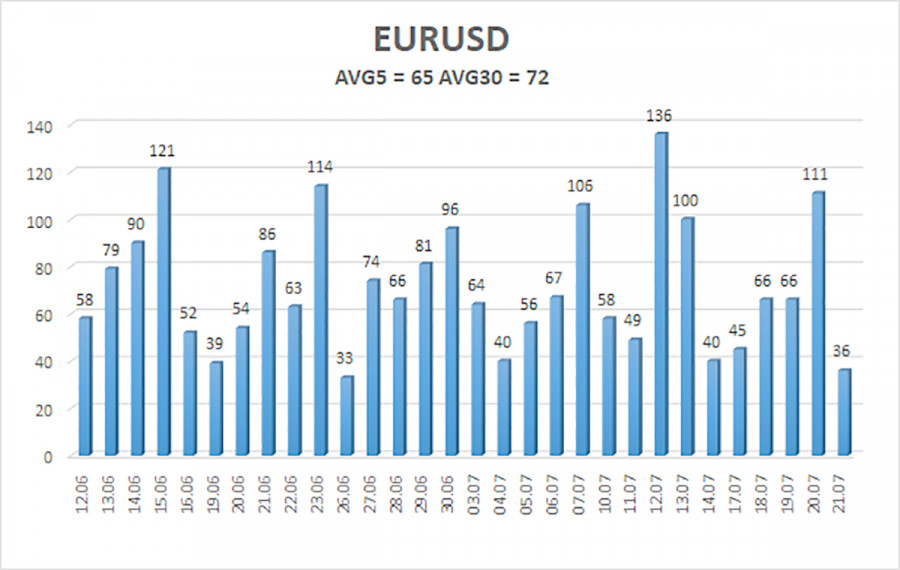

There was a mere 36-point movement from the daily high to the low throughout the day. It's evident that with such low volatility, trades should be held for several days at a minimum to expect profits. Consequently, during the past week, only one day showed real activity - Thursday - while all the other days remained flat. As the Heiken Ashi indicator did not reverse upward, traders could maintain their short positions.

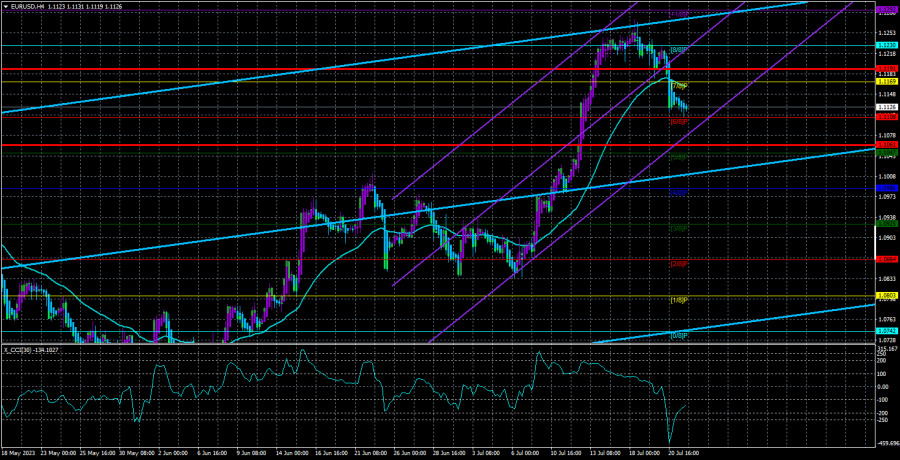

Friday's lack of significant macroeconomic and fundamental background explains the traders' lack of activity. However, it's worth noting that the upcoming week promises to be much more interesting, especially after the CCI indicator entered the oversold zone on Thursday. Being just 150 points away from the yearly highs, we are already receiving signals of oversold conditions, which have nothing to do with objective reality. These signals are only related to the indicator's oversold status. As a result, we might witness an upward correction next week. Moreover, considering the current week's downward movement as a correction, the probability of resuming the upward trend remains high. Especially given the market's unpredictable reaction to the ECB and Fed meetings since no one knows what Jerome Powell and Christine Lagarde will announce after their meetings.

Hence, the market participants are still not factoring in the fundamental and macroeconomic factors. The euro remains overbought and is barely able to correct itself. If the ECB signals about 2-3 rate hikes in 2023, it may trigger a new strengthening of the euro, although, in our view, the market has already priced in all future tightening measures. Let's remember that the Fed is also raising its key rate.

The euro still has a high chance of growth.

Next week, there will be a few significant publications in the Eurozone. We can mention the business activity indices for services and manufacturing in Germany and the EU for July, but there is little else to highlight. According to forecasts, business activity indexes are not expected to rise, so the euro may show a decline on Monday-Tuesday. However, traders' attention will mainly focus on the ECB meeting, not necessarily on the decisions to be announced (as they are practically known already), but on what Christine Lagarde will communicate to the markets.

It's important to note that central bank leaders rarely make bold statements after meetings. Therefore, we shouldn't expect definite statements like "We will raise the rate five more times." Nevertheless, through hints and implications, Ms. Lagarde may explain how long her department plans to tighten monetary policy and the state of the economy and inflation. The more hawkish her rhetoric, the higher the chances of witnessing at least a surge in the euro to neutralize the CCI indicator's oversold condition.

Of course, we should remember the Fed's meeting (which will be discussed in an article about GBP/USD). There will be other important events during the week that could also influence the movement of the EUR/USD pair. However, the overall situation is likely to remain the same. The euro should still decline, despite the fundamentals and macroeconomics. Nevertheless, it can still rise due to the market's bullish sentiment, which ignores the fundamentals and macroeconomics. The rebound from the 61.8% Fibonacci level in the 24-hour timeframe is a strong signal, and the correction will continue. We expect the pair to drop at least to the 5th level. Considering the recent growth of the euro, the correction should be even more significant. The question is just when it will begin.

As of July 23, the average volatility of the euro/dollar currency pair over the last five trading days is 65 points, considered "average." Therefore, we anticipate the pair to move between the levels of 1.1061 and 1.1191 on Monday. A reversal of the Heiken Ashi indicator upwards will indicate the start of an ascending correction.

Nearest support levels:

S1 - 1.1108

S2 - 1.1047

S3 - 1.0986

Nearest resistance levels:

R1 - 1.1169

R2 - 1.1230

R3 - 1.1292

Trading recommendations:

The EUR/USD pair has started a downward movement, and the question is how long it will continue. It is advisable to remain in short positions with targets at 1.1108 and 1.1061 until the Heiken Ashi indicator reverses upwards. Long positions will become relevant only after the price is fixed above the moving average line with targets at 1.1230 and 1.1292.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are directed in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel in which the pair will move in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an upcoming trend reversal in the opposite direction.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ZN61Mgo

via IFTTT