The EUR/USD pair remains sidelined at the lowest level in two weeks after five-day downtrend. Eurozone, German PMI for July disappointed Euro bulls as manufacturing gauge slumped to multi-month low.

the US released consumer and producer price inflation figures, indicating a decline in price pressures. Consequently, the dollar hit its lowest point in 15 months, and there was a surge in the euro. The US inflation data instilled optimism among investors regarding the approaching conclusion of the Fede's rate-hiking phase.

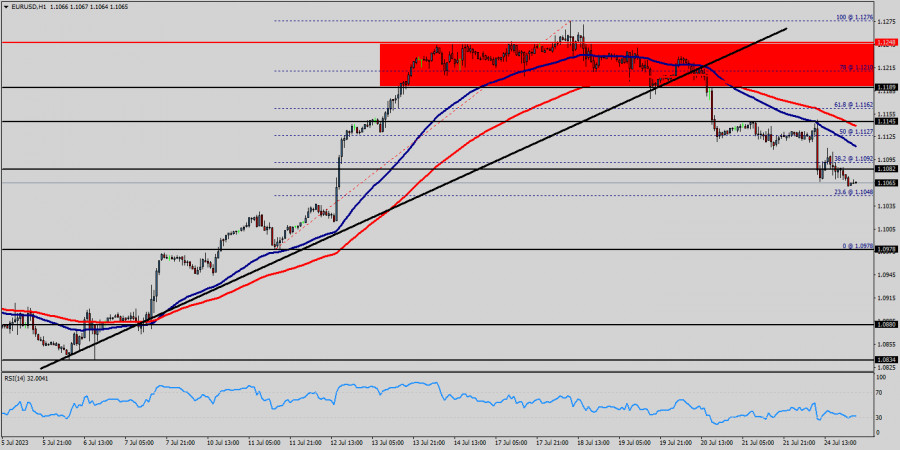

As expected the EUR/USD pair continues to move downwards from the areas of 1.1248 and 1.1064. Yesterday, the pair dropped from the level of 1.1248 to 1.1064, which coincides with a ratio of 23.6% Fibonacci on the H4 chart. Today, resistance is seen at the levels of 1.1248 and 1.1303. So, we expect the price to set below the strong resistance at the levels of 1.1248 and 1.1303; because the price is in a bearish channel now.

Data revealed that US consumer prices witnessed their slowest growth in over two years. Additionally, Thursday's data showed the smallest increase in US producer inflation in almost three years. Furthermore, on Friday, the government reported a 0.2% decrease in US import prices last month.

The EUR/USD holds a bullish bias on the daily chart, as the price remains above key simple moving averages (SMA) and also above a trendline from May's low and stands around 1.0950. Before that area, the 20-day SMA awaits at 1.1040. The Euro needs to regain the 1.1200 level to open the doors for a potential resumption of the main trend.

Money market traders expect the Federal Reserve to increase rates by 25 basis points on July 26. However, they have decreased the likelihood of additional rate hikes later this year.

On the 4-hour chart, the pair is moving with a bearish bias. The Relative Strength Index (RSI) is at oversold levels; however, no signs of stabilization are seen at the moment. Price remains below the 20-SMA. The next support stands at 1.1030, followed by 1.1000. On the upside, the immediate resistance is located at 1.1090; however, the Euro needs to break above 1.1050 to negate the short-term negative bias.

Amid the previous events, the price is still moving between the levels of 1.1303 and 1.1000. In overall, we still prefer the bearish scenario as long as the price is below the level of 1.1303. Furthermore, if the EUR/USD pair is able to break out the bottom at 1.1064 , the market will decline further to 1.1000 (daily support 2).

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/U2S0wKv

via IFTTT