The Federal Reserve has clearly won the fight against inflation. Victory is not inevitable, and its timing is not determined, but no one is talking about stagflation or hyperinflation at the moment. The markets responded favorably to the June consumer price report in the United States, selling off the American dollar. EUR/USD quotes soared to 15-month highs, and this is far from the limit. Deutsche Bank predicts the pair to rise to 1.15 by the end of the year, while Eurizon SLJ Capital suggests a level of 1.2.

When the divergence in monetary policy between the European Central Bank and the Fed is accompanied by a rise in global risk appetite and the decline of American exceptionalism, the US dollar is forced to raise the white flag. Currently, the gap between consumer and producer prices is at a record high. When such situations have occurred in the past, stock markets have risen. This has happened either in the very late stages of a recession or in the early stages of an upturn.

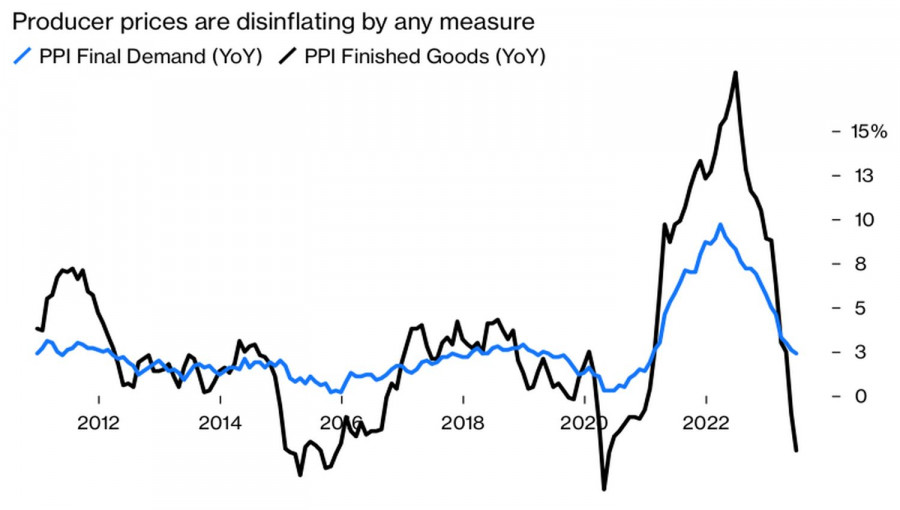

The dynamics of prices for final demand and finished products in the US indicate a shift towards a weaker dollar and stronger euro.

It is quite possible that the United States will be able to avoid the downturn that has been talked about for so long. The markets are envisioning a Goldilocks scenario—a combination of slowing inflation and steady GDP growth slightly below the trend. It's no wonder that the S&P 500 reached a 15-month peak. It's difficult for the US dollar, as a safe-haven asset, to withstand such a significant improvement in global risk appetite.

The Fed's aggressive monetary tightening will eventually start to slow down the economy. Meanwhile, China is likely to accelerate the recovery of its GDP, which will have a favorable impact on the export-oriented eurozone. As a result, the bullish factor of American exceptionalism for the US dollar will become a thing of the past.

The hawkish comments from FOMC officials do not help the bears on EUR/USD. Christopher Waller still expects a federal funds rate hike to 5.75% and claims that making decisions based on a single inflation report is reckless. We can't sit and wait for the economy to cool down. It's like waiting on the platform for a train that has already left.

At the same time, the euro is being supported by the minutes of the June ECB meeting and a speech by Isabel Schnabel. The German ECB board member stated that despite the slowdown in inflation, markets are sending different signals. They reflect investors' concerns about whether the central bank has done enough to tackle high prices. In the latest Governing Council meeting, one official voted for an immediate 50 bps deposit rate hike.

It seems that the ECB is not planning to stop, while the Fed may force a significant inflation slowdown. Along with the sharp rise in global risk appetite and the loss of American exceptionalism, this allows for the prediction of continued euro rally against the US dollar.

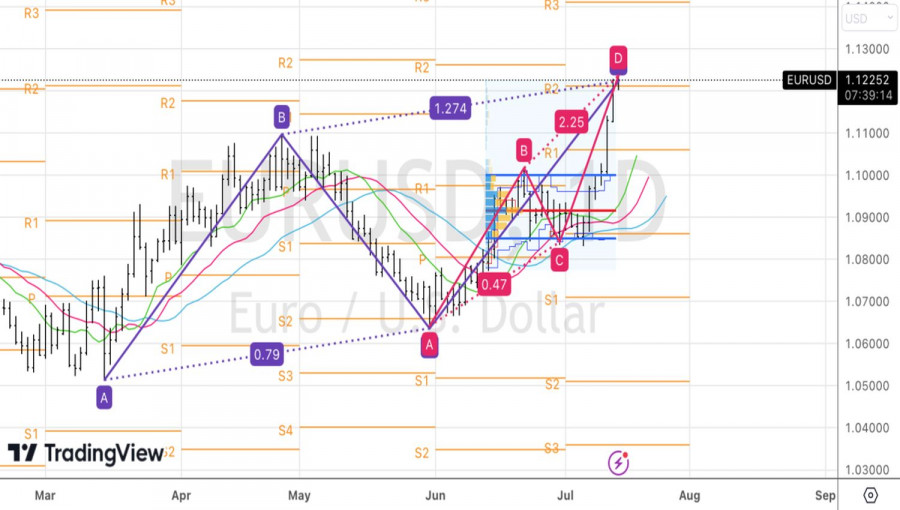

Technically, on the daily chart of EUR/USD, reaching targets at 127.2% and 224% based on AB=CD patterns increases the risk of a pullback. For this to happen, the pair would need to drop below the pivot level of 1.1215. Any decline should be used to form long positions.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/5Vf03ah

via IFTTT