As soon as the macroeconomic statistics for the United States began to worsen, and inflation in the leading countries of the eurozone exceeded expectations, the EUR/USD bulls rushed to counterattack. A decrease in consumer confidence from the Conference Board, a reduction in job openings and layoffs, resulted in a decline in the yields of Treasury bonds and a drop in the U.S. dollar. Meanwhile, the chances of the ECB raising the deposit rate to 4% increased, allowing the euro to rise.

For the second consecutive month, consumer price growth in Spain reached 2.4%, and the German indicator increased by 6.4%, higher than Bloomberg experts expected. This intensified rumors of the ECB's monetary policy tightening cycle to continue in September. Derivatives raised the chances of borrowing costs increasing at the next Governing Council meeting from 52% to 66% and brought back 100% confidence that the peak rate will be 4% by the end of 2023. This led to a rally in German bond yields and the euro's return above 1.09.

Dynamics of German and Spanish inflation

The words of Austrian central bank governor Robert Holzmann come to mind that there will be no recession in the eurozone, and the absence of inflation surprises will necessitate a rate hike to 4% in early autumn. His colleague from Latvia, Martins Kazaks, believes it's better to overdo it with monetary restrictions than to allow another surge in consumer prices in the currency bloc.

Such statistics for German and Spanish CPI raise doubts that European inflation will slow to 5.1%. A higher figure will provide grounds for the 'hawks' of the Governing Council to insist on the continuation of the ECB's monetary policy tightening cycle in September and add fuel to the EUR/USD rally.

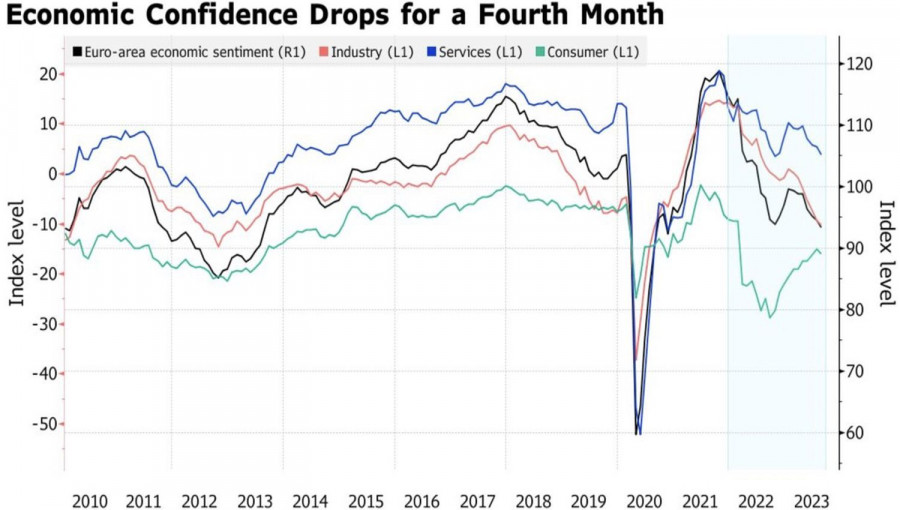

However, the fourth consecutive decline in the eurozone's economic confidence index convinces that the currency bloc is in a state of stagflation. The higher the rate rises, the greater the chance of a GDP reduction.

Dynamics of economic confidence in the eurozone

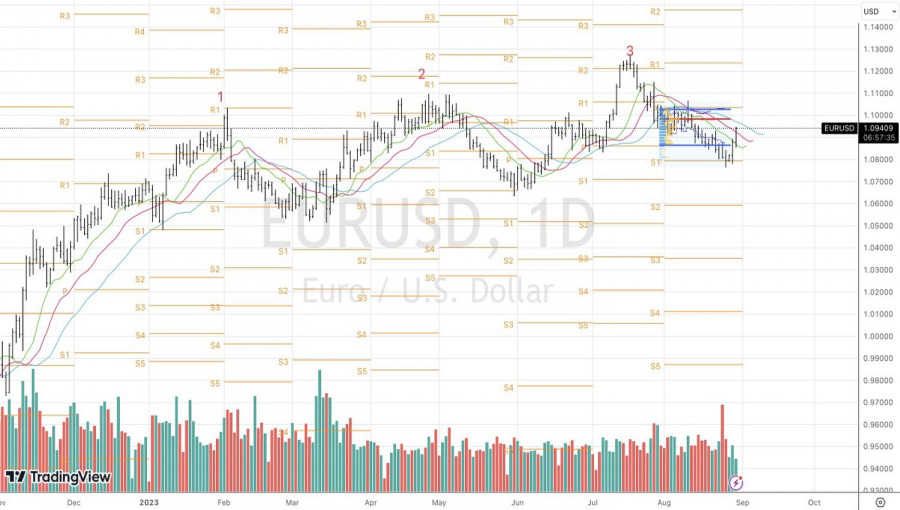

In my opinion, EUR/USD could hardly have returned above 1.09 if not for the weakness of the US dollar. After Jerome Powell's speech in Jackson Hole, investors began to take profits on the US currency long positions, and weak labor market statistics and consumer confidence accelerated the euro's upward bounce.

What's next? The final clarifications can be provided by the releases of labor market and inflation data in the U.S. The first report will be released by the end of the week on September 1st. The employment growth predicted by Bloomberg experts at 170 thousand, or a stronger figure, will restore interest in the dollar. On the contrary, disappointing statistics will add fuel to the EUR/USD rally.

Technically, on the daily chart, EUR/USD has returned to the fair value range of 1.087-1.1025. This attests to the bulls' serious intentions and allows for building long positions formed on breaks at 1.084 and 1.0865. Initial targets are 1.098 and 1.1035.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/qNul5gt

via IFTTT