The fact that markets are beginning to doubt the Federal Reserve's victory over inflation gives pause for thought. Despite a significant slowdown in consumer prices in the U.S., five-year interest rate swaps signal a rise in inflation expectations to 2.5%. This figure is flirting with the peak of April 2022. If it surpasses this, it will reach a 14-year high. Are we facing a new wave of price growth and a continuation of the Fed's monetary tightening cycle? If so, it's time for EUR/USD to sound the alarm.

Dynamics of market inflation expectations in the U.S.

The Bank of Japan's abandonment of strict yield curve control, the downgrade of the U.S. credit rating, and the extensive Treasury auctions have triggered a sharp rally in U.S. bond yields. However, the EUR/USD's position hasn't changed much. This indicates that the market doesn't want to sell such a pro-cyclical currency as the euro, even against the backdrop of alarming signals from China. China's export and import initially disappointed, followed by consumer prices. The country faced deflation for the first time in over two years, signaling weak domestic demand, which is bad news for the export-oriented eurozone and its currency.

Yet, despite the negatives, EUR/USD shows signs of life. It seems there are many optimists in the market. They believe that Europe and Asia will bring pleasant surprises for the rest of the year, while the U.S. will maintain its stability. With this scenario, the global economy will be a sight for sore eyes, and pro-cyclical currencies will rise significantly.

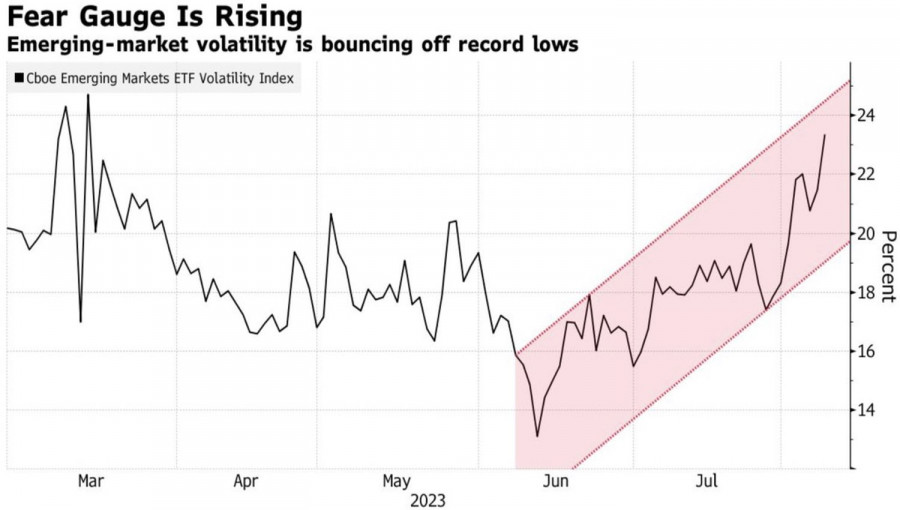

Arguments in favor of buying EUR/USD also include the limited potential for the U.S. dollar to strengthen. If the Fed has truly ended its monetary tightening cycle, the USD index is unlikely to grow significantly. ING forecasts a consolidation of the euro in the $1.09–1.11 range in August. The company sees no reason for it to break its lower limit. In my opinion, there are reasons. Firstly, fear is gradually returning to the markets. This is evident not only in the correction of U.S. stock indices but also in the dynamics of the volatility of emerging market assets. Its growth indicates a decrease in global risk appetite. During such periods, the dollar is in demand.

Dynamics of volatility of emerging country ETFs

Secondly, high inflation may return. This is indicated by the growth of market inflation expectations and Bloomberg experts' forecast of CPI acceleration to 3.3% in July. Lastly, the eurozone has so many structural problems that it's hard for its economy to please EUR/USD enthusiasts. Periodic political shocks only exacerbate the situation. For instance, the Italian government's intention to introduce a 40% tax on banks' excess profits sent European stock indices plummeting.

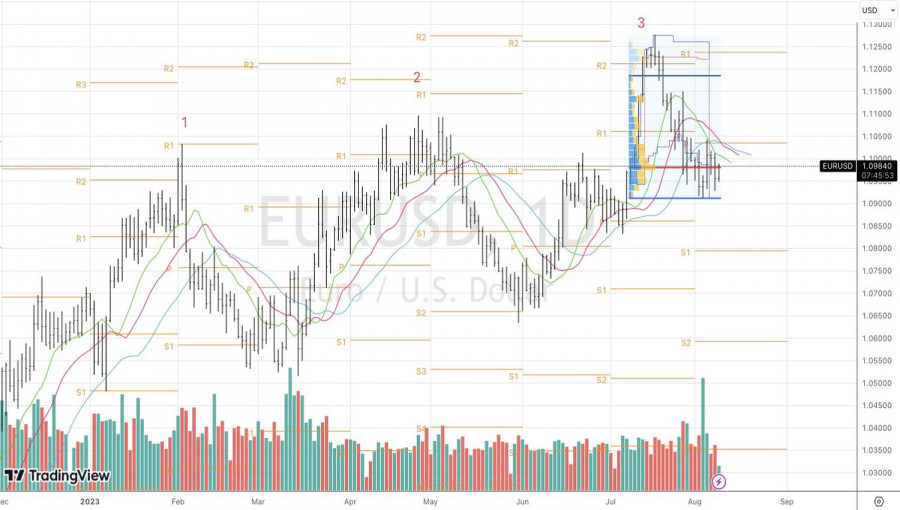

Technically, on the daily chart, EUR/USD is consolidating in the 1.091–1.103 range. The 1.098 mark becomes a distinctive red line. Establishing quotes above it allows for considering opportunities to buy the pair, below it—to sell.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/sWKu4Ap

via IFTTT