Oil closed in the red for the second consecutive week due to concerns about global demand. China, which was expected to account for a third of the world's growth in oil demand in 2023, delivered an unpleasant surprise. Its economy is recovering much slower than anticipated, and monetary expansion is leading to a weakening yuan and capital flight from the country's financial markets. Brent was under pressure, but the bulls are not planning to wave the white flag just yet.

In reality, deflation in China isn't all that bad for the global economy. It suppresses price growth in other countries, including the US. If it were different, a new wave of inflationary pressure would have forced the Federal Reserve to increase interest rates again. This would increase the risk of recession in the US economy and negatively affect commodity markets.

It's a different matter if China's deflation is accompanied by stagflation in Europe and a downturn in the US. Then we could talk about a global economic crisis, which is bad news for the demand and oil prices. However, while the eurozone holds, and the US shows resilience to the aggressive monetary tightening by the Fed, it's a good time to focus on the oil supply.

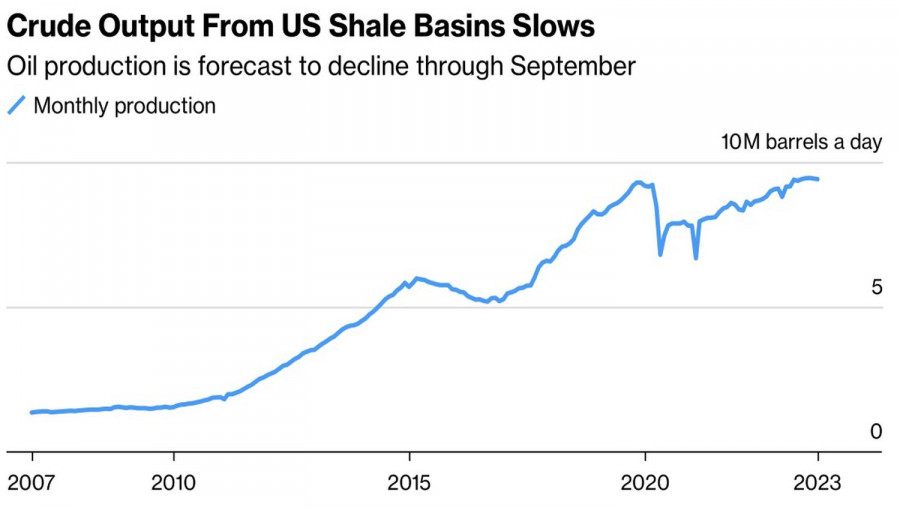

Rumors that Saudi Arabia is extending its own commitment to reduce production by 1 million bpd until the end of October, as well as the gradual decrease in shale oil production in the US, inspire Brent enthusiasts. As does the approach of tropical storm Idalia to the shores of the Gulf of Mexico. This threatens power outages and a halt in oil company operations.

Dynamics of oil production in the US

On the other hand, Turkey's intention to resume the operation of the key Iraqi pipeline as quickly as possible, as well as rumors about the easing of US sanctions against Iran and Venezuela, give optimism to the bears regarding the North Sea grade. These events can increase the volume of oil production.

Nevertheless, in general, the market remains optimistic. The premiums between nearby and more distant oil futures contracts are increasing, indicating either high demand or concerns about supplies. Take note that Fed Chairman Jerome Powell's emphasis on the strength of the US economy in Jackson Hole is encouraging for the US stock market and Brent. The upward rebound of the S&P 500 indicates an improved global risk appetite and creates a tailwind for oil.

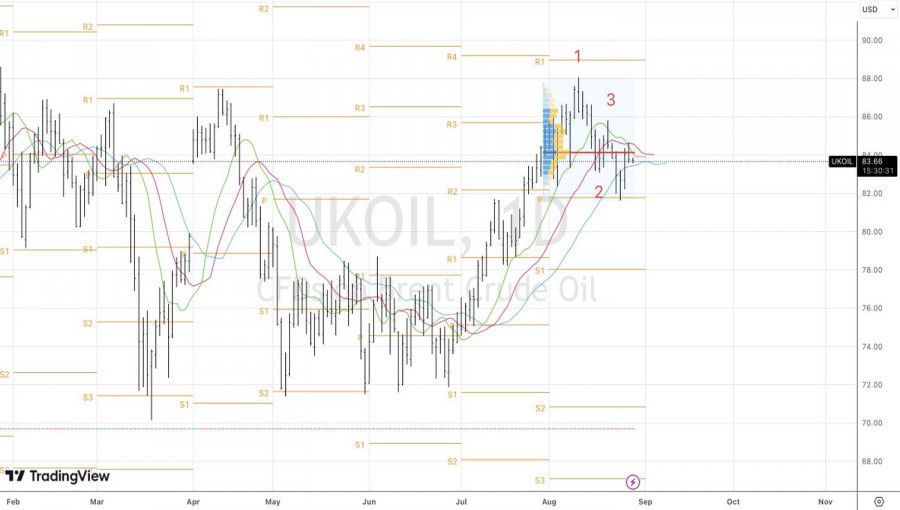

Technically, on the daily chart of the North Sea grade, the corrective movement has been used up. It was triggered by the execution of the 1-2-3 pattern. Brent is entering a consolidation phase, which is manifested in price fluctuations near fair value and frequent crossing of moving averages. In such a situation, the basis for purchasing oil will be a renewal of the local peak at $84.65 per barrel. For a pullback to develop, a breakthrough of the convergence zone at $81.8-82.1 is required.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/mOM7HxE

via IFTTT