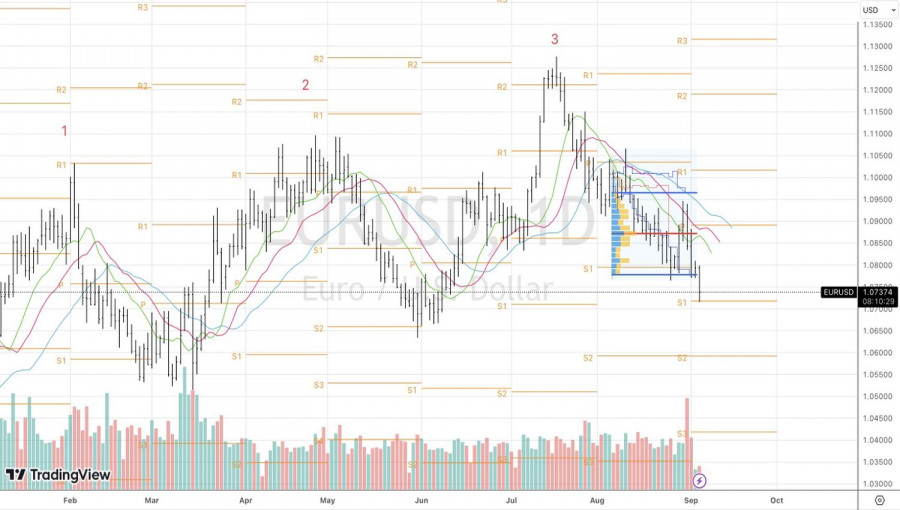

Two main forces, higher yields and weak growth outside the U.S., have forced the EUR/USD bulls to capitulate. The main currency pair collapsed to the area of a 3-month low after even more disappointing statistics on European business activity for August were released than the flash estimate had anticipated. It immediately brought to mind European Central Bank executive board member Isabel Schnabel's statement that the prospects of the currency bloc are even more dreadful than expected. How can the euro not decline here?

If the USD index finishes another week in the green zone, it will mark the longest winning streak since 2005. This seems remarkable against the backdrop of the markets' anticipated end to the Fed's monetary tightening cycle. However, in reality, the strength of the U.S. economy means that the central bank has no intention of lowering rates. On the contrary, the derivatives' forecast of borrowing costs falling to 4.25–4.5% in 2024 looks highly doubtful.

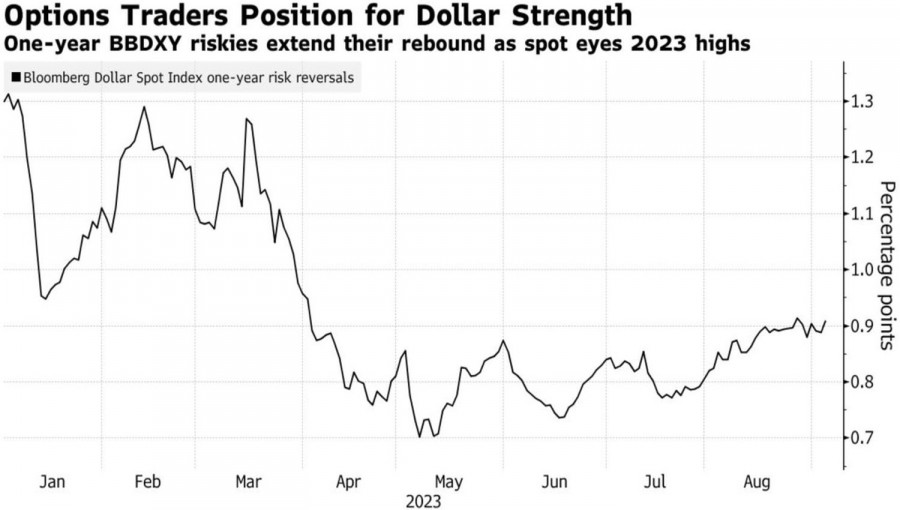

It's not surprising that options traders are betting on the continuation of the USD index rally. The risks of a reversal for the U.S. dollar have returned to April highs. Meanwhile, the most negligible net longs on the "greenback" in the last two years suggest that its growth potential is far from being exhausted.

Dynamics of U.S. Dollar reversal risks

Weakness in the European economy, on the other hand, provides grounds for speculation that the ECB has not just concluded its cycle of monetary tightening, it may lower its deposit rate before the Fed. In this scenario, EUR/USD bulls are doomed. Divergences in economic growth and monetary policy will serve as a true testament to their opponents – fans of the U.S. dollar.

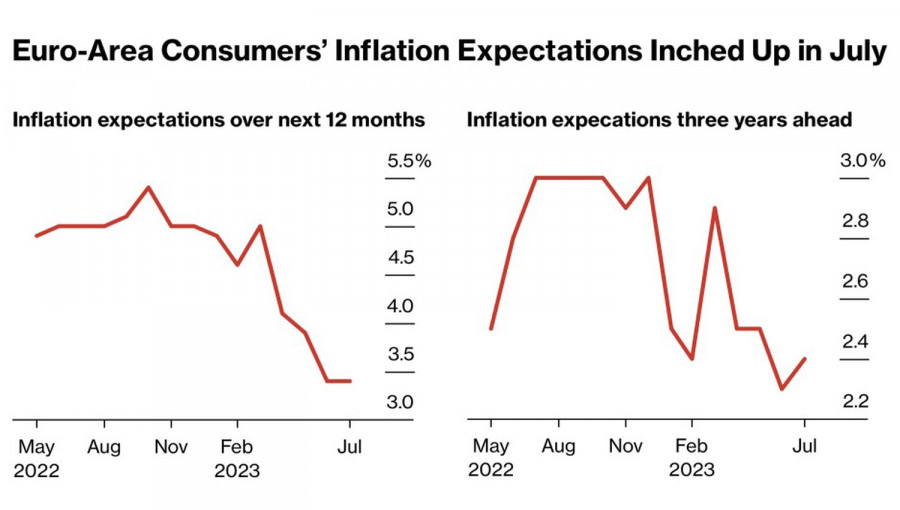

The mixed statistics on inflation expectations in the eurozone do not please buyers of the main currency pair either. While the annual indicator remains at the same level of 3.4%, the three-year one has accelerated from 2.3% to 2.4%. The European Central Bank is doing its job less efficiently than the Fed. So why shouldn't EUR/USD fall?

Dynamics of European inflation expectations

There is no sign of a silver lining for the euro just yet. As I mentioned earlier, for the main currency pair to find its bottom, it requires an improvement in macroeconomic statistics for the eurozone or a deterioration in the U.S. However, it's hard to bring joy to the currency bloc when winter is approaching. And soon enough, questions about filling gas storage facilities and the specter of an energy crisis will arise.

The Fed will stick to the idea of a possible federal funds rate hike to 5.75% until the end. The central bank does not want to repeat the mistakes of its predecessors. In the 1970s, Paul Volcker and his team relaxed, declaring victory over inflation. And immediately after that, they faced a new surge in consumer prices. Fighting them cost the U.S. economy a double recession.

The technical inability of EUR/USD bulls to hold on to the lower boundary of fair value at 1.0775-1.0965 is a sure sign of their weakness. If the bears are not stopped by the pivot level at 1.071, the decline towards 1.0595 will continue. We hold previously formed shorts and periodically add to them.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/Idl37t0

via IFTTT