The trading week started on an interesting note. Both instruments traded with low volatility on Monday as the economic calendar was almost empty. However, on Monday, European Central Bank President Christine Lagarde delivered a speech in which she avoided giving an indication of whether the European Central Bank will raise or hold interest rates next week. It's possible that Lagarde's speech exerted downward pressure on the euro and the pound on Tuesday. Although the market's sentiment cannot be ruled out, as both instruments are extending their downtrends.

Apart from Lagarde's speech, other representatives of the Governing Council have recently given interviews as well. According to ECB Governing Council member Pierre Wunsch, the ECB might have to do a little bit more to hit the target rate. Wunsch also said he doesn't expect inflation to hit the ECB's target of 2% before 2025, a date previously mentioned by other ECB members.

Philip Lane highlighted a "welcome development" in the August data but mentions that core inflation should fall throughout the autumn. He said that easing services inflation helps, which may have been supported by the strong demand for tourism in many countries. He also added that the ECB expects inflation to weaken for energy and food products.

Boris Vujcic mentioned that economic activity is slowing down faster than expected and that weaker economic growth could bring eurozone inflation down faster. However, the labor market remains resilient and strong, which could slow down the decline in the Consumer Price Index.

Francois Villeroy de Galo also noted decreasing inflation but added that it's important to maintain the pace of its decline. He was the only one to touch on the topic of interest rates at the September meeting, stating that the ECB is "open" to any scenarios. However, he also mentioned that the ECB is close to the peak in their interest rates.

It's worth mentioning that apart from Villeroy, no one else discussed interest rates, and on Monday, Lagarde also avoided this topic. It seems that the ECB is either preparing an unexpected decision or doesn't want to create panic in the markets with its decision to pause tightening. Either way, demand for the euro is falling based on market uncertainty regarding the ECB's monetary policy.

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite feasible. Therefore, I will continue to sell the instrument with targets located near the levels of 1.0637 and 1.0483. A successful attempt to break through the 1.0788 level will indicate the market's readiness to sell further, and then we can expect the aforementioned targets, which I have been talking about for several weeks and months.

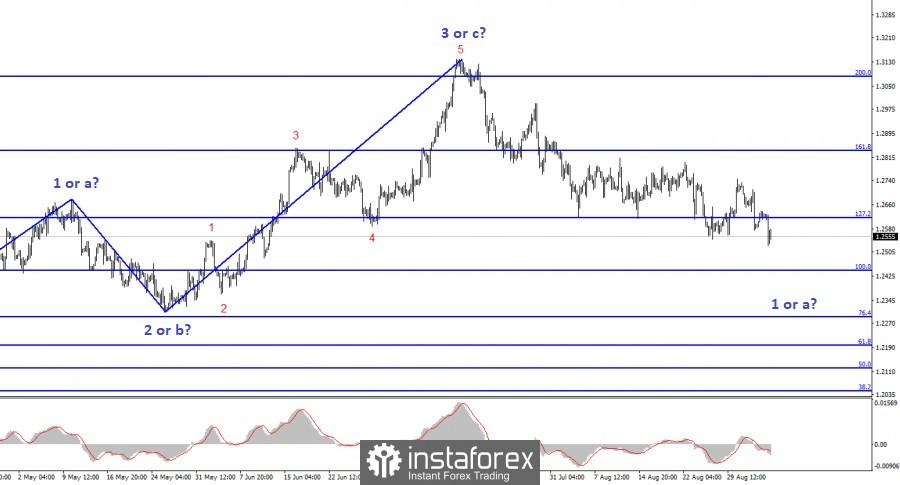

The wave pattern of the GBP/USD pair suggests a decline within the downtrend. There is a risk of completing the current downward wave if it is d, and not wave 1. In this case, the construction of wave 5 might begin from the current marks. But in my opinion, we are currently witnessing the construction of the first wave of a new segment. Therefore, the most that we can expect from this is the construction of wave "2" or "b". I still recommend selling with targets located near the level of 1.2442, which corresponds to 100.0% according to Fibonacci.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/xf7IuXb

via IFTTT