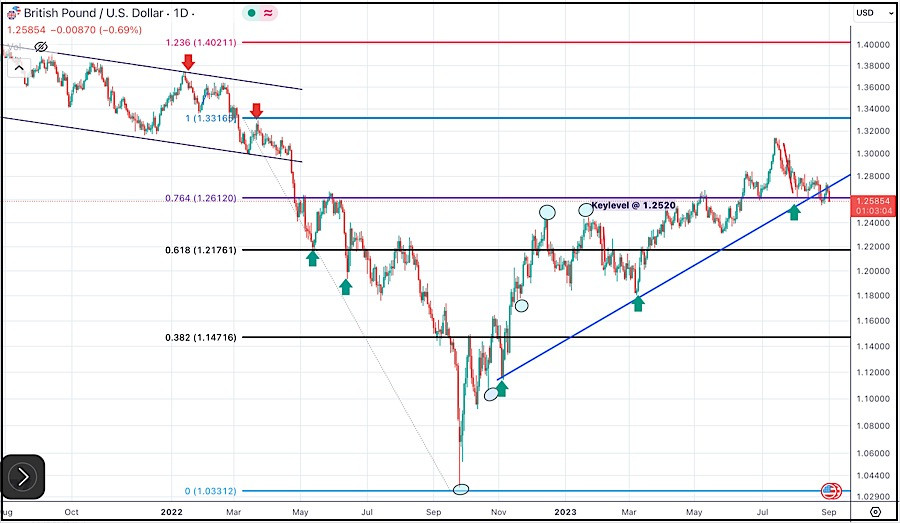

Recently, The GBP/USD pair managed to climb above 1.2600 and tried to advance toward 1.2900 and target around 1.3200.

Moreover, the GBP/USD had long-term higher targets around 1.3300 if sufficient bullish momentum was maintained.

However, the GBP/USD pair has shown signs of bearish rejection just below 1.3200, initiating the recent bearish movement.

After bearish closure below the price level of 1.2800 on a H4 candlestick, it continued to fall toward 1.2500 where the depicted uptrend line comes to meet a significant Fibonacci Level.

This should be considered for Intraday traders as a valid BUY Entry with Stop Loss to be placed just below 1.2500.

This scenario was just supported with the recent bullish rejection manifested in Yesterday' daily candlestick.

On the other hand, if the pair manages to break and persist below 1.2500, further bearish decline should be expected at least towards 1.2400 and probably 1.2200.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/7e1hvxI

via IFTTT