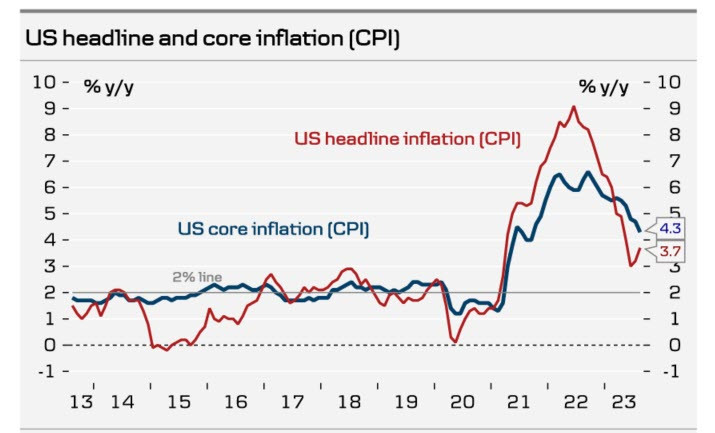

The market's reaction to the Consumer Price Index report was quite muted. The core Consumer Price Index came in at 0.278% m/m, beating expectations of 0.2%. The initial market reaction was a rise in yields, but the movement quickly stalled. The increase was driven by faster inflation in the services sector, where the cost of airfare tickets saw a particularly sharp rise.

Apparently, the slight increase in inflation will not change the Federal Reserve's plans. There was nothing that could dissuade the Fed from its belief that it's time to end the rate hike cycle.

Oil prices continue to rise and reached a new yearly high on Wednesday. The International Energy Agency warned that the oil cuts by Saudi Arabia and Russia will cause a significant global supply shortfall in the market. Furthermore, last week, the United States purchased an additional 300,000 barrels for its strategic reserves. Replenishing reserves also reduces supply, although the U.S. slowed its purchases last week compared to previous weeks.

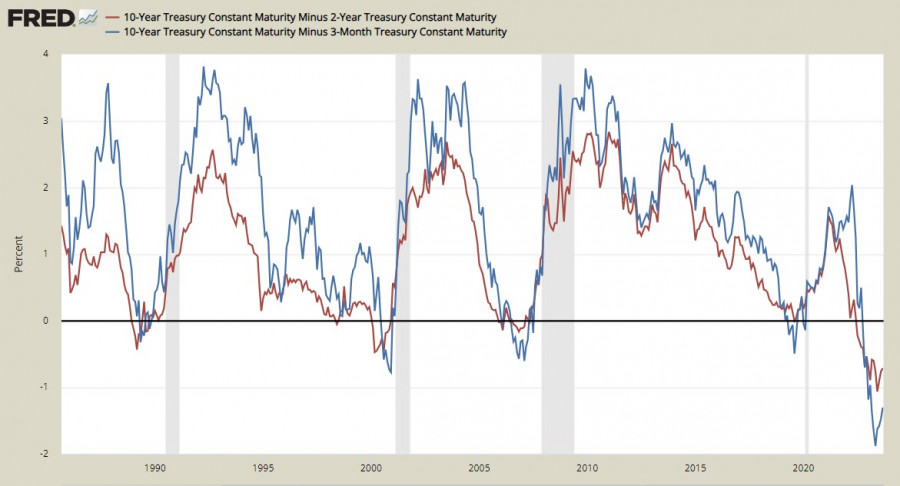

There is a possibility that in the second half of the year, the oil deficit could reach its highest level in the past 10 years. OPEC's oil production in the third quarter is approximately 1.8 million barrels per day less than what is needed to meet global demand. At the same time, forecasts are based on the assumption that the global economy will continue to recover, and thus, demand for energy sources will grow, which is also not a given – yield curves are inverted, meaning that short-term bond yields are lower than long-term bond yields, which has historically been considered a sign of an impending recession.

The European Central Bank was expected to raise interest rates at its meeting with investors betting on a 70% probability, which could give a short-term boost to the euro. The ECB anticipates that inflation in the 20 eurozone countries will remain above 3% next year, which supports the arguments for a tenth consecutive interest rate hike on Thursday, according to a source familiar with the discussion, as reported by Reuters.

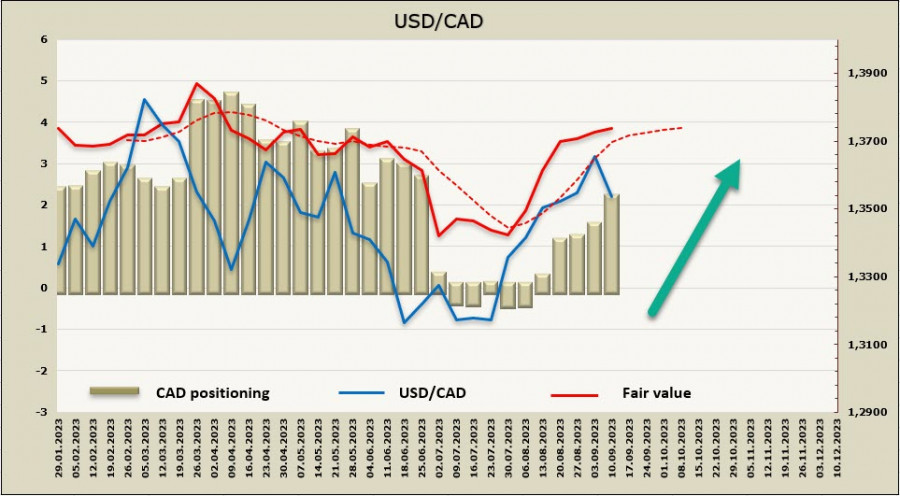

USD/CAD

The Canadian dollar is the only G10 currency that is trying to strengthen against the US dollar, and there are some reasons for that. Firstly, rising oil prices. This factor is not strong enough to reverse the trend, but it provides some support. Secondly, the August labor market report, which supported inflation expectations.

Average hourly wages increased by 5.2% after a 5% increase in July, while a decrease to 4.7% was expected. Additionally, Statistics Canada reports that employment growth is outpacing population growth. This means that the Bank of Canada's decision to leave interest rates unchanged may have been too dovish, as the economy has not slowed to a level where current financial conditions are considered sufficiently restrictive. This, in turn, increases the chances that the Bank of Canada will resume rate hikes.

The net short CAD position increased by 0.7 billion to -1.8 billion, with the implied price above the long-term average and is pointing upwards.

Rising oil prices and the labor market are supporting the Canadian dollar, so the market can hold back from testing the 1.37 level for some time. The probability of a pullback to the middle of the 1.3330/50 channel has increased, and technically, such a possibility looks quite possible. However, apart from rising oil prices and slowing inflation in the United States, the loonie doesn't have enough reasons to start a significant uptrend. We don't expect the correction to be deep, and in the short term, it will turn into consolidation, afterwards the uptrend will resume. The nearest resistance zone is 1.3660/80, followed by 1.3860. Once it reaches this level, the correction will end.

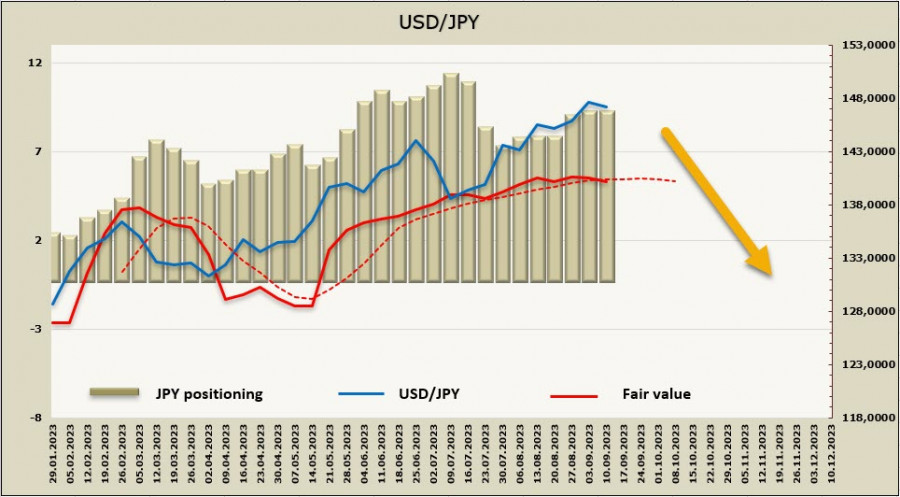

USD/JPY

The yen retreated from its highs after Bank of Japan Governor Kazuo Ueda's remarks. In an interview with The Yomiuri newspaper, Ueda hinted at the possibility of ending the Bank's negative interest rate policy.

A bit of history: The BoJ introduced QQE in April 2013, expanded it in October 2014, and in January 2016, the policy was supplemented with a series of measures by the government, which introduced quantitative and qualitative monetary easing with a negative interest rate.

As Kuroda stated, the Bank may end its negative interest rate policy when it becomes evident that the 2% inflation target has been achieved. Markets are inclined to believe that Kuroda was trying to support the yen to avoid intervention.

The yen has several reasons to strengthen. Firstly, US yields are at their peak, and it is likely to decline further, which means that yield spreads will decrease. Secondly, there is a growing belief that in the fourth quarter, the BOJ will begin policy normalization. Lastly, most G10 banks are preparing to end their rate hike cycles, which will increase demand for the yen in cross-currency pairs.

The yen sell-off appears to be nearing its end. The net short JPY position has decreased by 0.2 billion to -8.2 billion, and although positioning remains bearish, seller activity is decreasing. The price is falling below the long-term average for the first time since May.

The likelihood of a corrective decline in USD/JPY has increased. Despite the yield spread still favoring the dollar, there are increasing signs that it will decrease as slowing US inflation brings the start of the Fed rate-cutting cycle closer, and Japan, in turn, signals its readiness to make changes to its ultra-loose monetary policy. Technically, the possibility of renewing the high at 147.86 and breaking above the upper band of the channel is not excluded, but the likelihood of a deep retracement has increased. We assume that the correction may develop, with the nearest significant support at 145.00, followed by the middle of the channel at 143.30/70.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ZUyYdE7

via IFTTT