Analysis of Thursday trades:

EUR/USD 30M chart

The EUR/USD pair continued its downward slide on Thursday, with muted volatility. Despite the subdued movement, the euro depreciated by the day's end, highlighting the persisting bearish trend. This is evident from the trend line. Today, traders had two significant reports to note. The first was the third estimate for EU's Q2 GDP. We had previously indicated that the third estimate is more crucial than the second. The final growth figure stood at +0.1%, down from +0.3% in the prior estimate, marking another disappointing data from the EU. Meanwhile, U.S. jobless claims outperformed expectations, bolstering the U.S. dollar. The euro was fortunate not to end the day with more significant losses.

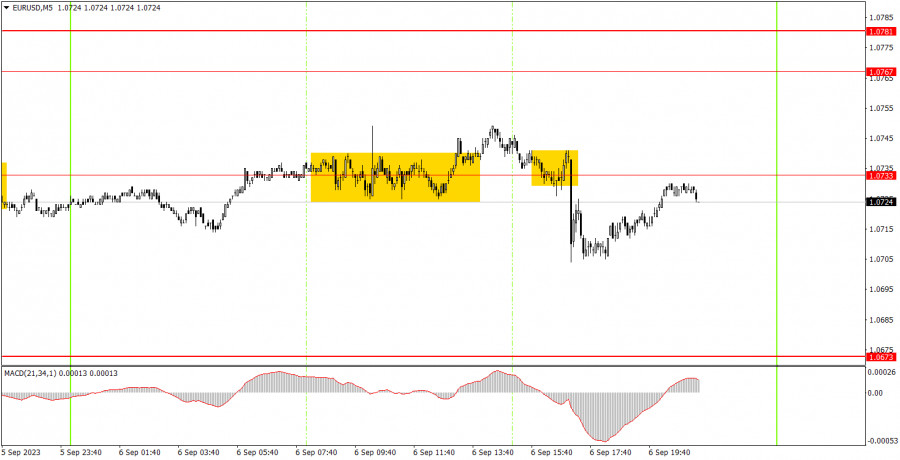

EUR/USD 5M chart

On Thursday, the 5-minute timeframe generated only one trade signal, which occurred overnight. Prices rebounded from the 1.0733 mark and, by the European session's onset, hadn't strayed far from that point, suggesting a potential short position. The pair subsequently moved roughly 30 pips in the expected direction, but no further signals were presented throughout the day. Thus, the short position should've been manually closed towards the evening, yielding a profit of around 15 pips.

Trading insights for Friday:

Movements on the 30-minute timeframe over recent weeks have been somewhat erratic but maintain a near-perfect trend alignment. Given the 1.0767-1.0781 area has been surpassed and the downward trend line remains relevant, a continued bearish movement is anticipated. Medium-term projections are aligned with this trend, irrespective of the macroeconomic and fundamental backdrop. For the 5-minute timeframe on Friday, levels to monitor are 1.0517-1.0533, 1.0607-1.0613, 1.0673, 1.0733, 1.0767-1.0781, 1.0835, 1.0871, 1.0901-1.0904, 1.0936, and 1.0971-1.0981. Once a 15 pip move in the correct direction is achieved, a break-even Stop Loss can be set. On the economic calendar for Friday, Germany will release its final August inflation data, but no other major announcements are expected. Another day of subdued volatility is likely.

Basic rules of a trading system:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/UbIMJ9V

via IFTTT