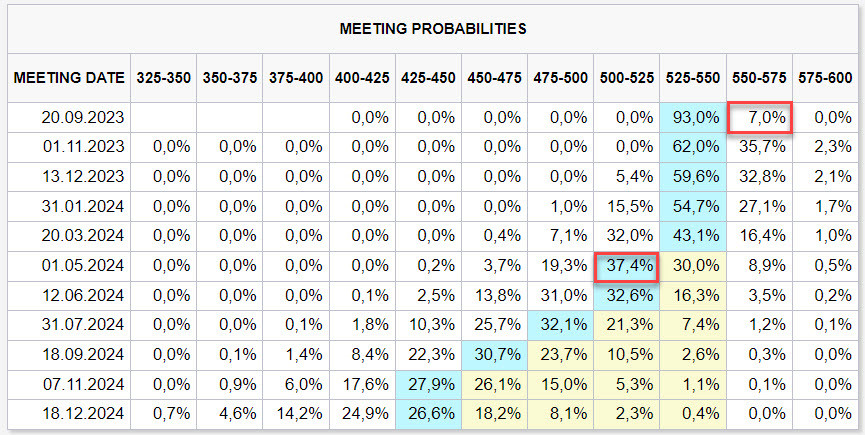

The US non-farm payroll report for August, published on Friday, turned out to be perfect for the Federal Reserve. It's not so much about the figures, which were quite moderate, but about how they perfectly supported the Fed's strategy. The chances of a rate hike at the Fed's September meeting have dropped to 7%, which means it's safe to say that the rate hike cycle is over. Unless, of course, something unbelievable happens, but such assumptions should hardly be expected.

The first rate cut is expected in May 2024, and this forecast has not changed.

What was positive in the report?

First and foremost, it was the fact that average hourly earnings increased 0.2% for the month, against the expectations of 0.3%. This is the smallest increase in the last 12 months. Slower wage growth is an important basis for reducing overall inflationary pressure.

Nonfarm payrolls grew by 187,000 for the month, defying expectations, which could have been seen as a high level of activity had the previous month had it not been for a revision to the previous two months' figures of 110,000, which more than offset the excess. The unemployment rate rose from 3.5% to 3.8%, the highest since February 2022. Overall, we can say that the Fed is consistently achieving its goal of cooling the economy to reduce inflationary pressure.

Another significant release on Friday was the US ISM manufacturing index, which showed that the slowdown in the US manufacturing sector continues, albeit at a slower pace than expected (47.6 versus a consensus 47).

Market activity was reduced on Monday due to the holiday in the United States.

EUR/USD

The Eurozone Harmonised Index of Consumer Prices jumped 0.6% in August, exceeding expectations of 0.4%. The annual eurozone HICP remained at 5.3% against a forecast of 5.1%. However, the data did not cause any shock as the core index decreased in line with expectations from 5.5% to 5.3% y/y.

Speaking after the data release, European Central Bank Vice President Guindos stated that the new ECB forecasts would show that inflation prospects had not changed significantly over the summer, although economic prospects had deteriorated. The data indicates a decrease in economic activity in the third and possibly fourth quarters, and the rate decision in September is still open for debate. Earlier on the same day, ECB representative Schnabel (a hawk) stated that underlying inflationary pressure remains high, but economic activity has noticeably decreased. In her opinion, monetary policy remains a topic of discussion at every meeting, so she could not offer a view on what should happen this month.

Thus, there is no clear position from the ECB. On Monday, ECB President Christine Lagarde was scheduled to speak, as well as Lane and Panetta, and on Tuesday, Lagarde will speak again with Schnabel and Guindos. Investors are eyeing the speeches for clues on the ECB's plans. If something different from the market consensus on this issue is voiced, increased volatility is inevitable.

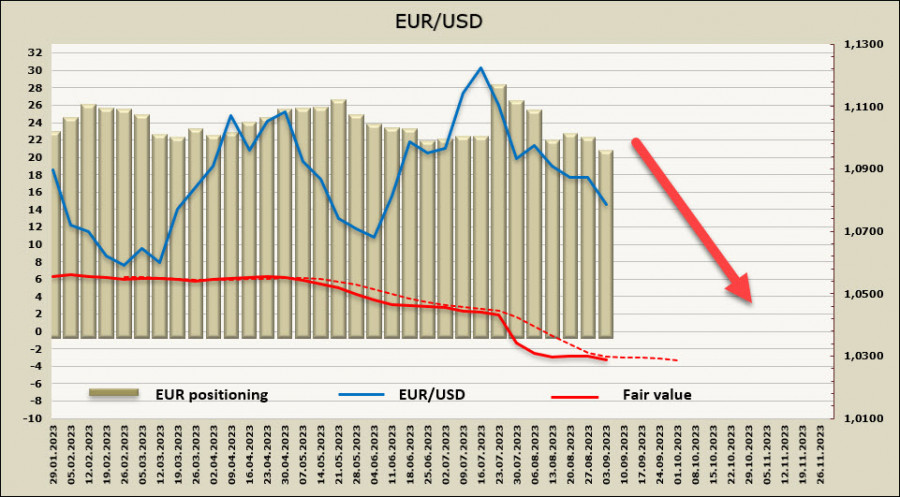

The net long position on the EUR decreased by 0.4 billion to 21.1 billion over the reporting week, with positioning remaining bullish. However, the trend toward selling the euro is becoming increasingly noticeable. The price remains below the long-term average and is falling again.

A week ago, we anticipated that EUR/USD would attempt a shallow correction after a pronounced two-month decline. This attempt took place, but then the bears attacked, and the euro fell to the recent low of 1.0764, failing to break it on the first attempt. We assume that after a brief consolidation, the downward movement will resume, the lower band of the channel will not hold, and the euro will move towards the nearest target of 1.0634. The dynamics will depend primarily on the stability of the US economic recovery and the Federal Reserve's future course of actions.

GBP/USD

Bank of England Chief Economist Huw Pill noted that services price inflation has become less favorable recently and that the UK is facing the effects of "second-round" effects (i.e., wage-driven) and that the Committee needs to see the work aimed at suppressing inflation through.

Pill referred to two scenarios, the first of which involves a succeeding increase in rates followed by a rapid decrease, and the second involves maintaining high interest rates for an extended period. In his opinion, the profile of the inflation trajectory in both cases will be almost identical, but personally, he leans towards the second approach due to risks to financial stability.

In any case, markets are anticipating a rate hike in September to 5.5%, which is already priced in, but a higher rate level appears increasingly unlikely.

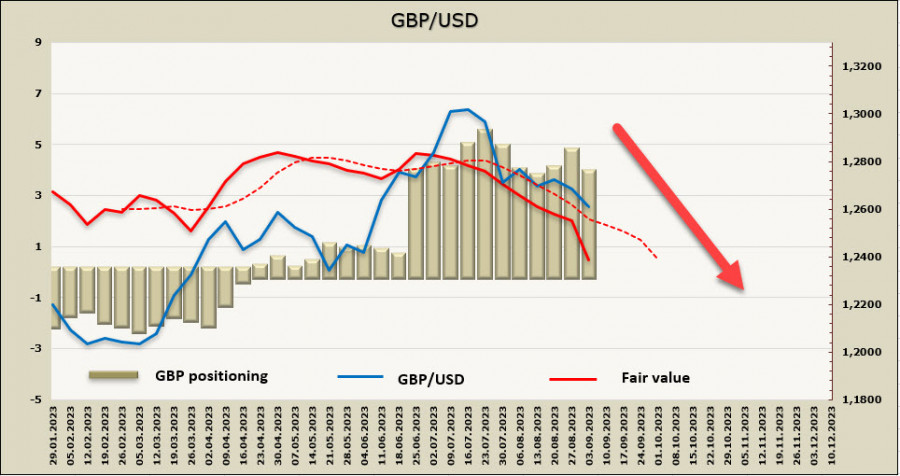

The net long position on GBP decreased by 0.6 billion to 4.1 billion over the reporting week, and the price dropped sharply.

Within the framework of a short-term correction, the pound rose above the resistance area of 1.2680/90, which we identified in the previous review as a likely level for a sell-off, but after the correction, it went down as expected. We assume that the sell-offs will intensify, the support at 1.2545 will not hold, and the long-term target of 1.2290/2310 remains relevant.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ckmzZIn

via IFTTT