Overview :

The EUR/USD pair dropped from the level of 1.1076 to the bottom around 1.1000. But the pair has rebounded from the bottom of 1.1000 to close at 1.1040. Today, the first support level is seen at 1.0910, and the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.1006, which coincides with the 100% Fibonacci retracement level - last bullish wave.

On the one-hour chart, the current rise will remain within a framework of correction. However, if the pair fails to pass through the level of 1.1076 (major resistance), the market will indicate a bearish opportunity below the strong resistance level of 1.1013. This resistance (1.1013) has been rejected several times confirming the downtrend.

The US dollar's strong gains against the Euro have continued today ahead of the sturdy news. The common currency reached a high of more than three week earlier this morning. This technical analysis of EURUSD looks at the one-hour chart. The highest price that EUR/USD reached for that period was 1.1006 (last bullish wave - top).

The lowest price that the EUR/USD pair reached during that period was 1.0950 (right now). Thus, the EUR/USD pair settled below 1.0950 and is testing the support level at 1.0910. RSI and Moving averages continue to give a very strong sell signal with all of the 50 and 100 EMAs successively above slower lines and below the price. The 50 EMA has extended further below the 100 this week. Support from MAs comes initially from the value zone between the 50 and 100 EMAs. Industriously, Euro Is Losing ground against U.S.

Dollar around -95 pips. Additionally, the RSI starts signaling a downward trend. As a result, if the EUR/USD pair is able to break out the first support at 1.0910, the market will decline further to 1.0850 in order to test the weekly support 2. In the H1 time frame, the pair will probably go down because the downtrend is still strong.

Consequently, the market is likely to show signs of a bearish trend. Since there is nothing new in this market, it is not bullish yet. So, it will be good to sell below the level of 1.1013 with the first target at 1.0910 and further to 1.0850. At the same time, the breakdown of 1.0500 will allow the pair to go further up to the levels of 1.1013 in order to retest the weekly top.

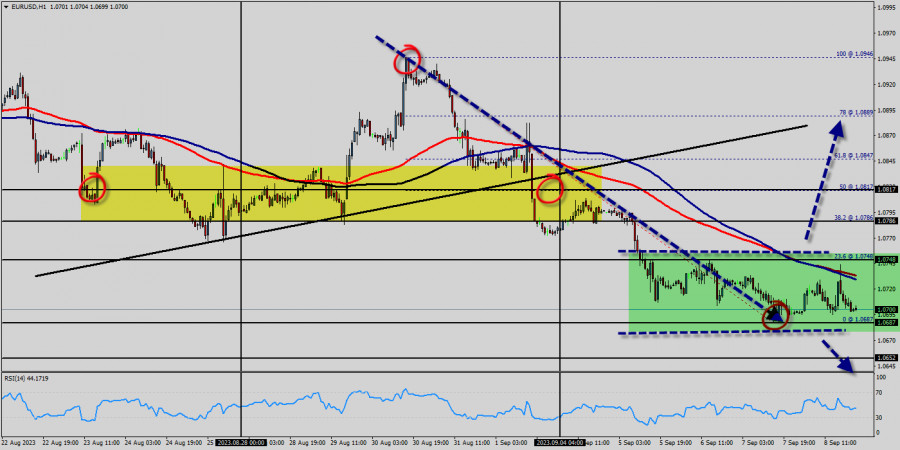

Overview : The EUR/USD pair hit the weekly pivot point and resistance 1, because of the series of relatively equal highs and equal lows. But, the pair has dropped down in order to bottom at the point of 1.0835. Hence, the major support was already set at the level of 1.0766. Moreover, the double bottom is also coinciding with the major support this week.

Additionally, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100. Therefore, it will be advantageous to sell below the resistance (supply zone) level of 1.0810 with the first target at 1.0766. From this point, if the pair closes below the weekly pivot point of 1.0835, the EUR/USD pair may resume it movement to 1.0700 to test the weekly support 1. Stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss below the last bottom at 1.0877.

The EUR/USD pair steadies near 1.0715 after USD slide. The EUR/USD pair reached a peak of 1.0715 following the release of a weak ISM Services PMI report from the US. The EUR/USD pair is currently hovering near the 1.0715 level, unchanged for the day. The EUR/USD pair trades with modest losses, not far above the two-week low posted last week at 1.0636.

Technical readings in the daily chart favor a downward extension as a bearish 50 Simple Moving Average (SMA) heads south below a flat 100 SMA, both above the current level. Also, the pair remains above a critical static support level, the 23.6% Fibonacci retracement of the 2023 yearly slump at 1.0682. Finally, technical indicators remain within positive levels, with neutral-to-bullish slopes. The EUR/USD pair broke resistance which turned to strong support at the level of 1.0682.

The level of 1.0682 coincides with 23.6% of Fibonacci, which is expected to act as major support today. Since the trend is above the 23.6% Fibonacci level, the market is still in an uptrend. From this point, the EUR/USD pair is continuing in a bullish trend from the new support of 1.0682. Currently, the price is in a bullish channel. According to the previous events, we expect the EUR/USD pair to move between 1.0682 and 1.0789.

On the H1 chart, resistance is seen at the levels of 1.0757 and 1.0789. Also, it should be noticed that, the level of 1.0734 represents the daily pivot point. Therefore, strong support will be formed at the level of 1.0682 providing a clear signal to buy with the targets seen at 1.0734. If the trend breaks the support at 1.0734 (first resistance) the pair will move upwards continuing the development of the bullish trend to the level 1.0789 in order to test the daily resistance 2. However, stop loss is to be placed below the level of 1.0636 - last bearish wave.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/qzTFduK

via IFTTT