Another day has passed in the currency market, and the European currency is ending it in far from the best mood. If you look at it this way, the euro has not had a good mood for two months, if not longer. I can't say that the decline of the European currency during this period was illogical or unjustified. I expected such a movement toward the 1.05 figure. The rise of the European currency began in September of last year, and almost all this time, demand for it has been on the rise. Yes, there were periods when it hardly increased, but at the same time, it hardly decreased either. As we know, wave formations or trends alternate in any market. If the last segment of the trend was upward, the next one should be downward. We are currently witnessing the first wave of this segment. So, everything is logical.

The news background for the euro has been poor even when demand for it remained very high. Just look at the GDP figures for the past year; remember that inflation has risen more than in the US, while the ECB's key rate has not risen more than the Fed's rate. What matters to us is not just the news background, economic indicators, or their values in one country or another for a specific currency. What matters is the comparison of statistics between the EU and the US. And in my opinion, the US has been winning for a long time. If that's the case, then a stronger dollar is logical and justified. Again.

In the last three weeks, the euro has been bombarded from all sides with jabs in the form of statements from ECB policymakers, each of whom considers it their duty to announce the end of the process of tightening monetary policy. Perhaps the market has already priced in this rhetoric and the ECB's decision, but almost every day a new representative of the Governing Council repeats that the rate has probably reached its peak. The market would be happy to build a corrective wave, but something seems to hinder it almost every day.

Based on the analysis conducted, I conclude that the construction of a bearish set of waves continues. The targets around 1.0500–1.0600 have been ideally worked out, but the decline may continue for some time. Since the attempt to break through the 1.0463 level is currently unsuccessful, I would advise not to rush into new sales but to gradually get rid of old ones. The probability of starting the construction of an upward wave is high. Once the 1.0463 level is breached, selling the euro can be considered with targets around the 1.0242 level, which corresponds to 161.8% according to Fibonacci.

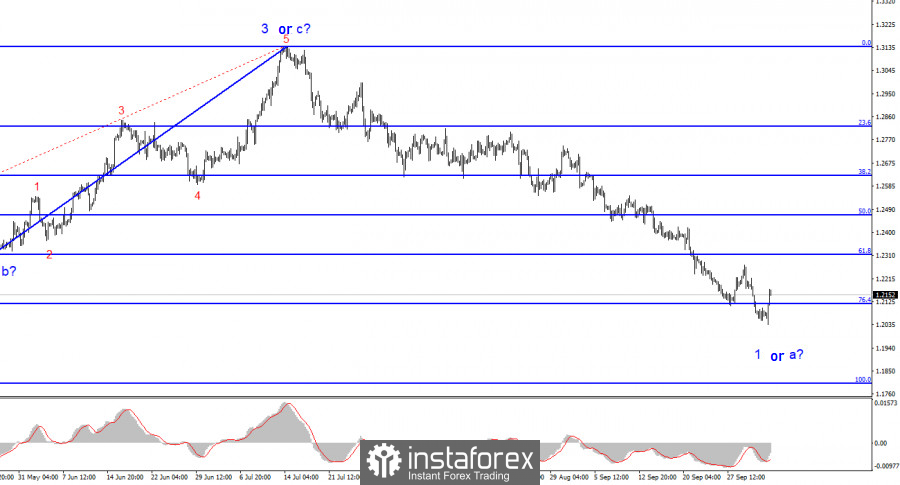

The wave pattern of the pound/dollar pair suggests a decline within a new downward trend segment. The maximum that the British pound can expect in the near future is the construction of wave 2 or b. But as we can see, even with a corrective wave, significant problems arise. At the moment, I would remain cautious about selling, as the construction of a corrective wave can begin at any moment. I do not recommend buying within the correction.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/F4ncCUo

via IFTTT