The US ISM Manufacturing PMI report improved in September and exceeded analysts expectations, arriving at 49 from 47.6 in August. Numbers below 50 show contraction. The index of new orders also remains below 50, reflecting continued weak consumer demand for industrial goods. However, inventories are decreasing more rapidly than orders, indicating a slow recovery in production.

Comments from the Federal Reserve officials also lack unanimity. Bowman, who is one of the more hawkish FOMC members, maintains her previous view that rates will need to be raised further. Barr expressed a more cautious stance, stating that "I think it is likely that we are at or very near to the level that is sufficiently restrictive to bringing inflation back to 2% over time,". Fed Chairman Jerome Powell did not touch on the prospects for monetary policy in his public remarks.

At present, the US Dollar continues to be favored in the market, and there are no reasons to expect a reversal.

NZD/USD

The Reserve Bank of New Zealand held its monetary policy meeting on Tuesday. BNZ bank believed that the rate will remain at the current level of 5.50% because the balance of factors affecting the rate is too uncertain.

On one hand, the labor market is clearly weakening, with the latest Westpac survey showing a sharp drop in employment confidence to 98.3 in the September quarter and an increase in job seekers. These are signs of rising unemployment, which, in turn, will lead to slower wage growth and ultimately inflation.

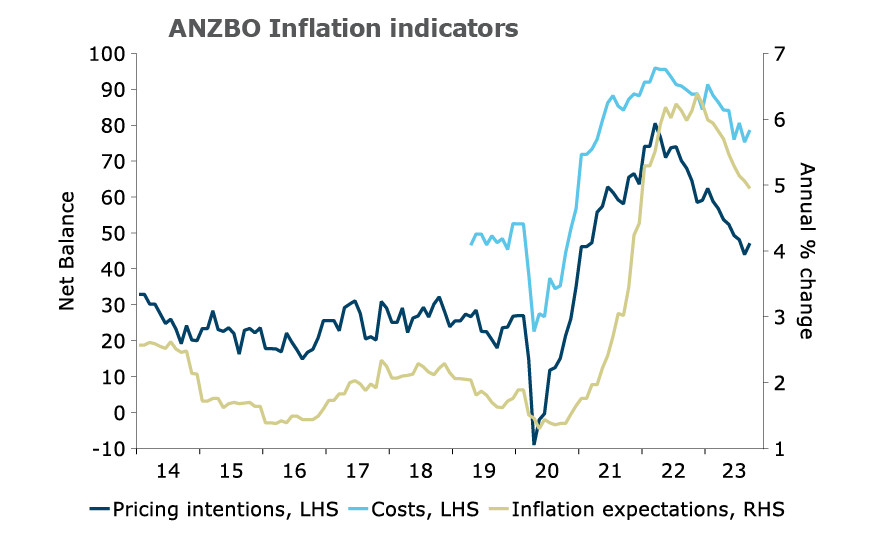

On the other hand, there is an increase in housing and energy prices in the market, which raises overall inflation, and retail interest rates are under pressure due to higher financing costs. ANZ bank's Business Outlook survey showed an increase in business confidence in September from a very low -63 to -52, but at the same time, the retail sector in September expects prices to rise at a faster pace than in the August survey.

The general consensus is that the RBNZ will remain in 'watch and wait' mode, and a rate hike of 25 basis points is projected for November. Since GDP growth has exceeded expectations, restrictive policy is necessary to reduce activity, ensuring that inflation will go down. Therefore, a pause seems to be the right decision, and markets will be focused on the release of the quarterly inflation report on October 17, which will allow for adjustments to the RBNZ's peak rate forecast.

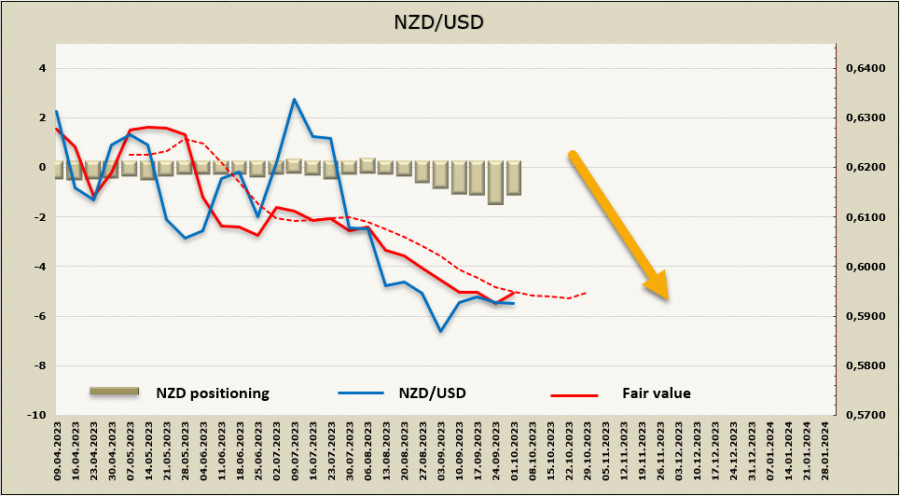

The net short NZD position decreased for the first time after 6 weeks of selling, by 0.4 billion to -0.9 billion. The bearish bias is still intact, but the price has lost momentum and currently does not have a clearly defined direction.

A week ago, we took note of a growing likelihood of a bullish correction. It has already taken place, as the kiwi retraced to the middle of the channel, forming a local low at 1.6044. There's a low chance of another upward wave. Instead, investors will likely test the local low at 0.5852. However, since the price has lost momentum, we expect the pair to trade within a range in the short-term.

AUD/USD

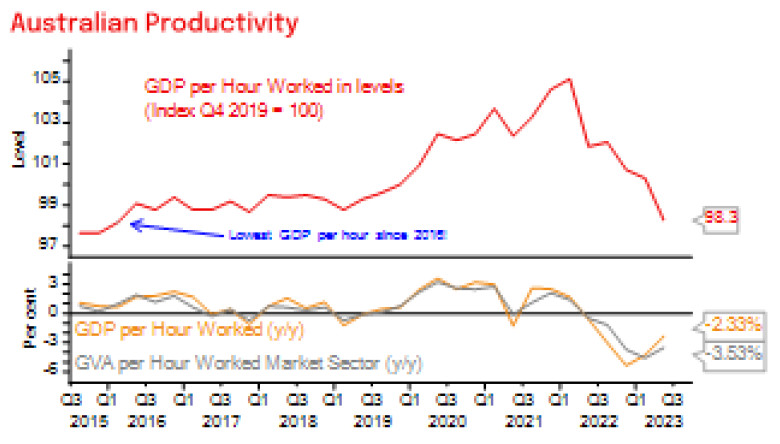

As expected, the Reserve Bank of Australia did not raise the rate at its meeting. Despite the monthly inflation indicator showing stable price growth in the service sector, the RBA is likely to wait for confirmation of the trend, with data for the third quarter to be published on October 25. Take note that after the September RBA meeting, officials were slightly more optimistic about inflation, noting that it was returning to the target level "in due course," but the situation has deteriorated somewhat since then. Productivity, measured as GDP growth per hour worked, is at its lowest level since 2016.

NAB predicted one more rate hike to 4.35% in November. If the incoming data confirms this, it could support the aussie, raising the chances of stopping the decline or maybe a corrective rise. However, at present, there are no compelling arguments in favor of either a rise or a fall.

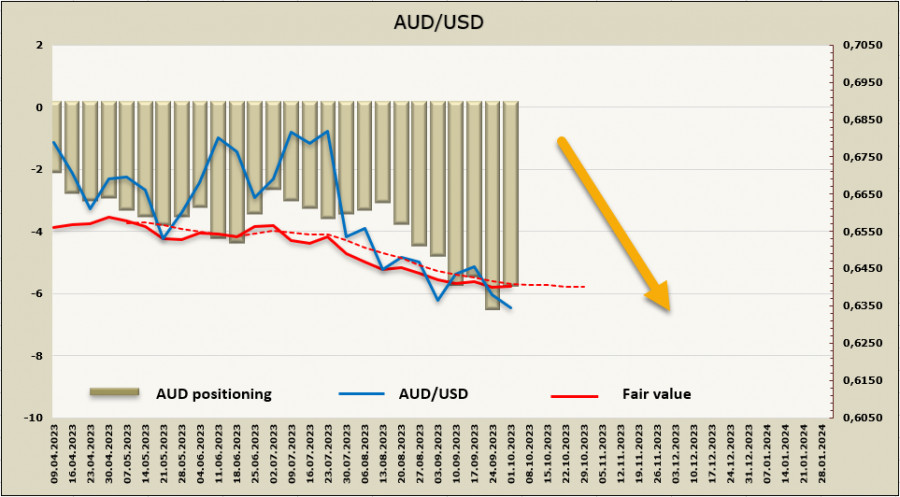

The net short AUD position corrected by 0.7 billion to -5.6 billion during the reporting week. The bearish bias is still intact, and the price has lost momentum.

AUD/USD has set a new low, easily breaking through the support level at 0.6358. The nearest target is 0.6280/6300. Technically, the long-term trend is bearish, but the loss of momentum increases the likelihood of consolidation near the lower band of the channel at 0.6280/6300. There are few reasons for the pair to significantly correct higher to the middle of the channel at 0.6520/30, especially for a bullish reversal. We expect an attempt to move towards 0.6280 with subsequent consolidation.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/ysVChBQ

via IFTTT