The market is accustomed to playing the odds. At the end of 2022, there was much talk about the lagging cycle of monetary tightening by the European Central Bank (ECB) compared to the Federal Reserve, which, over time, was expected to break the downward trend in EUR/USD. In mid-2023, rumors circulated about the Fed's dovish pivot, which could also lead to a weakening of the U.S. dollar. Finally, towards the end of this year, the market is confident that Washington will provide monetary stimulus faster than Frankfurt. Could investors be wrong again this time?

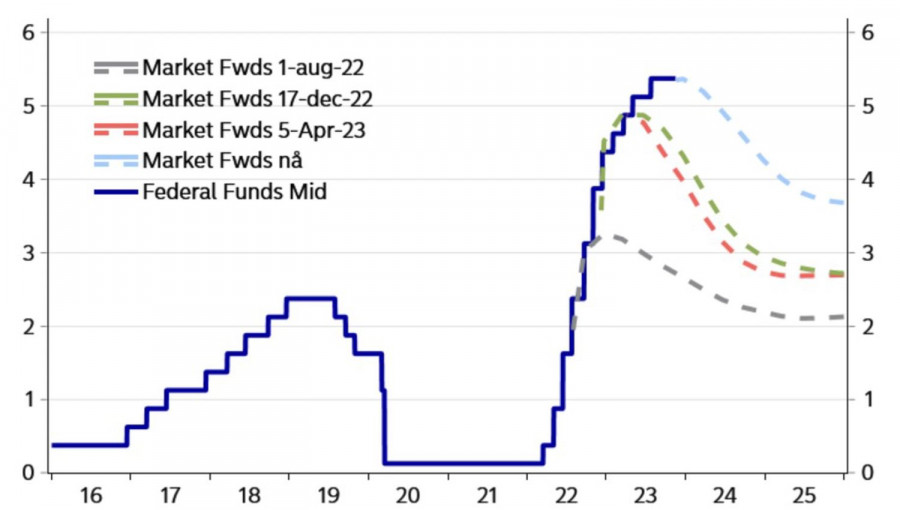

According to Standard Bank, it is quite strange that derivatives signal a reduction in the federal funds rate and deposit rates by the same magnitude—approximately 100 basis points. The U.S. economy is clearly stronger than the European one, so why should the Federal Reserve act proactively? It will lag behind the ECB, negatively impacting EUR/USD.

Dynamics of Fed Rate and Market Expectations

However, divergence in monetary policy is not the only driver of exchange rate formation. The strength of the U.S. dollar was linked to American exceptionalism and suppressed global risk appetite. It's one thing when the most aggressive tightening of the Fed's monetary policy threatens to plunge the U.S. economy into a recession. It's another when it shows remarkable resilience, soft landings occur, and markets expect a 100 basis points reduction in the federal funds rate in 2024.

A favorable environment for stock indices and risky assets in general is created. On the contrary, the U.S. dollar comes under pressure as a safe-haven currency. It's no wonder that the smile theory of the dollar states that the USD index rises either when things are bad with the global economy or when things are good with the U.S. economy. If the U.S. GDP begins to slow down, EUR/USD rises.

For a long time, the main currency pair reacted to events in the United States. However, recent data on the German economy have been promising, suggesting that it has already hit bottom and will begin to recover. If business activity in the currency bloc also presents a pleasant surprise, EUR/USD will have the opportunity to rise even higher. This would mean a reduction in the divergence in economic growth between the United States and the eurozone.

Overall, the idea of breaking the downward trend in the euro against the U.S. dollar is gaining new evidence. Primarily, thanks to the deterioration of macro statistics in the United States, including employment, consumer and producer prices, and unemployment benefit claims. If everything continues in the same vein, EUR/USD may rise and solidify above 1.1 by the end of the year.

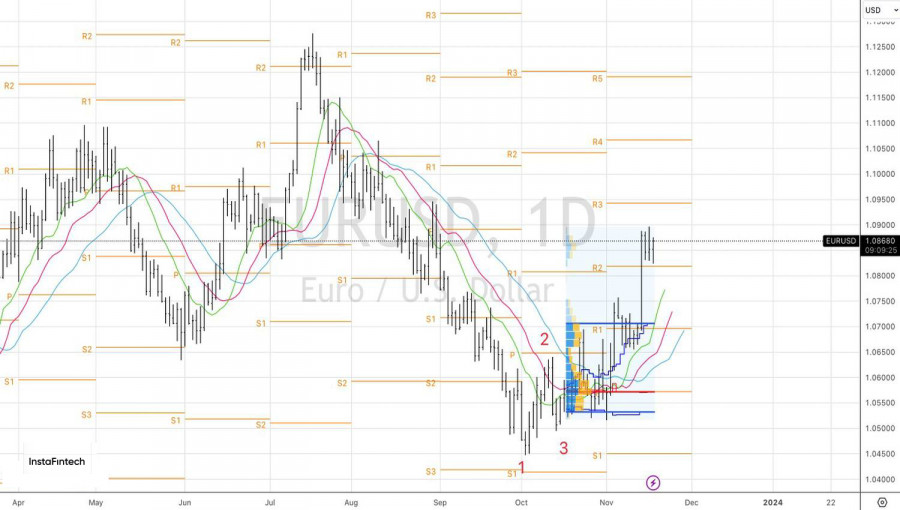

Technically, on the daily chart, the main currency pair is undergoing consolidation after a sharp upward explosive movement. This corresponds to the Adam and Eve pattern. Several attempts to play the inside bar have not been successful, but the risks of breaking the range of short-term consolidation at 1.083–1.089 are growing rapidly. Two pending orders should be set for its breakout: buy from 1.089 and sell from 1.083.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/4xo5B0b

via IFTTT