Friday brought a series of negative data indicating a gradual slowdown in the U.S. market. The New York Federal Reserve said its general business conditions index plunged from a positive 9.1 in November to a negative 14.5 in December, indicating a decline in capacity utilization. The manufacturing sector was up by only 0.2% in November, which clearly appears as a rollback after -0.8% in October.

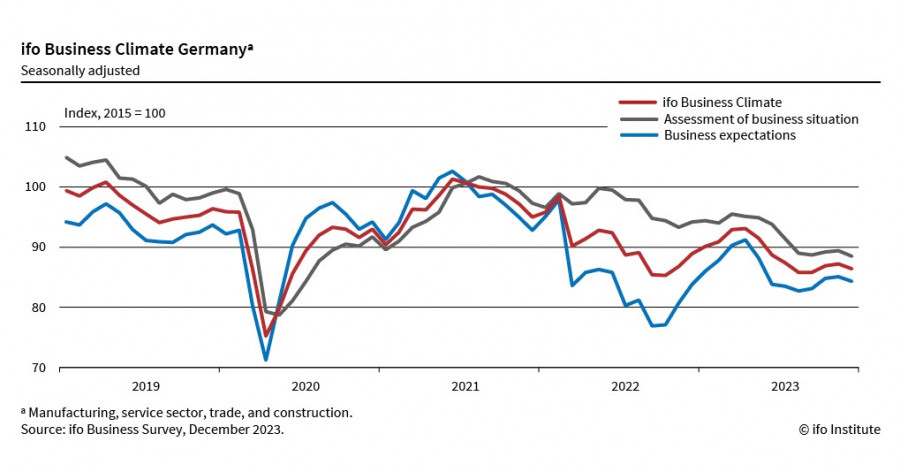

The German ifo Business Climate Index fell in December, with companies being less satisfied with their current business. Trade also declined, and in construction, it fell to the lowest level since September 2005. Every second company expects further deterioration in the coming months. In the service sector, the business climate improved slightly.

In the pre-Christmas week, no significant movements are expected in the foreign exchange market.

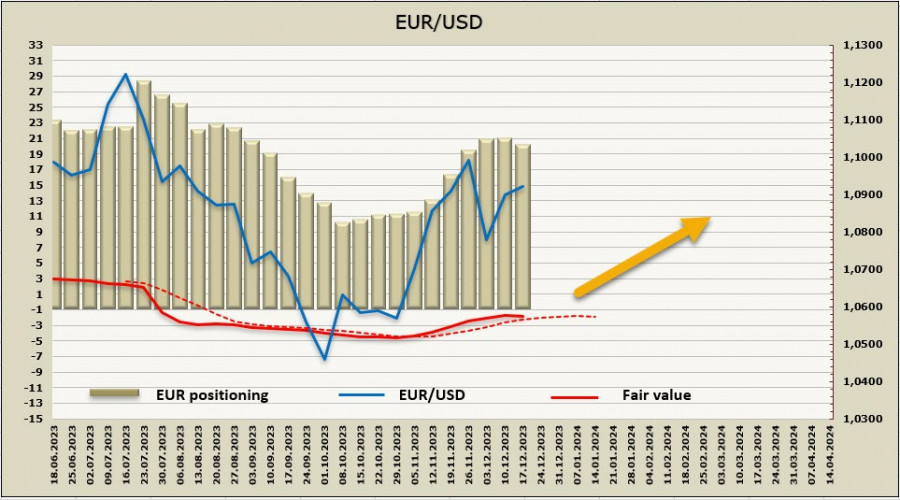

EUR/USD

The European Central Bank also announced changes to the PEPP purchases (reinvestment) schedule for 2024. This decision, expected in January, involves reducing the current reinvestment levels from 18 billion to 7.5 billion per month. This means that in the second half of 2024, the ECB will reinvest more than 10 billion euros per month. This decision should be considered dovish, indicating that it will exert pressure on the euro.

In terms of the prospects for exiting the ECB's tight policy, it aligns with the Federal Reserve, adjusted for specifics. Data dependence has more weight than time dependence, complicating the forecast for the ECB's further steps. The main focus will be on new labor market data. The inflation forecast for 2024 has been noticeably reduced to an expected 2.7% (previously 3.2%).

Currently, forecasts suggest the first rate cut of 25 basis points in June, which is later than the first Fed rate cut, giving the euro at least the opportunity not to decline against the dollar.

As for the state of the economy, ECB President Christine Lagarde characterized it as a period of weak and slightly negative growth, mainly due to the contraction of the manufacturing sector.

The EUR/USD pair grew after the meeting, providing grounds to anticipate further attempts of bullish pressure on the pair, although it has no strong reasons to rally.

The net short EUR position decreased by 686 million to 19.878 billion over the reporting week. This is significantly lower than the peak levels observed in the summer, but the bullish bias remains intact. The price is above the long-term average, and there are attempts at a bearish reversal, although the dynamics are weak.

EUR/USD tried to resume the upward movement but failed to overcome the resistance at 1.1018. Currently, the most likely scenario is consolidation with a slight bullish bias. The target is the upper band of the horizontal range at 1.1000/20, with support at 1.0810/30. In case the euro surpasses the initial resistance, the next target is 1.1055/70.

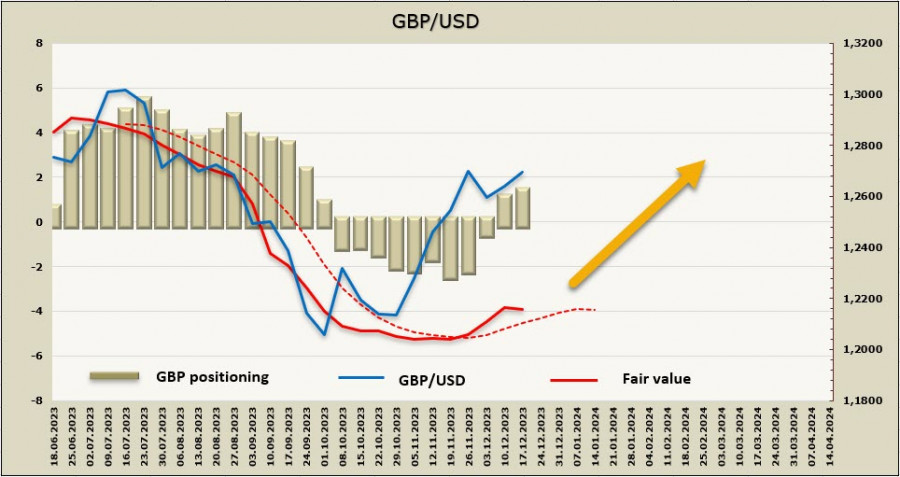

GBP/USD

Last week, the Bank of England, as expected, kept the key rate unchanged at 5.25%. The distribution of votes repeated the situation at the November meeting: 6 members voted for an unchanged decision, and 3 members voted for a 25 bps rate hike.

Most members justified their decision by noting that, although some key data received after the previous meeting were negative, they had a limited impact on forecasts for the further development of the economy and inflation. It was also emphasized that it was too early to conclude that inflation and wage growth were sustainably decreasing, making any talk of a possible rate cut premature.

The BoE evidently aimed to avoid changes in rate expectations towards an earlier tightening to prevent premature easing of financial conditions, and it seems to have achieved its goal. Markets interpreted the meeting results as hawkish, and the pound received slight support against the dollar, testing a 4-month high.

The UK economy currently appears weak, inflation is stabilizing, and the main question now is at what level wage growth will stop. When more confident forecasts emerge on this criterion, then, evidently, one should expect the first hints of the end of the period of high rates. Until that happens, the pound will likely continue to enjoy an advantage against the USD.

The net short GBP position increased by 776 million to 1.695 billion over the reporting week. Positive dynamics have been observed for the fourth consecutive week, forming a bullish bias, albeit a weak one. The price is above the long-term average, providing grounds to expect that the pound will continue to rise, though the direction is currently unclear.

The pound made an attempt to rise after the BoE meeting, surpassing the resistance at 1.2730. However, it couldn't consolidate at the achieved levels and develop further success. The target is still 1.2810/40, and an attempt to reach the upper band of the channel seems plausible. Still, given that the momentum is getting weaker, consolidation with a slight bullish bias appears to be the more likely scenario.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/UD8suhV

via IFTTT