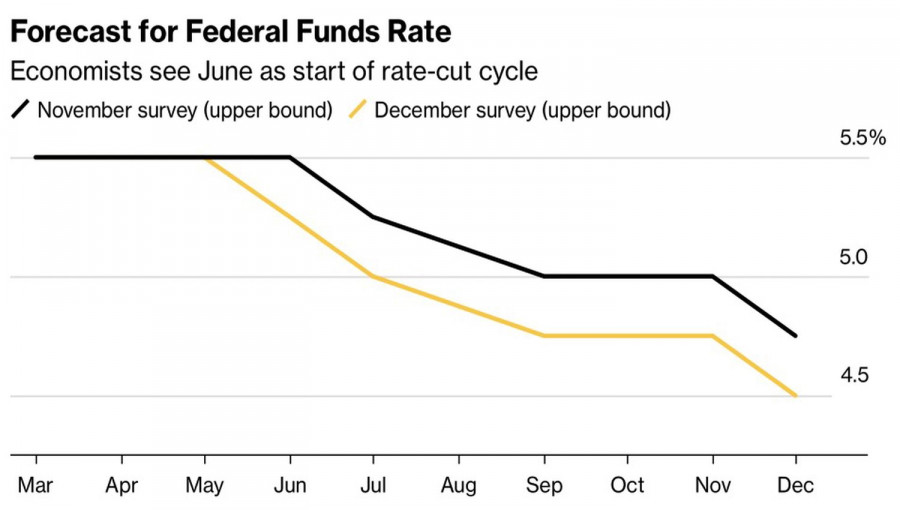

The Golden Mean. If the markets expect a 150 basis point rate cut in 2024, and the FOMC forecasts show three acts of monetary expansion, Bloomberg analysts are counting on four. In their opinion, the cost of borrowing will drop to 4.5% by the end of 2024. The Federal Reserve will start tightening monetary policy from June, not July, as previously thought. It seems that everyone is confident in rate cuts, allowing EUR/USD bulls to dictate their will to opponents.

Forecasts of experts on the Fed's rate

The euro is not bothered that investors expect an even bigger cut from the European Central Bank than from the Fed – by 162 bps. And the eurozone economy is clearly weaker than the American one. Weekly options show immense interest in buying the EUR/USD pair since February 2022. Investors believe that the improvement in global risk appetite is a more significant factor than the different pace of monetary expansion. As long as stock markets support EUR/USD, the pair will continue to rise.

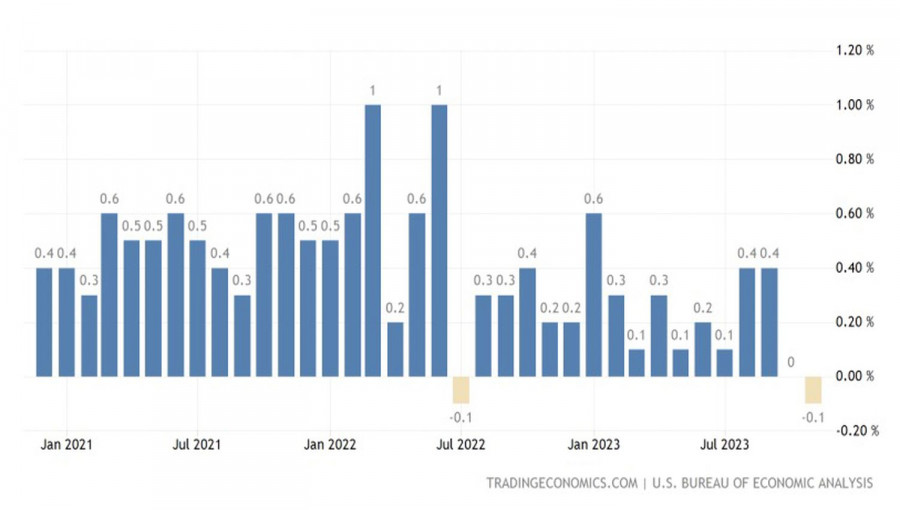

However, one of the bullish drivers for it has been expectations of a slowdown in US inflation. The report showed a decrease in the growth rate of the Personal Consumption Expenditures (PCE) index from 2.9% to 2.6% YoY. Moreover, on a monthly basis, the indicator decreased by 0.1% for the first time since mid-2022. The core PCE increased by 3.2% with an estimate of 3.3%. It seems that the reports give the green light to the buyers. However, the euro is not in a hurry to take advantage of it. Could it be that once again the "buy the rumor, sell the fact" principle will come into play?

U.S. Personal Consumption Expenditures (PCE) Index Dynamics

In my opinion, the market has been showered with gifts. Strong employment and slowing inflation indicate a soft landing. The dovish pivot by the Fed allowed the Dow Jones and Nasdaq 100 to rewrite record peaks. Against this backdrop, the bears on EUR/USD look like punching bags, and Deutsche Bank's forecasts evoke a skeptical smile. According to the bank, the stronger US economy compared to the European one will help the dollar regain lost positions in 2024. Allegedly, as global inflation risks resume, tightening global conditions will aid the USD index.

Deutsche Bank is clearly going against the crowd, which expects the euro to rise to almost $1.21, as predicted by RBC Global Asset Management. The majority is not always right, but those going against it may be burned at the stake. While optimism prevails in the market, EUR/USD intends to rise, especially during the Santa Claus rally in the U.S. stock market. The period at the end of the old year and the beginning of the new one is extremely favorable for stock markets. They have proven this over the past seven years. Why not repeat it?

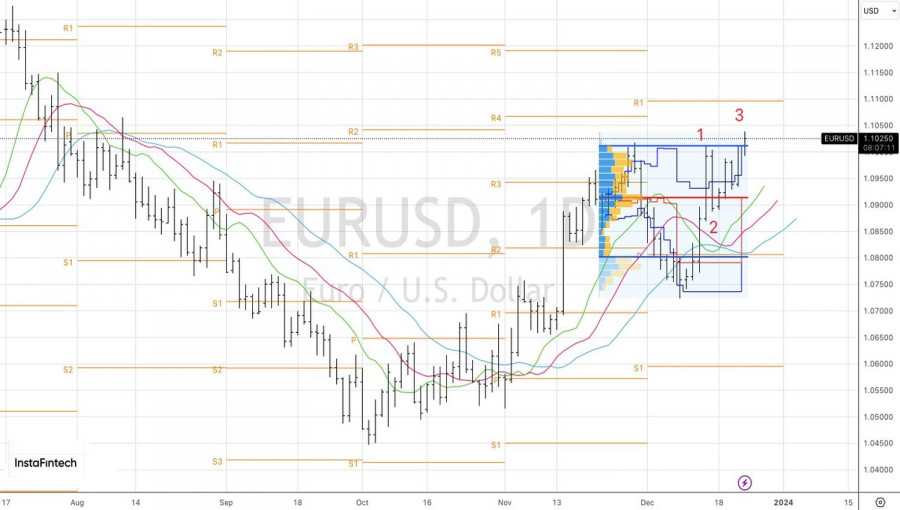

Technically, the clear use of an inside bar on the daily chart allowed traders to form long positions from 1.0985. Closing the day above 1.1015 would provide grounds to hold and increase them on pullbacks. Otherwise, there are significant risks of the pair returning to the consolidation range of 1.0800–1.1000.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/s4XHEdJ

via IFTTT