Why did oil rebound from 5-month lows? At first glance, the answer seems obvious – attacks by Iran-backed Houthi rebels on vessels in the Red Sea forced companies to seek alternative shipping routes. Disruptions with them are a clear bullish factor for Brent. However, the rally in the North Sea grade following the announcement of the results of the December Fed meeting raises doubts that geopolitics is the sole driver of the upward price movement.

In reality, the black gold market conditions remain bearish. According to the IEA, global demand is expected to grow by 2.3 million bpd in 2023, but in 2024, it will slow down by 50% to +1.1 million bpd against consumers turning to more efficient resources and electric vehicles. The International Energy Agency believes that increasing oil production in non-OPEC+ countries will be sufficient to meet this demand. Essentially, this means that without additional production cuts by the Brent Alliance, prices could collapse below $60 per barrel.

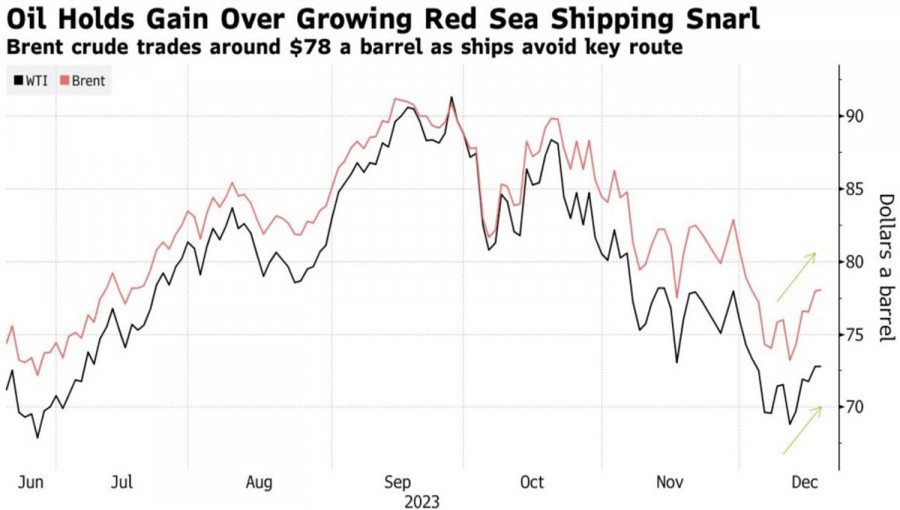

Major Oil Grades Dynamics

Indeed, the issue of oversupply persists. It has not disappeared anywhere. The U.S. shale industry has challenged predictions of a slowdown, demonstrating strong growth. Oil production in Iran has sharply increased as Washington turned a blind eye to sanctions compliance. Measures against Russia are not working, and Brazil, Guyana, and other countries have increased supply.

In this regard, the Houthi attack on vessels in the Red Sea allowed Brent bulls to catch their breath. The 192 km Suez Canal is the fastest route between Asia and Europe. About 9.2 million bpd, or 9% of global demand, passed through it in the first half of 2023. Finding alternative routes will take time and money, reflecting in the rising cost of delivery contracts.

However, Goldman Sachs does not consider this a significant problem. According to the bank's estimates, the hypothetical redirection of 7 million bpd over an extended period will only increase prices for the North Sea grade by $3-4 per barrel. Geopolitics has a temporary impact on markets, and there is no need to expect Iran's full involvement in the conflict.

On the other hand, the Federal Reserve's dovish pivot is a different story. The 15% rise in the S&P 500 from October lows, a 106 bps drop in the yield of 10-year Treasury bonds, a decline in the USD index, and a reduction in credit spreads are easing financial conditions. Essentially, this is about significant economic stimulus, which can increase domestic demand for oil and oil products and support other countries. The actual global demand for black gold may be much higher than the IEA predicts. And this could be the beginning of a Brent rally.

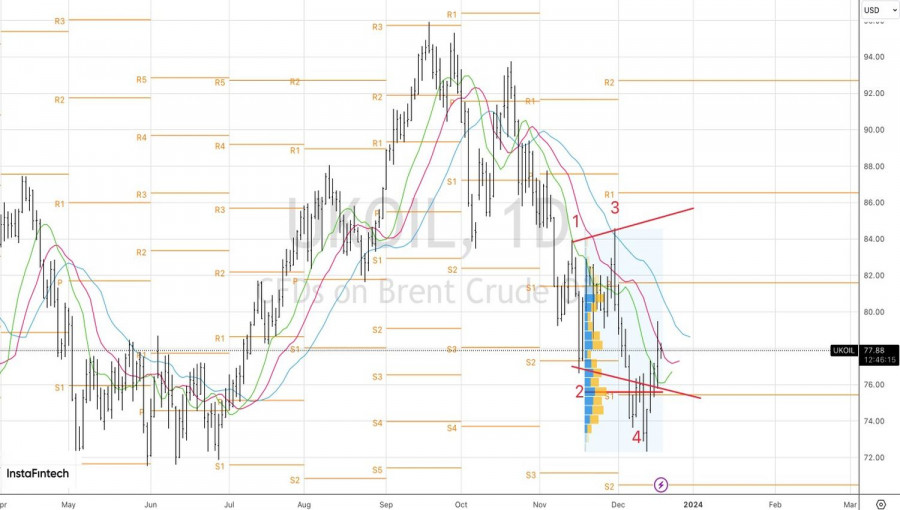

Technically, the idea of implementing the Rising Wedge reversal pattern can be confirmed on the daily chart of the North Sea grade. For this, Brent needs to rise above $81 per barrel. An aggressive long entry implies storming resistance at $79.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/RIVbWCP

via IFTTT