Spectators in stadiums often cheer for the underdogs, which gives them strength and allows them to win. The GBP/USD pair looks weaker. After the release of Q3 GDP data, investors believe that the UK economy is in a recession. Its American counterpart is growing rapidly. The Bank of England is starting to feel pressure from the government. Nevertheless, GBP/USD quotes are trying to return to the area of August highs. It's obvious to whom the spectators give their sympathy.

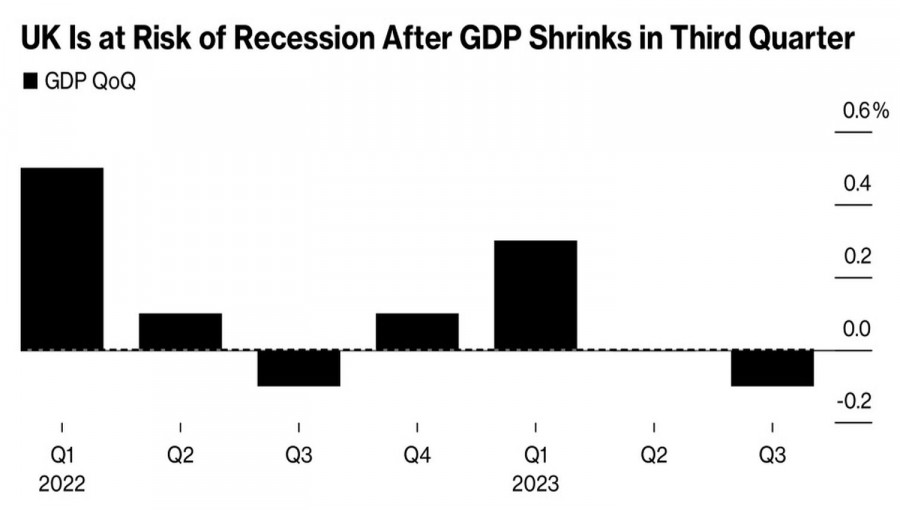

GDP data for Great Britain has been revised lower. The British economy saw 0 growth in the second quarter of the year, instead of the previously announced +0.2%, and contracted by 0.1% in July-September. The data increases the risks of Britain being in a recession, which, combined with the slowdown in inflation to 3.9% in November, opens the way for a rate cut and theoretically should lower GBP/USD quotes.

The dynamics of the British GDP

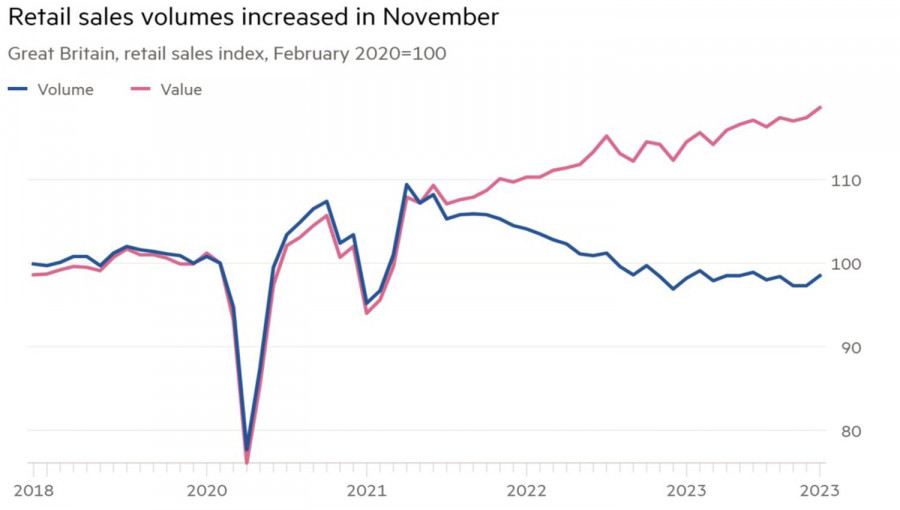

In fact, gross domestic product (GDP) is a lagging indicator. Two consecutive quarters of negative growth are required for a technical downturn. However, strong retail sales data for November allow sterling enthusiasts to hope for the best. The indicator grew by 1.3%, significantly outpacing Bloomberg experts' forecasts of +0.4% month-on-month. Moreover, real wages accelerated to 1.4% in August-October, instilling belief in further improvement in consumer activity.

On the other hand, the surge in retail sales was likely due to significant discounts on Black Friday. Chancellor Jeremy Hunt's statement that a decline in inflation could allow the BoE to ease monetary policy in 2024 indicates growing political pressure on the pound. Indeed, the ruling Conservative Party is trailing in public opinion polls to the Labour Party, which, ahead of parliamentary elections, forces it to show increased activity.

Dynamics of retail sales in the UK

The United States is also facing presidential elections next year. However, if Donald Trump resolves all his issues and decides to run for the head of state, the rise in political risks will contribute to the US dollar's strength as a safe-haven asset.

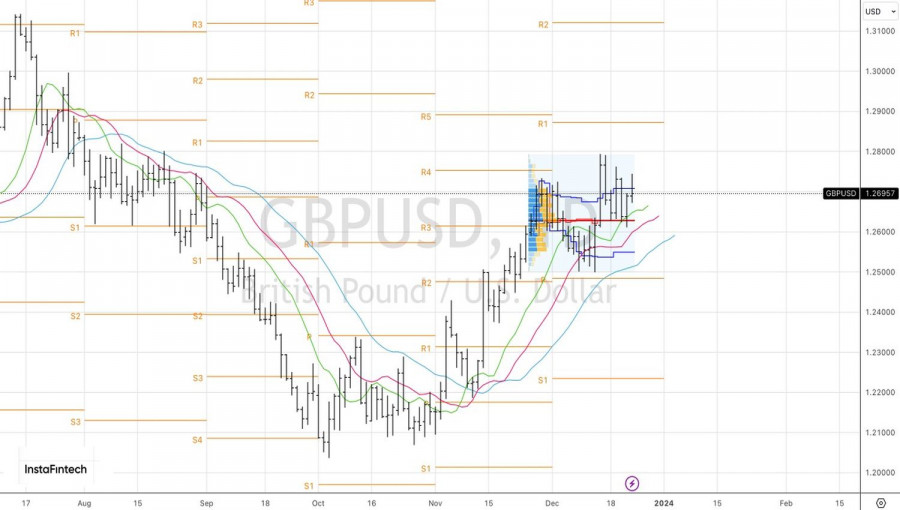

For now, the US currency feels unwell amid slowing inflation to 2.6% in November. Its weakness is the main reason for the GBP/USD rally. The lower consumer prices and the personal consumption expenditures index go, the higher the probability that the Federal Reserve will reduce the federal funds rate. Not three times, as the December FOMC forecasts suggest, but more times, as the urgent market demands.

Technically, on the daily chart, the bears are trying to form a reversal pattern 1-2-3. Its combination with Anti-Turtles could be a strong argument in favor of selling. If, of course, quotes fall below the fair value at 1.263. On the contrary, their rise above 1.274 is a reason for buying.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/XRI9rL0

via IFTTT