The market is still confused about the interest rates. This applies to the Bank of England, the European Central Bank, and the Federal Reserve. The market receives plenty of information every day that constantly influences its interest rate expectations. Only a few members of the FOMC have spoken out, urging markets not to jump to conclusions, as the Fed's rate cuts may start much later than currently perceived. Following them, James Bullard suggests monetary easing as early as March.

Bullard is certainly no longer part of the monetary committee and will not participate in rate voting. However, he served in this committee for several years, and his opinions carry weight in the markets. Bullard still has colleagues within the Fed who may be better informed than the market. Bullard may interpret economic indicators somewhat differently than how the markets perceive them. In general, my point is that the "swing" continues. The market is thoroughly perplexed, with moving oscillating up and down.

On Tuesday, the CME's FedWatch Tool indicated a 42% probability of a rate cut in March, but on Wednesday, it changed to 50%. A few weeks ago, it was at 80%, then it dropped to 40%. The market's opinion keeps changing, not only regarding the Fed's rates.

The ECB faces just as many questions. Initially, the market assumed that the central bank would not start lowering rates until the autumn, but then ECB President Christine Lagarde hinted at the beginning of summer or late spring. Along with her, some members of the Governing Council also advised the market not to rush with rate cuts, as inflation could turn out to be much more stubborn.

One of those voices is Klaas Knot. Last week, he said that the markets are rushing the ECB, and inflation is not expected to return to 2% until 2025, implying that the first rate cut is not imminent. "We need to see a decline in wage growth before we can talk about easing financial conditions. The more the market prices in an imminent policy easing, the less likely it is that the ECB will start cutting rates anytime soon," Knot said.

On Thursday, Lagarde may address some of the rate-related questions that will be crucial for the euro. Next week, the market eagerly awaits the meetings of the Fed and the BoE.

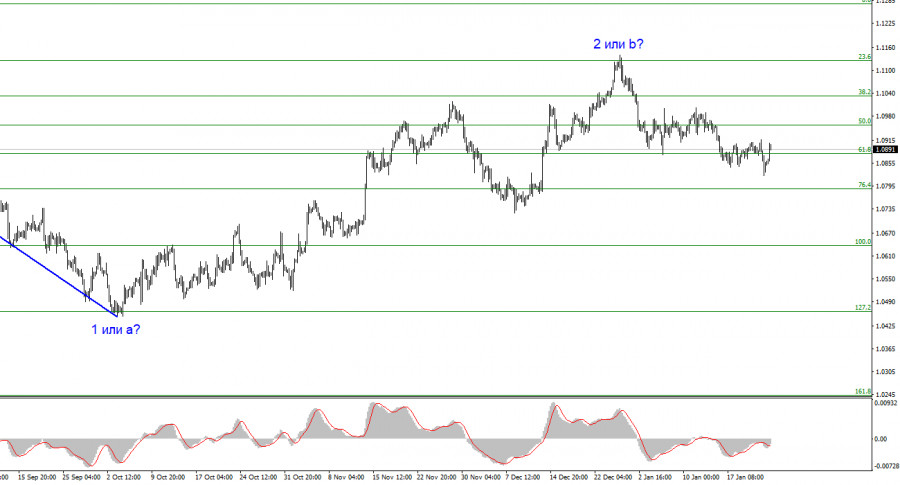

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, suggests that the market is prepared to sell over a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

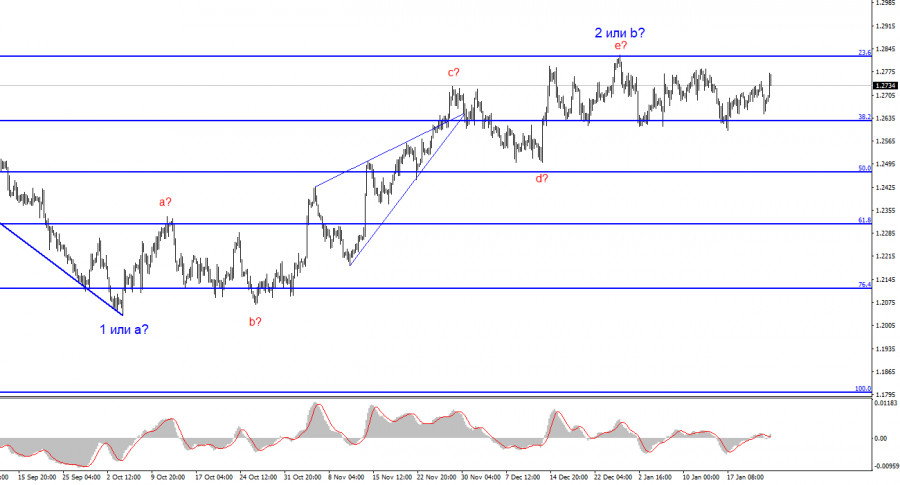

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing a flat pattern, I wouldn't rush to short positions at this time. Since the movement has been horizontal for a month now, I would wait for a successful attempt to break below the 1.2627 level in order to have more confidence in the instrument's decline.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/srFCjgn

via IFTTT