The first day of this eventful week was marked by the speech of European Central Bank Vice President Luis de Guindos. Besides him, two of his colleagues (Kazimir and Centeno) also spoke, but their comments received much less attention. Despite the fact that both Kazimir and Centeno voiced quite interesting thoughts on interest rates (which, by the way, contradicted each other), the market paid more attention to Guindos' speech.

Guindos said that the "ECB will cut interest rates when we are sure that inflation meets our 2% goal." He noted that the recent inflation reports were undoubtedly positive, so sooner or later, the ECB will begin easing its monetary policy. He also added that he looks optimistically at the inflation and core inflation indicators, expecting their further slowdown.

What conclusions could the market draw from his speech? The ECB will not start lowering interest rates in the coming months, which was already apparent. The recent inflation reports can hardly be called positive, but the overall trend is still downward. If inflation continues to fall at the current pace, Guindos and other policymakers may have to adjust their rhetoric and postpone the talk of rate cuts to a later date.

However, it is important to remember that Guindos is the second-in-command at the ECB after Christine Lagarde. Perhaps he possesses information that allows him to look optimistically into the future. But as of today, I would say that Centeno and Kazimir were much more specific and provided the market with at least some temporal guidance. Remember that Centeno advocated for a rate cut in April, while Kazimir suggested a time period not earlier than June.

I believe that Centeno's opinion will not be supported by the Governing Council, although he undoubtedly has the right to voice a more dovish rhetoric than his colleagues. Therefore, I currently advise basing the expectation on a rate cut in June. However, if other ECB policymakers support Centeno's opinion, it will only create additional problems for the euro, which is in line with the current wave analysis.

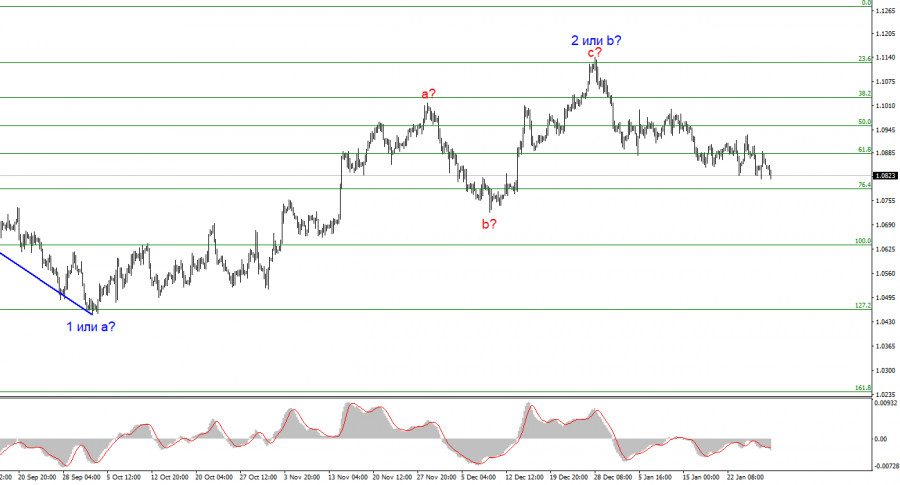

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci retracement, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets near the level of 1.0462, which corresponds to 127.2% Fibonacci.

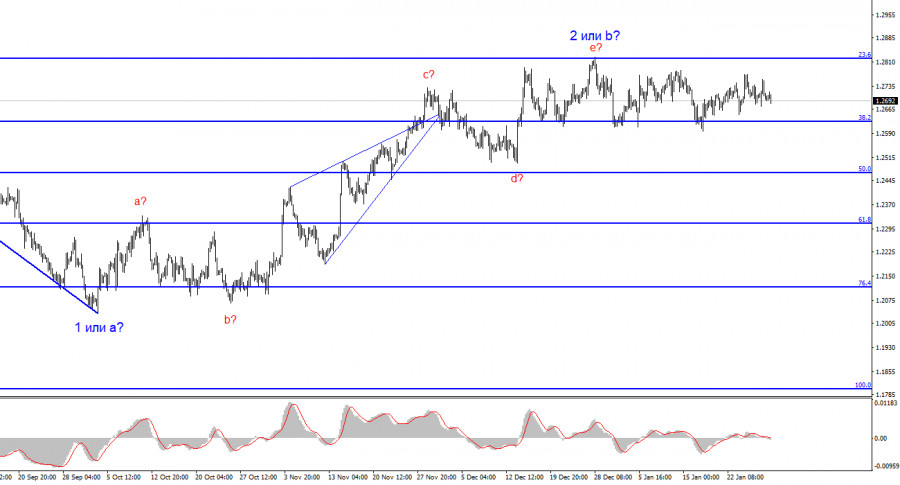

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, and could do so at any moment. However, since we are currently observing horizontal movement, I wouldn't rush to short positions at this time. I would wait for a successful attempt to break below the 1.2627 level in order to grow more confident about the instrument's decline.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/NmJ1L9B

via IFTTT