Geopolitics has proven to be one of the most toxic factors for financial market transactions. Every time investors bought oil due to armed conflicts in Ukraine and Israel, they lost money. However, the market continues to attribute the rise in Brent quotes to events in the Red Sea. In reality, the Houthis are unlikely to extend their attacks to the Strait of Hormuz, through which one-fifth of the world's oil flows, as it is not beneficial to Iran.

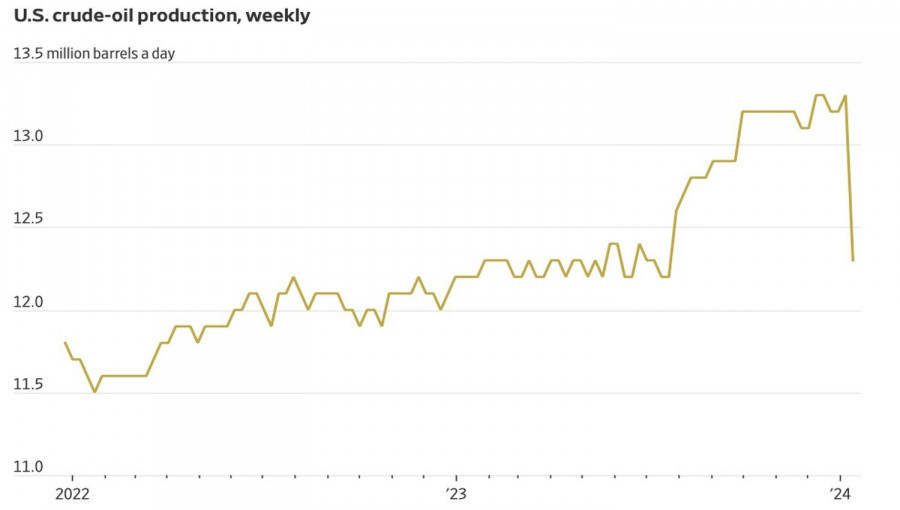

The main driver of the black gold rally has been events in the United States. Winter storms and low temperatures hit much of the country, leading to a reduction in production in North Dakota and Texas by 1 million barrels per day, which is 7.5% of normal oil production.

Dynamics of Oil Production in the USA

The reduction in supply was accompanied by an increase in demand amid the economy's resilience to the Federal Reserve's aggressive monetary tightening. The U.S. GDP expanded by 3.3% in the fourth quarter, surpassing Bloomberg experts' forecasts of 2%. Even the optimistic estimate of 2.4% from the Atlanta Fed's leading indicator was easily exceeded. Thanks to consumer activity, a strong job market, falling gasoline prices, and overall inflation, the economy continues to accelerate, positively impacting global demand for oil and pushing Brent to its highest levels since November.

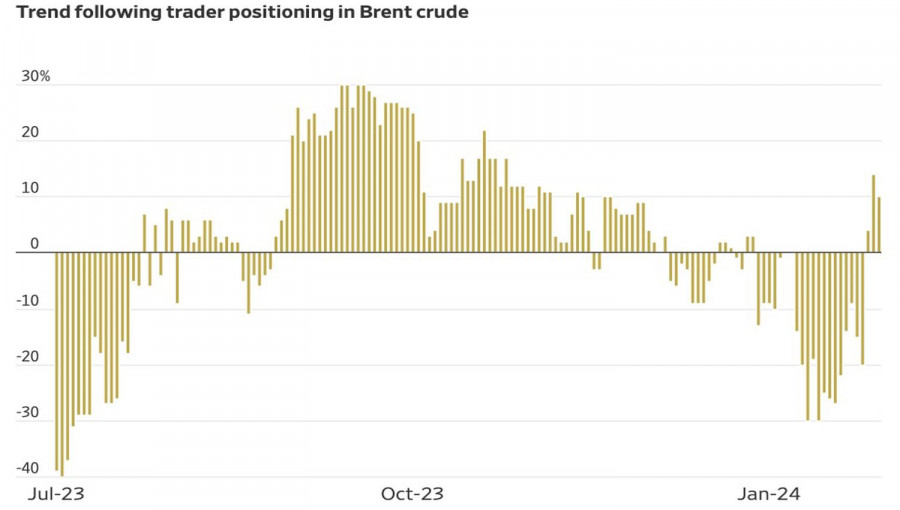

According to TD Securities research, the recent rise in the North Sea grade became a catalyst for mass purchases by trend-following traders. Indeed, speculators quickly turned from net sellers of Brent to net buyers, and their bullish positions reached their highest levels since November.

Dynamics of Speculative Positions on Brent

Now, oil needs a new growth driver, and it may find it in the worsening relations between the U.S. and Iran against the backdrop of the deaths of American soldiers in the Middle East and the revival of the topic of anti-nuclear sanctions against Tehran or in the weakness of the U.S. dollar. The USD index had a good start due to the reassessment of market views on the fate of the federal funds rate. However, now it's the Fed's turn. If the central bank pleasantly surprised fans of risky assets with a dovish pivot in December, why not present another surprise? Including for oil, which will enjoy a rally in case of a weakened U.S. dollar.

Thus, what started as geopolitics gradually transformed into an improvement in the fundamental conditions of the black gold market. If U.S. oil production cannot recover quickly and the economy takes off instead of having a soft landing, the rally in the North Sea grade will continue. Moreover, geopolitics has not been canceled.

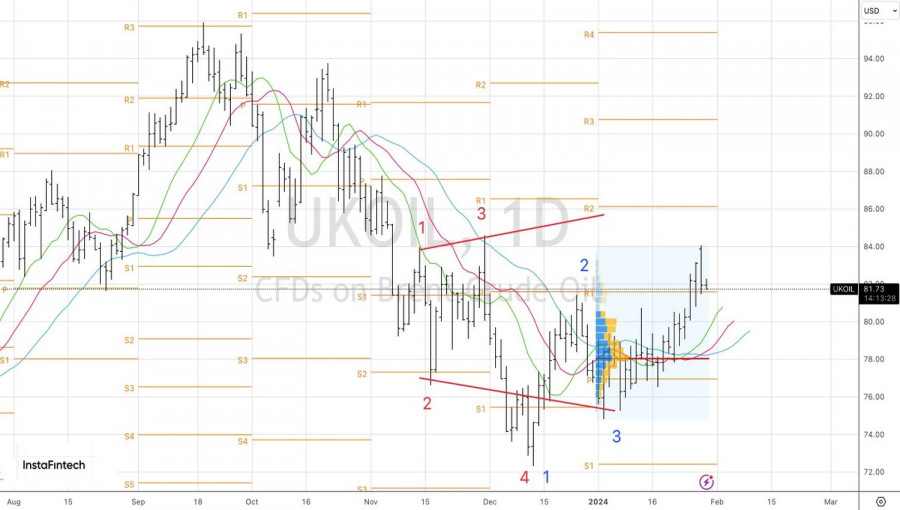

Technically, on the daily chart of Brent, what was supposed to happen did happen—a reversal of the downward trend thanks to the 1-2-3 pattern. In the case of updating the local high of the Broadening Wedge pattern near $84.6 per barrel, the rally risks continuing. At the same time, there will be a reason to increase long positions formed above $78.

The material has been provided by InstaForex Company - www.instaforex.comfrom Forex analysis review https://ift.tt/OZB7k6Y

via IFTTT